Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Perform a sensitivity analysis for the effects of key variables (e.g., sales growth rate, cost of capital, unit costs, sales price) on the estimated

- Perform a sensitivity analysis for the effects of key variables (e.g., sales growth rate, cost of capital, unit costs, sales price) on the estimated NPV or IRR in order to demonstrate the sensitivity of the model. The Scenario analysis of several variables simultaneously is encouraged (but not required). A document Sensitivity Analysis in Excel is provided in this learning module. It introduces the Data Table method that you can use for performing sensitivity analysis in Excel.

- Perform a sensitivity analysis for the effects of key variables (e.g., sales growth rate, cost of capital, unit costs, sales price) on the estimated NPV or IRR in order to demonstrate the sensitivity of the model. The Scenario analysis of several variables simultaneously is encouraged (but not required). A document Sensitivity Analysis in Excel is provided in this learning module. It introduces the Data Table method that you can use for performing sensitivity analysis in Excel.

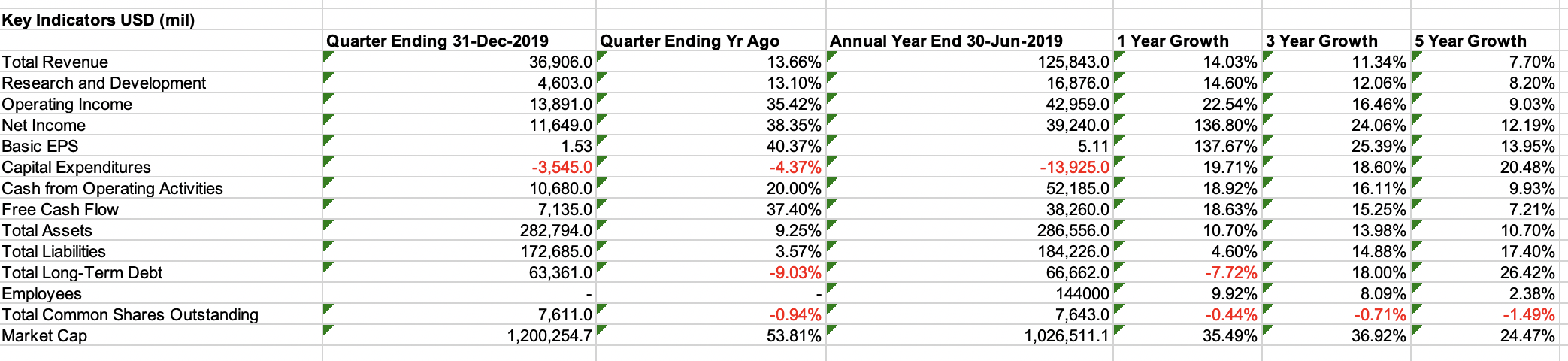

WACC is 6.54%

Key Indicators USD (mil) Total Revenue Research and Development Operating Income Net Income Basic EPS Capital Expenditures Cash from Operating Activities Free Cash Flow Total Assets Total Liabilities Total Long-Term Debt Employees Total Common Shares Outstanding Market Cap Quarter Ending 31-Dec-2019 36,906.0 4,603.0 13,891.0 11,649.0 1.53 -3,545.0 10,680.0 7,135.0 282,794.0 172,685.0 63,361.0 Quarter Ending Yr Ago 13.66% 13.10% 35.42% 38.35% 40.37% -4.37% 20.00% 37.40% 9.25% 3.57% -9.03% Annual Year End 30-Jun-2019 125,843.0 16,876.0 42,959.0 39,240.0 5.11 -13,925.0 52,185.0 38,260.0 286,556.0 184,226.0 66,662.0 144000 7,643.0 1,026,511.1 1 Year Growth 14.03% 14.60% 22.54% 136.80% 137.67% 19.71% 18.92% 18.63% 10.70% 4.60% -7.72% 9.92% -0.44% 35.49% 3 Year Growth 11.34% 12.06% 16.46% 24.06% 25.39% 18.60% 16.11% 15.25% 13.98% 14.88% 18.00% 8.09% -0.71% 36.92% 5 Year Growth 7.70% 8.20% 9.03% 12.19% 13.95% 20.48% 9.93% 7.21% 10.70% 17.40% 26.42% 2.38% -1.49% 24.47% 7,611.0 1,200,254.7 -0.94% 53.81% Key Indicators USD (mil) Total Revenue Research and Development Operating Income Net Income Basic EPS Capital Expenditures Cash from Operating Activities Free Cash Flow Total Assets Total Liabilities Total Long-Term Debt Employees Total Common Shares Outstanding Market Cap Quarter Ending 31-Dec-2019 36,906.0 4,603.0 13,891.0 11,649.0 1.53 -3,545.0 10,680.0 7,135.0 282,794.0 172,685.0 63,361.0 Quarter Ending Yr Ago 13.66% 13.10% 35.42% 38.35% 40.37% -4.37% 20.00% 37.40% 9.25% 3.57% -9.03% Annual Year End 30-Jun-2019 125,843.0 16,876.0 42,959.0 39,240.0 5.11 -13,925.0 52,185.0 38,260.0 286,556.0 184,226.0 66,662.0 144000 7,643.0 1,026,511.1 1 Year Growth 14.03% 14.60% 22.54% 136.80% 137.67% 19.71% 18.92% 18.63% 10.70% 4.60% -7.72% 9.92% -0.44% 35.49% 3 Year Growth 11.34% 12.06% 16.46% 24.06% 25.39% 18.60% 16.11% 15.25% 13.98% 14.88% 18.00% 8.09% -0.71% 36.92% 5 Year Growth 7.70% 8.20% 9.03% 12.19% 13.95% 20.48% 9.93% 7.21% 10.70% 17.40% 26.42% 2.38% -1.49% 24.47% 7,611.0 1,200,254.7 -0.94% 53.81%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started