Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perform financial analysis for a project using the formats provided in Figure 4-4, Figure 4-5 and Figure 4-6. Assume the projected costs and benefits

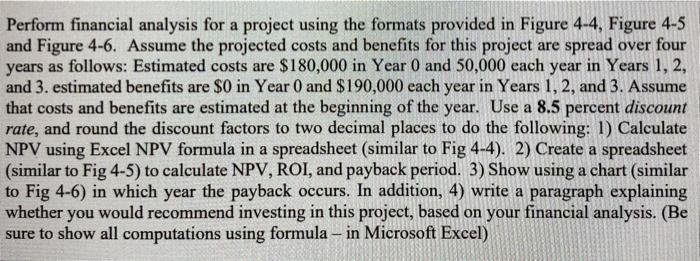

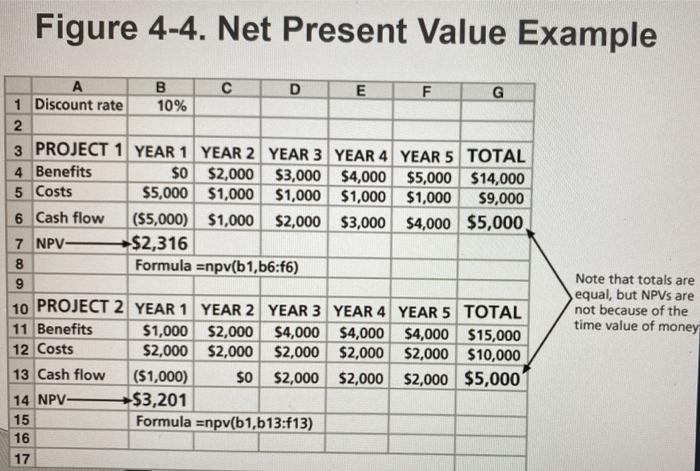

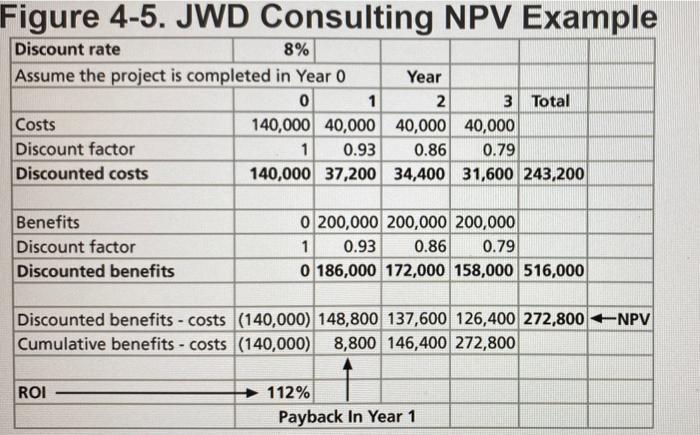

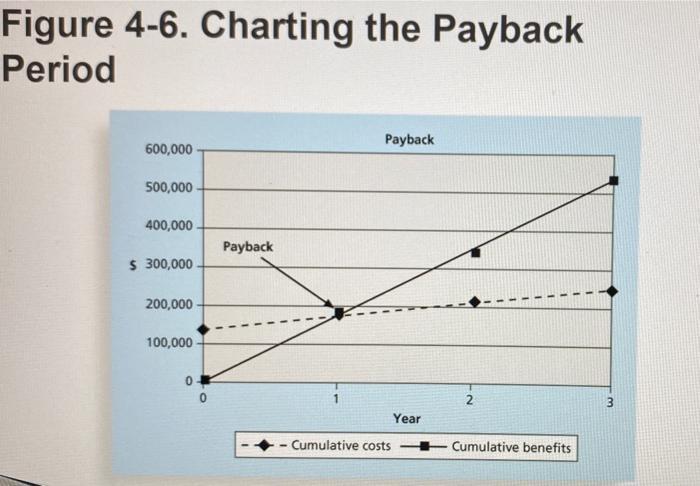

Perform financial analysis for a project using the formats provided in Figure 4-4, Figure 4-5 and Figure 4-6. Assume the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $180,000 in Year 0 and 50,000 each year in Years 1, 2, and 3. estimated benefits are $0 in Year 0 and $190,000 each year in Years 1, 2, and 3. Assume that costs and benefits are estimated at the beginning of the year. Use a 8.5 percent discount rate, and round the discount factors to two decimal places to do the following: 1) Calculate NPV using Excel NPV formula in a spreadsheet (similar to Fig 4-4). 2) Create a spreadsheet (similar to Fig 4-5) to calculate NPV, ROI, and payback period. 3) Show using a chart (similar to Fig 4-6) in which year the payback occurs. In addition, 4) write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. (Be sure to show all computations using formula - in Microsoft Excel) Figure 4-4. Net Present Value Example A Discount rate 15 16 17 13 Cash flow 14 NPV- B 10% 1 2 3 PROJECT 1 YEAR 1 YEAR 2 4 Benefits $0 5 Costs $5,000 6 Cash flow 7 NPV- 8 9 10 PROJECT 2 YEAR 1 YEAR 2 YEAR 3 11 Benefits 12 Costs D E F YEAR 3 YEAR 4 YEAR 5 TOTAL $2,000 $3,000 $4,000 $5,000 $14,000 $1,000 $1,000 $1,000 $1,000 $9,000 $5,000, ($5,000) $1,000 $2,000 $3,000 $4,000 $2,316 Formula =npv(b1,b6:f6) G YEAR 4 $1,000 $2,000 $4,000 $4,000 $4,000 $2,000 ($1,000) $3,201 Formula =npv(b1,b13:f13) YEAR 5 TOTAL $15,000 $2,000 $2,000 $2,000 $2,000 $10,000 $0 $2,000 $2,000 $2,000 $5,000 Note that totals are equal, but NPVs are not because of the time value of money Figure 4-5. JWD Consulting NPV Example Discount rate 8% Assume the project is completed in Year 0 0 Costs Discount factor Discounted costs Benefits Discount factor Discounted benefits Year ROI 1 2 140,000 40,000 40,000 40,000 1 0.93 0.86 0.79 140,000 37,200 34,400 31,600 243,200 3 Total 0 200,000 200,000 200,000 1 0.93 0.86 0.79 0 186,000 172,000 158,000 516,000 Discounted benefits - costs (140,000) 148,800 137,600 126,400 272,800 NPV Cumulative benefits - costs (140,000) 8,800 146,400 272,800 112% Payback In Year 1 Figure 4-6. Charting the Payback Period 600,000 500,000- 400,000- $ 300,000. 200,000 100,000 0 0 Payback Payback Cumulative costs Year 2 Cumulative benefits 3

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 NPV Calculation Discount rate 850 Project Year 0 Year 1 Year 2 Year 3 Benefits 0 190000 190000 190...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started