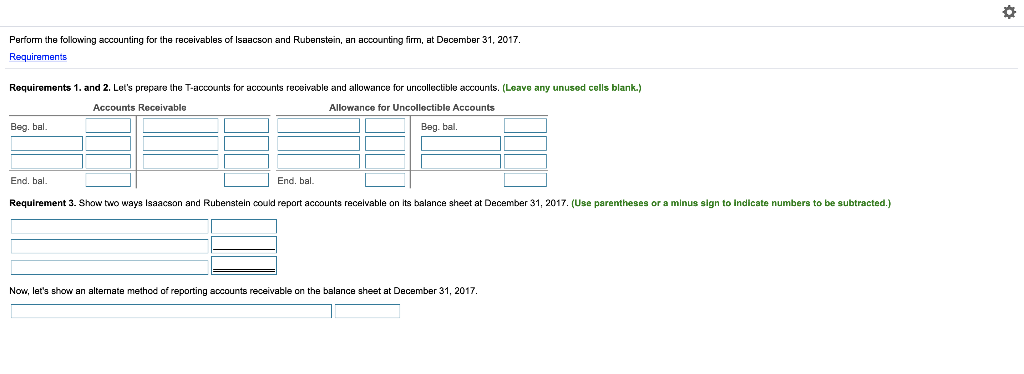

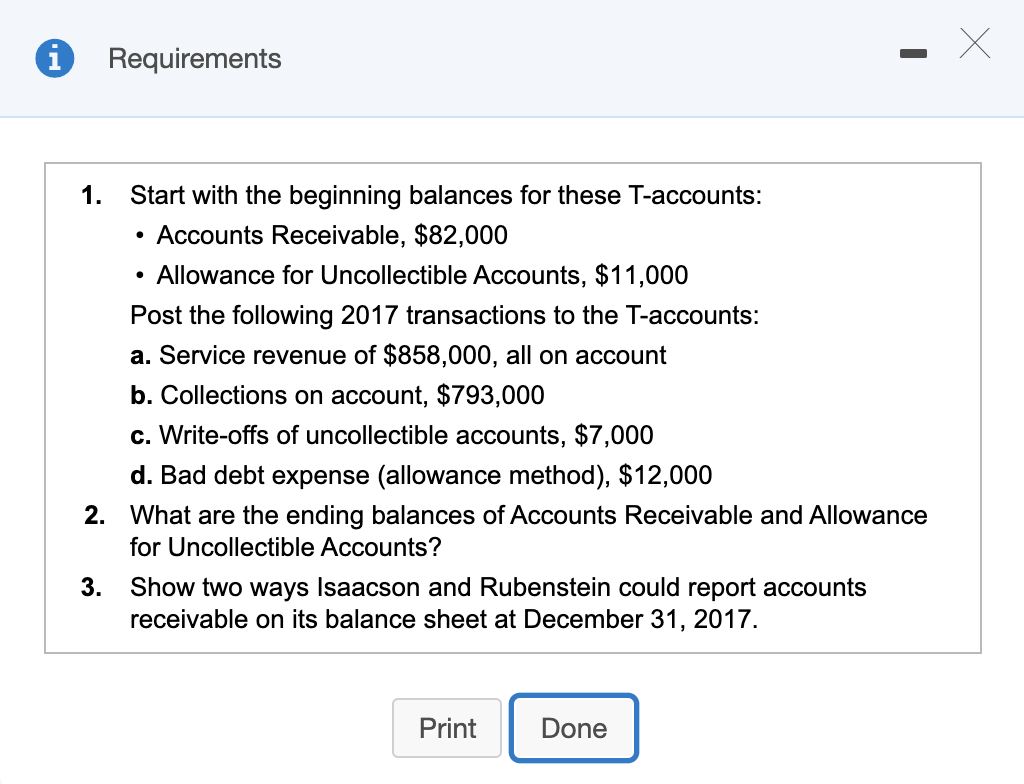

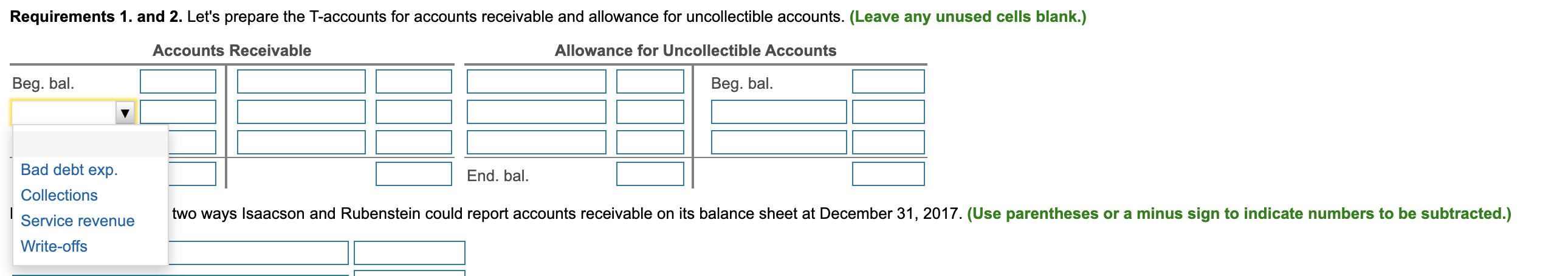

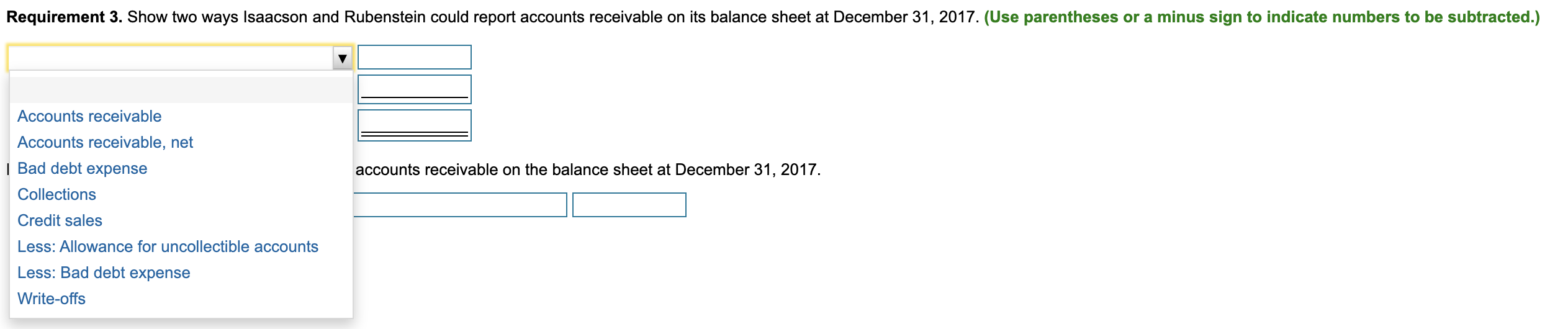

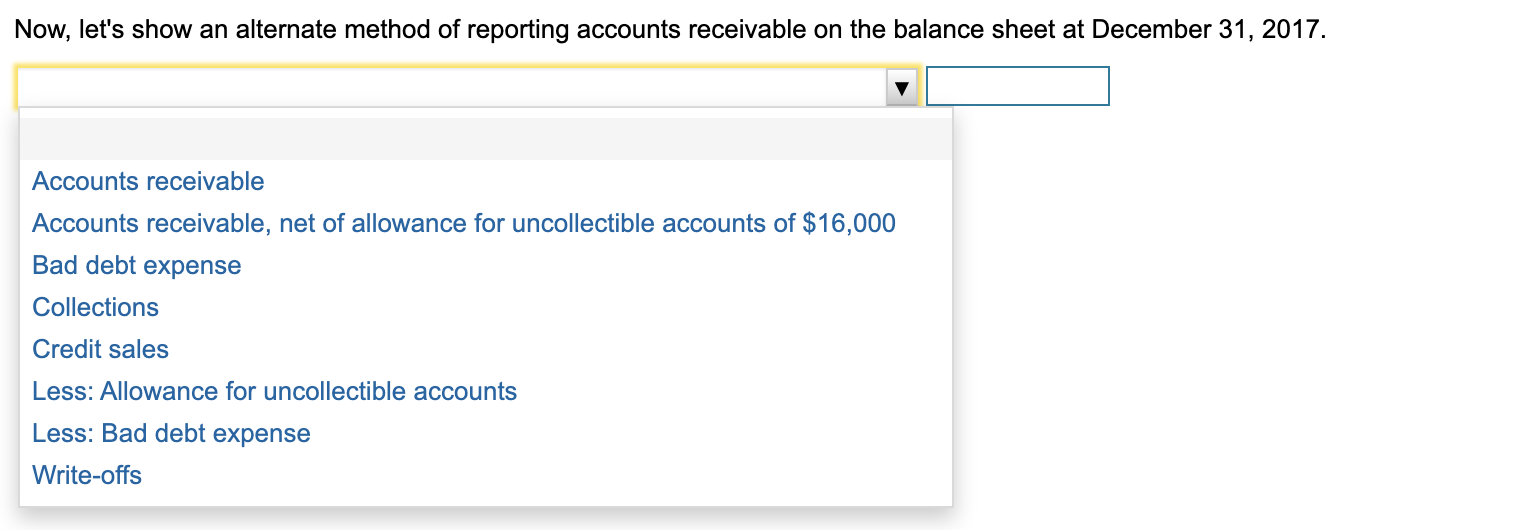

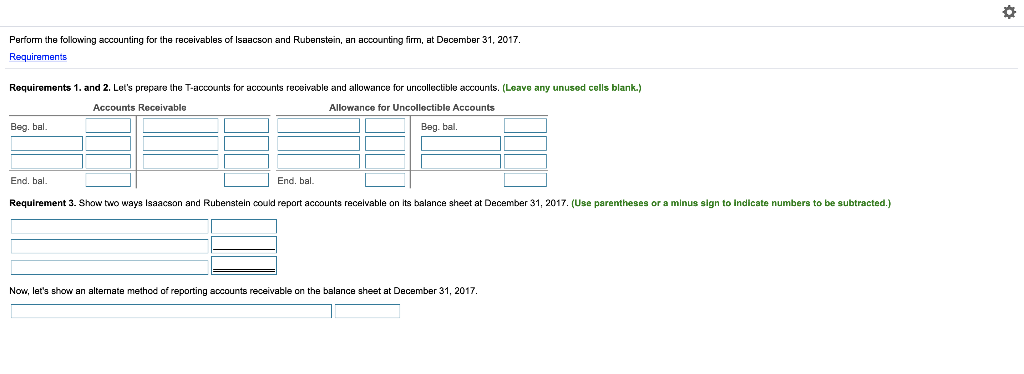

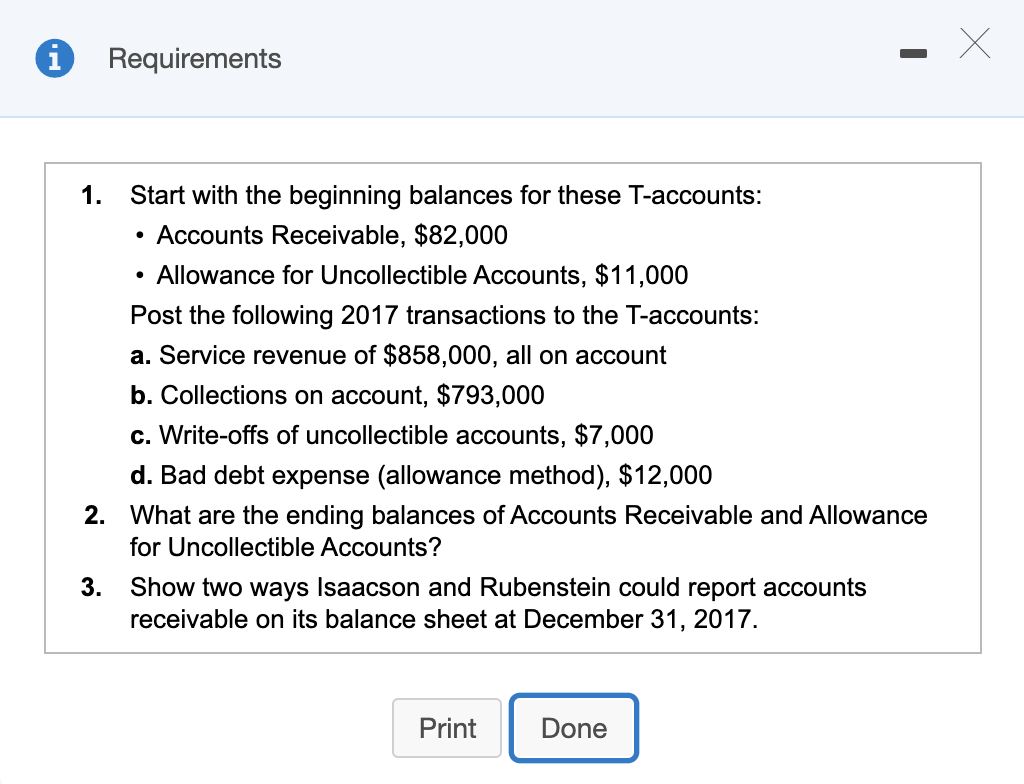

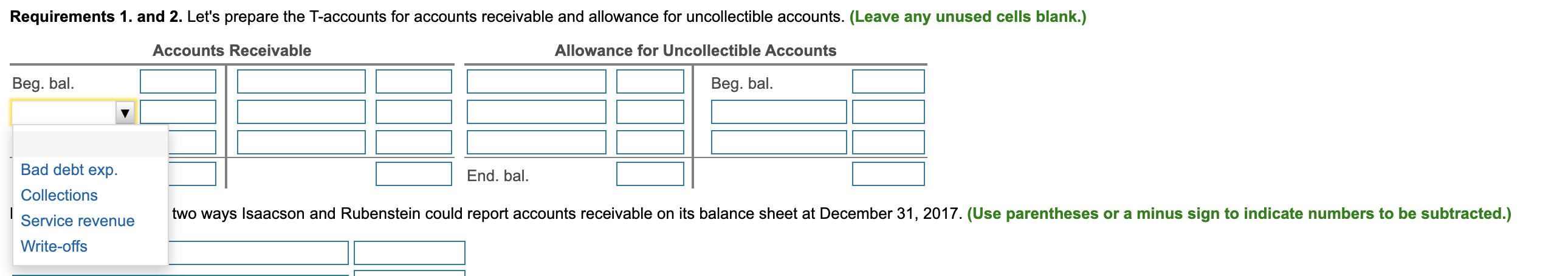

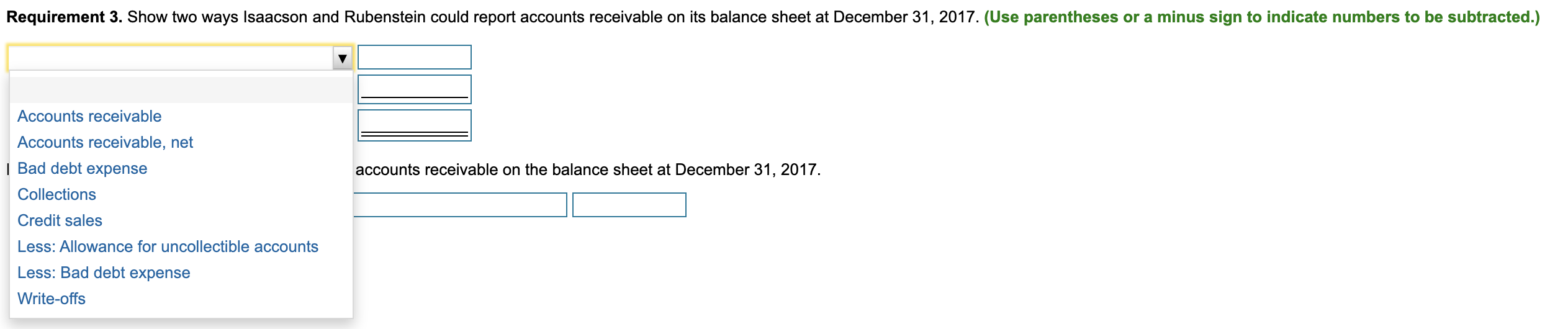

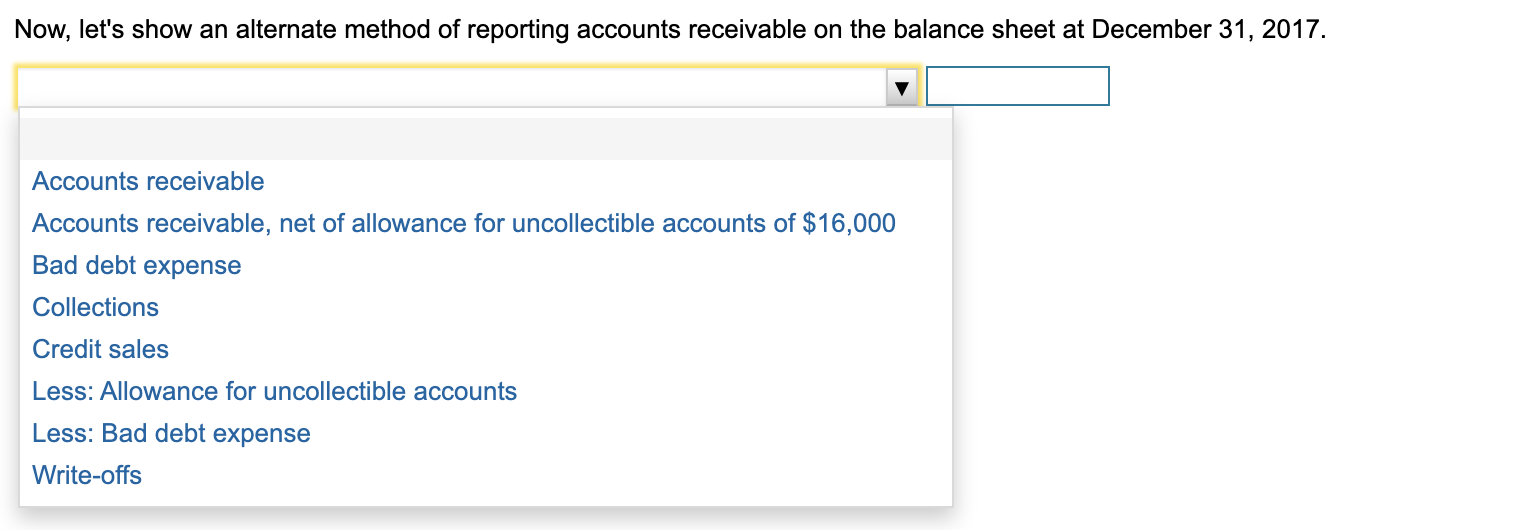

Perform the following accounting for the receivables of Isaacson and Rubenstein, an accounting firm, at December 31, 2017 Requirements Requirements 1. and 2. Let's prepare the T-accounts for accounts receivable and allowance for uncollectible accounts. (Leave any unused cells blank.) Accounts Receivable Allowance for Uncollectible Accounts Beg. bal. Beg. bal. End, bal. End. bal. Requirement 3. Show two ways Isaacson and Rubenstein could report accounts recevable on its balance sheet at December 31, 2017. (Use parentheses or a minus sign to indicate numbers to be subtracted.) Now, let's show an alternate method of reporting accounts receivable on the balance sheet at December 31, 2017. Requirements 1. Start with the beginning balances for these T-accounts: Accounts Receivable, $82,000 Allowance for Uncollectible Accounts, $11,000 Post the following 2017 transactions to the T-accounts: a. Service revenue of $858,000, all on account b. Collections on account, $793,000 c. Write-offs of uncollectible accounts, $7,000 d. Bad debt expense (allowance method), $12,000 2. What are the ending balances of Accounts Receivable and Allowance for Uncollectible Accounts? 3. Show two ways Isaacson and Rubenstein could report accounts receivable on its balance sheet at December 31, 2017. Print Print Done Done Requirements 1. and 2. Let's prepare the T-accounts for accounts receivable and allowance for uncollectible accounts. (Leave any unused cells blank.) Accounts Receivable Allowance for Uncollectible Accounts Beg. bal. Beg. bal. End. bal. Bad debt exp. Collections Service revenue Write-offs two ways Isaacson and Rubenstein could report accounts receivable on its balance sheet at December 31, 2017. (Use parentheses or a minus sign to indicate numbers to be subtracted.) Requirement 3. Show two ways Isaacson and Rubenstein could report accounts receivable on its balance sheet at December 31, 2017. (Use parentheses or a minus sign to indicate numbers to be subtracted.) Accounts receivable Accounts receivable, net Bad debt expense Collections accounts receivable on the balance sheet at December 31, 2017. Credit sales Less: Allowance for uncollectible accounts Less: Bad debt expense Write-offs Now, let's show an alternate method of reporting accounts receivable on the balance sheet at December 31, 2017. Accounts receivable Accounts receivable, net of allowance for uncollectible accounts of $16,000 Bad debt expense Collections Credit sales Less: Allowance for uncollectible accounts Less: Bad debt expense Write-offs