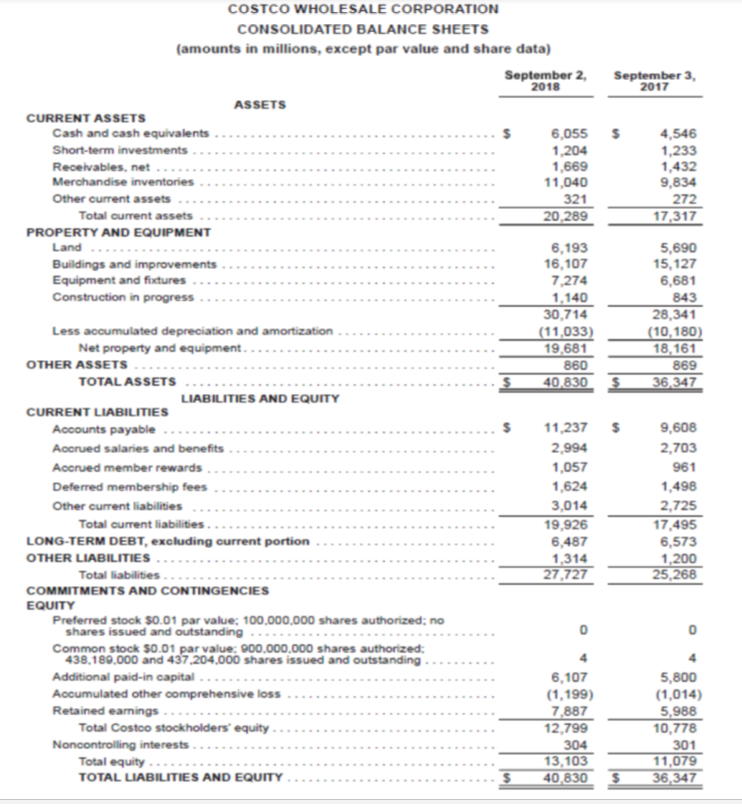

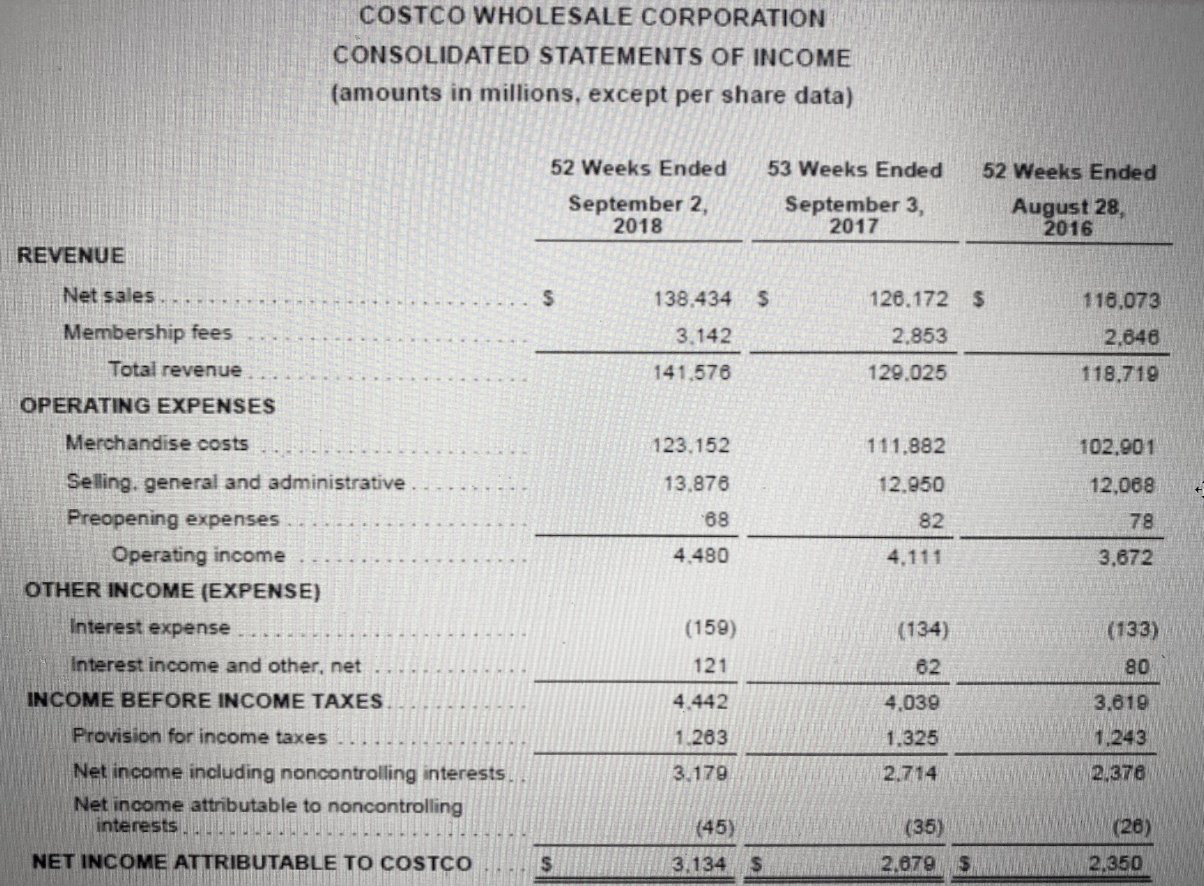

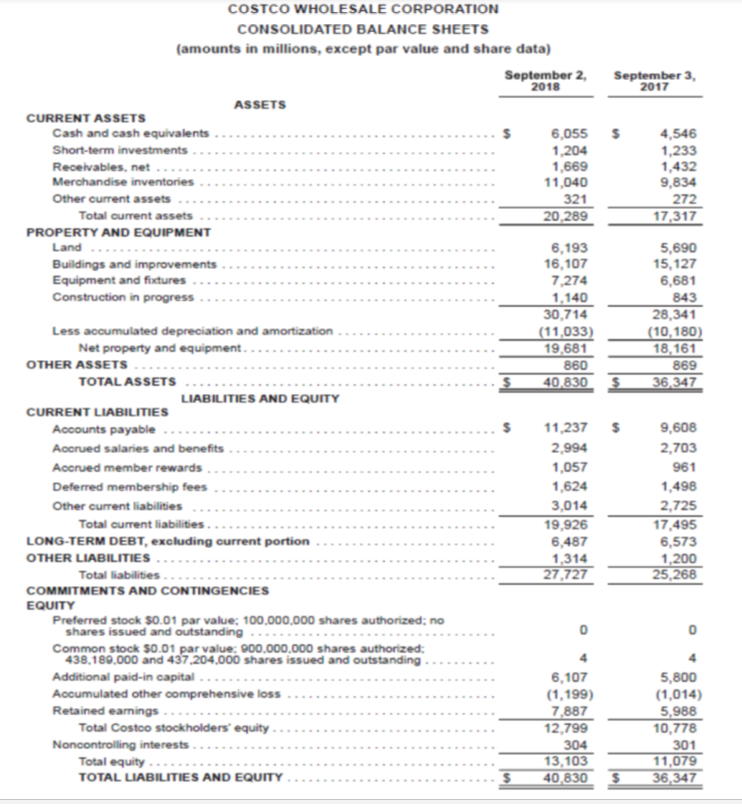

Perform horizontal and vertical analysis of the financial statements and calculate the changes for the following information below.

Set-up and label the following ratios for each year and calculate the change.

- Current Ratio

- Quick Ratio

- Debt to Assets Ratio

- Debt to Equity Ratio

- Return On Revenue Ratio

Using formulas Calculate the ratios (the nearest tenth or one decimal place) and comment on the change (if any) for #2 and #3.

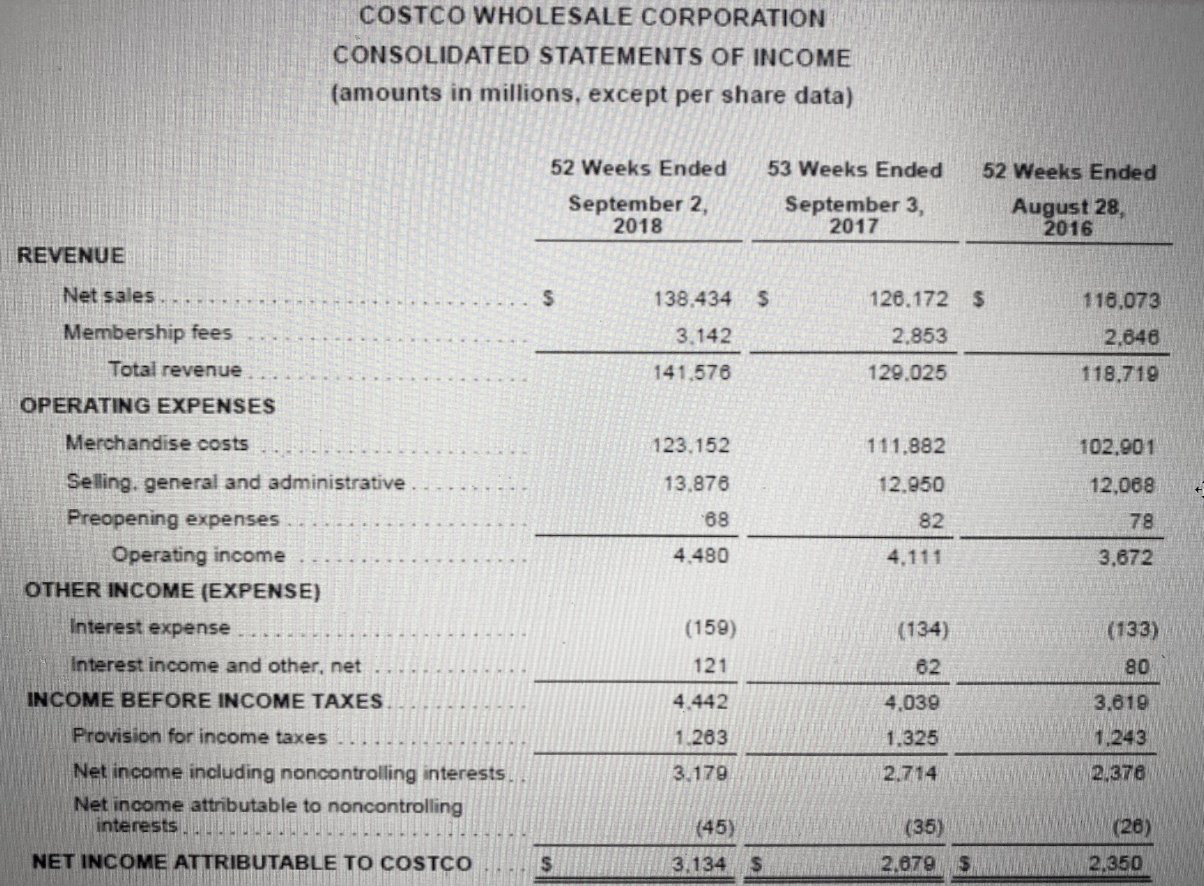

September 3, 2017 4,546 1,233 1,432 9,834 272 17,317 5,690 15,127 6,681 843 28,341 (10,180) 18,161 869 36,347 COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (amounts in millions, except par value and share data) September 2 2018 ASSETS CURRENT ASSETS Cash and cash equivalents 6,055 Short-term investments 1,204 Receivables, net... 1,669 Merchandise inventories 11,040 Other current assets 321 Total current assets 20.289 PROPERTY AND EQUIPMENT Land 6,193 Buildings and improvements 16,107 Equipment and fixtures 7,274 Construction in progress 1,140 30,714 Less accumulated depreciation and amortization (11,033) Net property and equipment... 19,681 OTHER ASSETS 860 TOTAL ASSETS 40.830 LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable 11,237 Accrued salaries and benefits 2,994 Accrued member rewards 1,057 Deferred membership fees 1,624 Other current liabilities 3,014 Total current liabilities..... 19,926 LONG-TERM DEBT, excluding current portion 6,487 OTHER LIABILITIES 1,314 Total liabilities 27,727 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock $0.01 par value: 100,000,000 shares authorized: no shares issued and outstanding Common stock $0.01 par value: 900,000,000 shares authorized: 438.180.000 and 437.204,000 shares issued and outstanding Additional paid-in capital 6,107 Accumulated other comprehensive loss (1,199) Retained earnings .... 7,887 Total Costco stockholders' equity 12,799 Noncontrolling interests 304 Total equity 13,103 TOTAL LIABILITIES AND EQUITY 40,830 $ 9,608 2,703 961 1,498 2,725 17,495 6,573 1,200 25,268 5,800 (1,014) 5,988 10,778 301 11,079 36,347 $ COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 52 Weeks Ended 52 Weeks Ended September 2, 2018 53 Weeks Ended September 3, 2017 August 28 2016 REVENUE Net sales $ 138,434 $ 128.172 $ 2.853 116,073 2.846 Membership fees 3.142 141.576 Total revenue 129.025 118,719 OPERATING EXPENSES 123.152 111.882 12.950 102.901 12.068 13,876 Merchandise costs Selling, general and administrative. Preopening expenses Operating income OTHER INCOME (EXPENSE) 68 82 78 4.480 4,111 3,672 Interest expense (134) (133) (159) 121 62 80 Interest income and other, net INCOME BEFORE INCOME TAXES 4.442 4,039 3.619 Provision for income taxes 1.325 1,243 1.263 3.179 2,714 2,378 Net income including noncontrolling interests Net income attributable to noncontrolling interests (45) (28) (35) 2.879 NET INCOME ATTRIBUTABLE TO COSTCO S 3.134 2.350 September 3, 2017 4,546 1,233 1,432 9,834 272 17,317 5,690 15,127 6,681 843 28,341 (10,180) 18,161 869 36,347 COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (amounts in millions, except par value and share data) September 2 2018 ASSETS CURRENT ASSETS Cash and cash equivalents 6,055 Short-term investments 1,204 Receivables, net... 1,669 Merchandise inventories 11,040 Other current assets 321 Total current assets 20.289 PROPERTY AND EQUIPMENT Land 6,193 Buildings and improvements 16,107 Equipment and fixtures 7,274 Construction in progress 1,140 30,714 Less accumulated depreciation and amortization (11,033) Net property and equipment... 19,681 OTHER ASSETS 860 TOTAL ASSETS 40.830 LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable 11,237 Accrued salaries and benefits 2,994 Accrued member rewards 1,057 Deferred membership fees 1,624 Other current liabilities 3,014 Total current liabilities..... 19,926 LONG-TERM DEBT, excluding current portion 6,487 OTHER LIABILITIES 1,314 Total liabilities 27,727 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock $0.01 par value: 100,000,000 shares authorized: no shares issued and outstanding Common stock $0.01 par value: 900,000,000 shares authorized: 438.180.000 and 437.204,000 shares issued and outstanding Additional paid-in capital 6,107 Accumulated other comprehensive loss (1,199) Retained earnings .... 7,887 Total Costco stockholders' equity 12,799 Noncontrolling interests 304 Total equity 13,103 TOTAL LIABILITIES AND EQUITY 40,830 $ 9,608 2,703 961 1,498 2,725 17,495 6,573 1,200 25,268 5,800 (1,014) 5,988 10,778 301 11,079 36,347 $ COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 52 Weeks Ended 52 Weeks Ended September 2, 2018 53 Weeks Ended September 3, 2017 August 28 2016 REVENUE Net sales $ 138,434 $ 128.172 $ 2.853 116,073 2.846 Membership fees 3.142 141.576 Total revenue 129.025 118,719 OPERATING EXPENSES 123.152 111.882 12.950 102.901 12.068 13,876 Merchandise costs Selling, general and administrative. Preopening expenses Operating income OTHER INCOME (EXPENSE) 68 82 78 4.480 4,111 3,672 Interest expense (134) (133) (159) 121 62 80 Interest income and other, net INCOME BEFORE INCOME TAXES 4.442 4,039 3.619 Provision for income taxes 1.325 1,243 1.263 3.179 2,714 2,378 Net income including noncontrolling interests Net income attributable to noncontrolling interests (45) (28) (35) 2.879 NET INCOME ATTRIBUTABLE TO COSTCO S 3.134 2.350