Question

Question 2(a): using the accounting and market information for ValueCo below, determine the enterprise value for ValueCo in a cash and stock transaction with

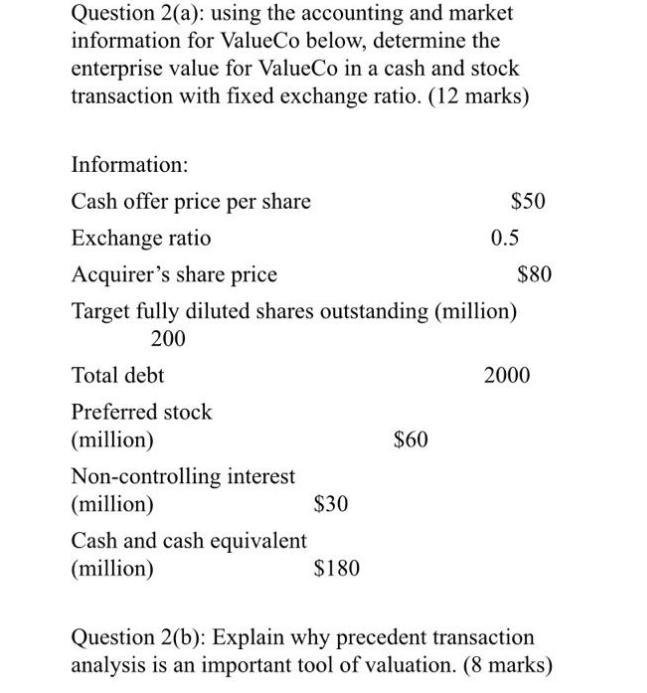

Question 2(a): using the accounting and market information for ValueCo below, determine the enterprise value for ValueCo in a cash and stock transaction with fixed exchange ratio. (12 marks) Information: Cash offer price per share Exchange ratio Acquirer's share price Target fully diluted shares outstanding (million) 200 Total debt Preferred stock (million) Non-controlling interest (million) Cash and cash equivalent (million) $30 $180 $60 $50 0.5 $80 2000 Question 2(b): Explain why precedent transaction analysis is an important tool of valuation. (8 marks)

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2a Particulars Market valie of common equity 50 x 200 Add Preferred stock Total debt Non controlling ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App