Answered step by step

Verified Expert Solution

Question

1 Approved Answer

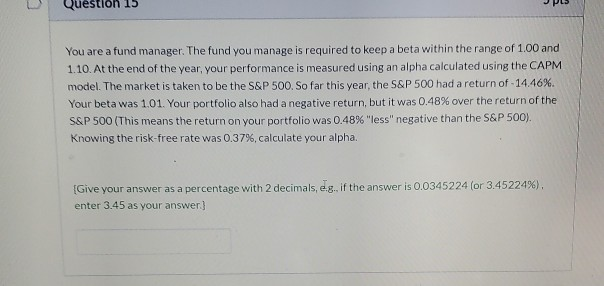

Question 15 You are a fund manager. The fund you manage is required to keep a beta within the range of 1.00 and 1.10. At

Question 15 You are a fund manager. The fund you manage is required to keep a beta within the range of 1.00 and 1.10. At the end of the year, your performance is measured using an alpha calculated using the CAPM model. The market is taken to be the S&P 500. So far this year, the S&P 500 had a return of -14.46%. Your beta was 1.01. Your portfolio also had a negative return, but it was 0.48% over the return of the S&P 500 (This means the return on your portfolio was 0.48% "less" negative than the S&P 500). Knowing the risk-free rate was 0.37%, calculate your alpha. Give your answer as a percentage with 2 decimals, e.g., if the answer is 0.0345224 (or 3.45224%). enter 3.45 as your answer.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started