Answered step by step

Verified Expert Solution

Question

1 Approved Answer

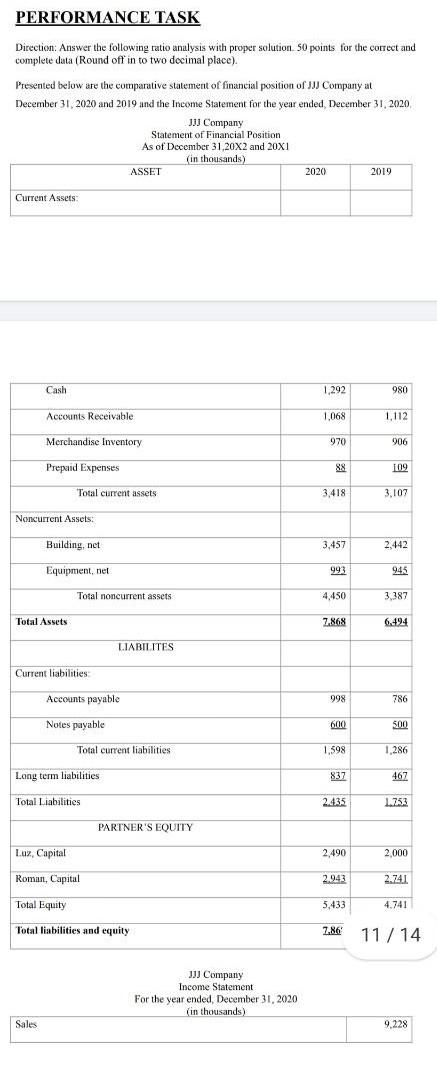

PERFORMANCE TASK Direction: Answer the following ratio analysis with proper solution. 50 points for the correct and complete data (Round oft in to two decimal

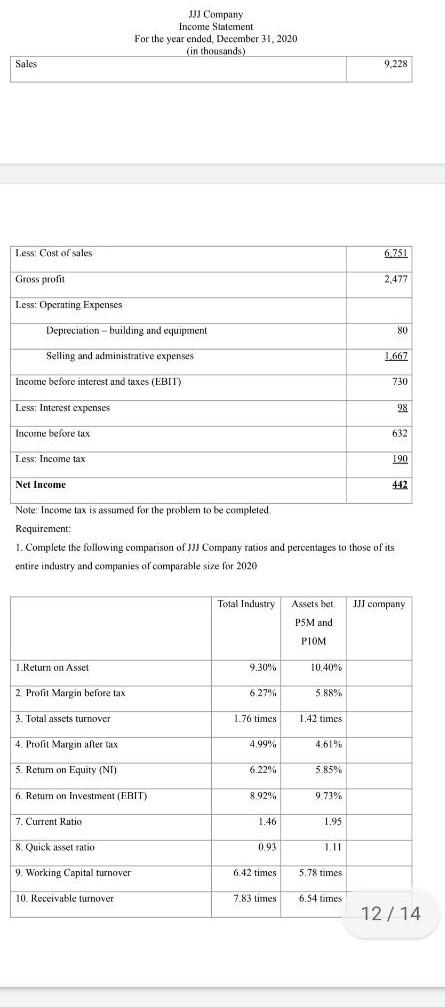

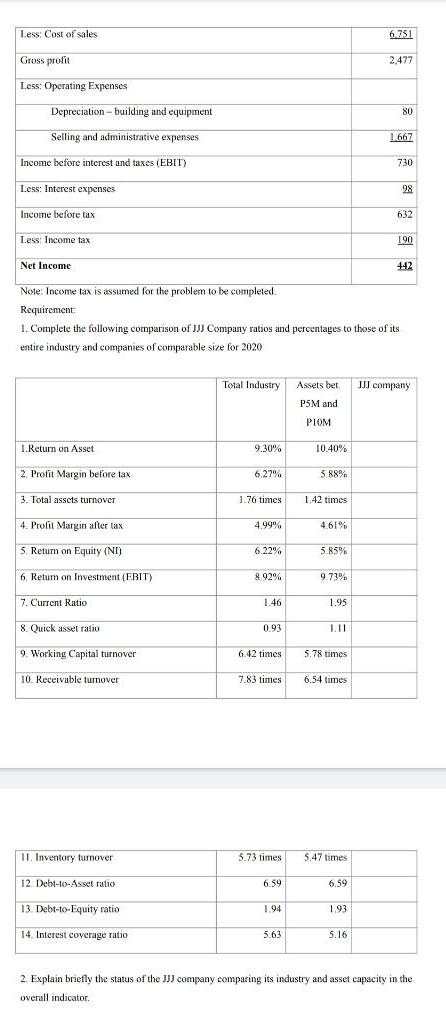

PERFORMANCE TASK Direction: Answer the following ratio analysis with proper solution. 50 points for the correct and complete data (Round oft in to two decimal place) Presented below are the comparative statement of financial position of JJ Company at December 31, 2020 and 2019 and the Income Statement for the year ended December 31, 2020 , JJJ Company Statement of Financial Position As of December 31, 20X2 and 20X1 (in thousands) ASSET 2020 2019 Current Assets Cash 1,292 980 Accounts Receivable 1,068 1,112 Merchandise Inventory 970 906 Prepaid Expenses 88 109 Total current assets 3,418 3.107 Noncurrent Assets: Building, net 3,457 2,442 Equipment, net 993 945 Total noncurrent assets 4,450 3.387 Total Assets 7.868 6.494 LIABILITES Current liabilities Accounts payable 998 786 Notes payable 6010 500 Total current liabilities 1.598 1.286 Long term liabilities 837 467 Total Liabilities 2.435 1.753 PARTNER'S EQUITY Luz, Capital 2.490 2,000 Roman, Capital 2.943 2.741 Total Equity 5,433 4.741 Total liabilities and equity 7.86 11/14 JJJ Company Income Statement For the year ended, December 31, 2020 (in thousands) Sales 9.228 JJJ Company Income Statement For the year ended, December 31, 2020 (in thousands) Sales 9.228 Less: Cost of sales 6.751 Gross profit 2.477 Less: Operating Expenses Depreciation - building and equipment 80 Selling and administrative expenses 1667 Income before interest and taxes (EBIT) 730 Less: Interest expenses 98 Income before tax 632 Less: Income tax 190 Net Income 442 Note: Income tax is assumed for the problem to be completed Requirement: 1. Complete the following comparison of JJ Company ratios and percentages to those of its entire industry and companies of comparable size for 2020 Total Industry Assets bet II company P5M and PIOM 1. Return on Asset 9.30% 10.40% 2. Profit Margin before tax 6 27% 588% 3. Total assets turnover 1.76 times 1.42 times 4. Prolit Margin after tax 4.99% 4.61% 5. Retum on Equity (NT) 6.2294 % 5.85% 6. Retum on Investment (EBIT) 8 92% 9.73% 7. Current Ratio 1.46 1.95 8 Quick asset ratio 093 1.11 9. Working Capital turnover 6.42 times 5.78 times 10 Receivable turnover 7.83 times 6.54 times 12 / 14 Less Cost of sales 6.751 Gross profit 2,477 Less: Operating Expenses Depreciation - building and equipment 80 Selling and administrative expenses 1.667 Income before interest and taxes (EBIT) ) 730 Less: Interest expenses 98 Income before tax 632 Less Income tax 190 Net Income 442 Note: Income tax is assumed for the problem to be completed. Requirement: 1. Complete the following comparison of JJJ Company ratios and percentages to those of its entire industry and companies of comparable size for 2020 Total Industry Il company Assets bet P5M and PIOM 1. Return on Asset 9.30% 10.40% 2. Profit Margin before tas 6.27% 5 88% 3. Total assets turnover 1.76 times 1.42 times 4. Prolit Margin after tax 4.99% 4.61% 5 Retum on Equity (NI) 6.22% 5.85% 6 Retum on Investment (ERIT) 8.92% 9.73% 7. Current Ratio 1.46 1.95 Quick asset ratio 093 9. Working Capital turnover 6.42 times 5.78 times 10 Receivable turnover 7.83 times 6.54 times 11. Inventory turnover 5.73 times 5.47 times 12 Debt-to-Asset ratio 6.59 6.59 13 Debt-to-Equity ratio 1.94 1.93 14. Interest coverage ratio 5.63 5.16 2. Explain briefly the status of the JJJ company comparing its industry and asset capacity in the overall indicator

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started