Question

Perform analysis work (complete BFDA) for these two cases in one excel file. For each case, use 1000 trials & after obtaining the results you

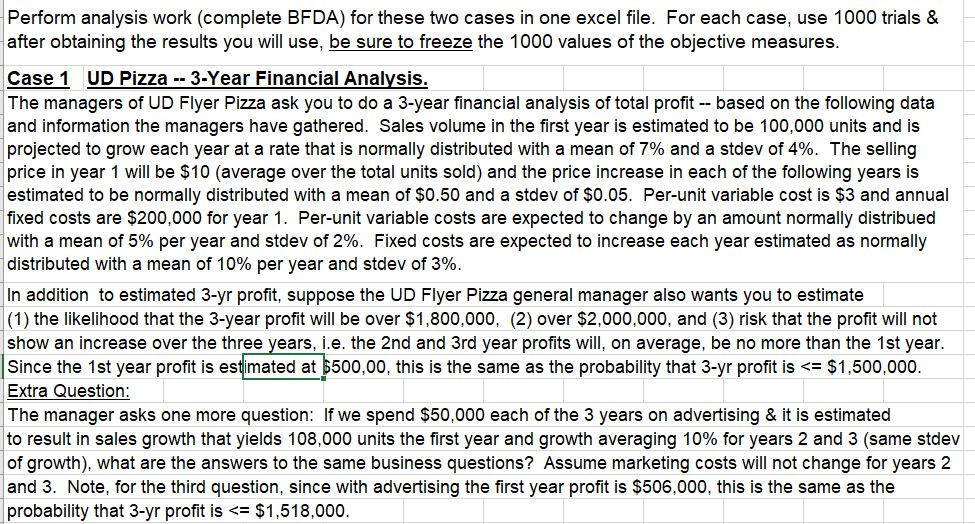

Perform analysis work (complete BFDA) for these two cases in one excel file. For each case, use 1000 trials & after obtaining the results you will use, be sure to freeze the 1000 values of the objective measures.

Case 1 UD Pizza -- 3-Year Financial Analysis.

The managers of UD Flyer Pizza ask you to do a 3-year financial analysis of total profit -- based on the following data and information the managers have gathered. Sales volume in the first year is estimated to be 100,000 units and is projected to grow each year at a rate that is normally distributed with a mean of 7% and a stdev of 4%. The selling price in year 1 will be $10 (average over the total units sold) and the price increase in each of the following years is estimated to be normally distributed with a mean of $0.50 and a stdev of $0.05. Per-unit variable cost is $3 and annual fixed costs are $200,000 for year 1. Per-unit variable costs are expected to change by an amount normally distribued with a mean of 5% per year and stdev of 2%. Fixed costs are expected to increase each year estimated as normally distributed with a mean of 10% per year and stdev of 3%.

In addition to estimated 3-yr profit, suppose the UD Flyer Pizza general manager also wants you to estimate (1) the likelihood that the 3-year profit will be over $1,800,000, (2) over $2,000,000, and (3) risk that the profit will not show an increase over the three years, i.e. the 2nd and 3rd year profits will, on average, be no more than the 1st year. Since the 1st year profit is estimated at $500,00, this is the same as the probability that 3-yr profit is

Extra Question:

The manager asks one more question: If we spend $50,000 each of the 3 years on advertising & it is estimated to result in sales growth that yields 108,000 units the first year and growth averaging 10% for years 2 and 3 (same stdev of growth), what are the answers to the same business questions? Assume marketing costs will not change for years 2 and 3. Note, for the third question, since with advertising the first year profit is $506,000, this is the same as the probability that 3-yr profit is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started