Answered step by step

Verified Expert Solution

Question

1 Approved Answer

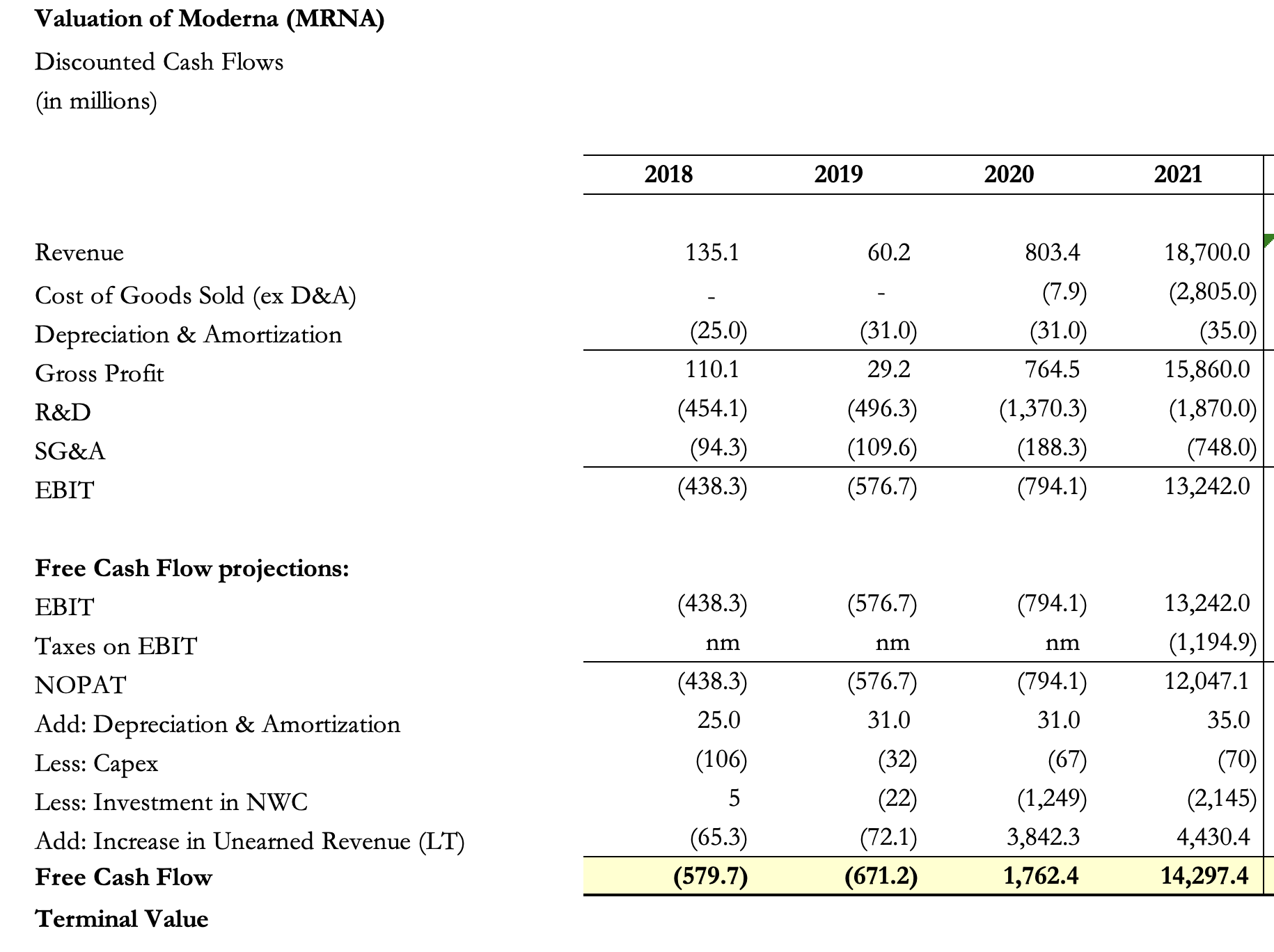

Perform a DCF valuation and write a very short memo that lists your intrinsic value for Moderna based on the info below. Cost of goods

Perform a DCF valuation and write a very short memo that lists your intrinsic value for Moderna based on the info below.

- Cost of goods sold will be 15% of revenue from 2022 to 2024, 13% of revenue from 2025 to 2027, 11% of revenue from 2028 to 2031, and 10% thereafter; the company will improve its margins through operational efficiencies.

- Research and Development (R&D) expense will be 10% of revenues from 2022 to 2024, 9% of revenues from 2025 to 2028, 8% of revenues from 2029 to 2032, and 7% of revenues thereafter.

- Selling, General, and Administrative (SG&A) expense will be 15% of revenue from 2022 to 2028, 12% of revenue from 2029 to 2032, and 10% of revenue thereafter.

- Capital expenditures will be .6% of sales in all years.

- Depreciation & Amortization will be 80% of capex from 2022 2025, 85% of capex from 2026 2028, 90% of capex from 2029 2031, 95% from 2032 2034, and 100% in 2035.

- The company will make investments in NWC equal to .1% of sales in each year.w

- Use the statutory tax rate of 26% in all years.

- The companys WACC is 10%.

- Assume a 3% growth rate in perpetuity; use the Gordon Growth method for terminal value.

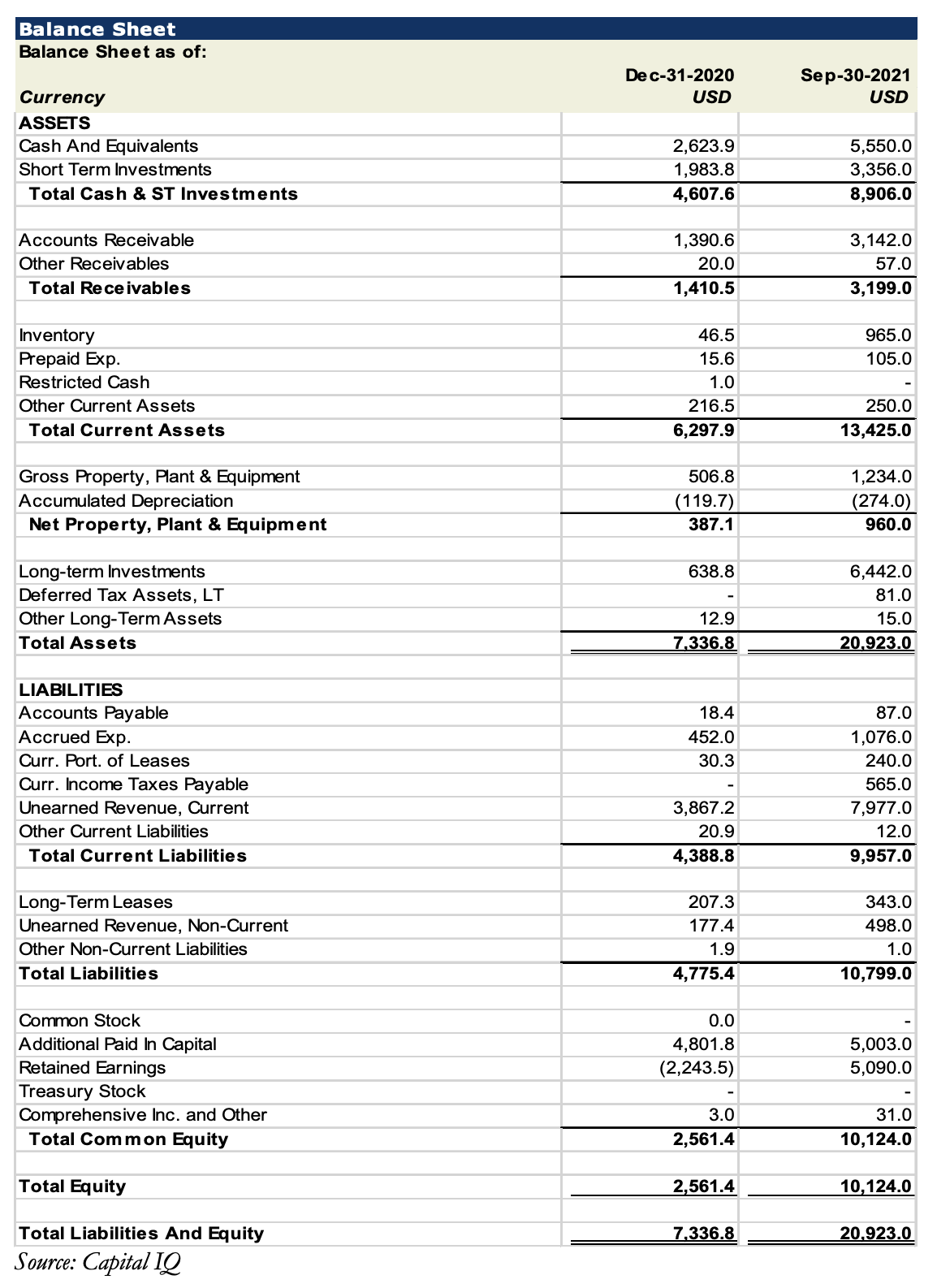

- Assume that Cash and Equivalents are required cash (part of NWC).

- Assume that Short Term Investments and Long Term Investments are excess cash.

- Do not worry about making any adjustments for operating leases the amounts are immaterial

- Do not worry about forecasting unearned revenue (long-term). Assume the balance will remain the same in all future years (thus there will be no impact to free cash flows).

- There are 473 million shares of stock outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started