Performing a Financial Ratio Analysis for McDonalds Corporation (MCD)

Purpose

Financial ratio analysis is one of the best techniques for identifying and evaluating internal

strengths and weaknesses. Potential investors and current shareholders look closely at firms

financial ratios, making detailed comparisons to industry averages and to previous periods of

time. Financial ratio analyses provide vital input information for developing an IFE Matrix.

Instructions

Step 1: On a separate sheet of paper, number from 1 to 20. Referring to McDonalds income statement

and balance sheet (pp. 3132), calculate 20 financial ratios for 2008 for the company. Use Table

4-7 as a reference.

Step 2: In a second column, indicate whether you consider each ratio to be a strength, a weakness, or a

neutral factor for McDonalds.

Step 3: Go to the Web sites in Table 4-6 that calculate McDonalds financial ratios, without your having

to pay a subscription (fee) for the service. Make a copy of the ratio information provided and

record the source. Report this research to your classmates and your professor.

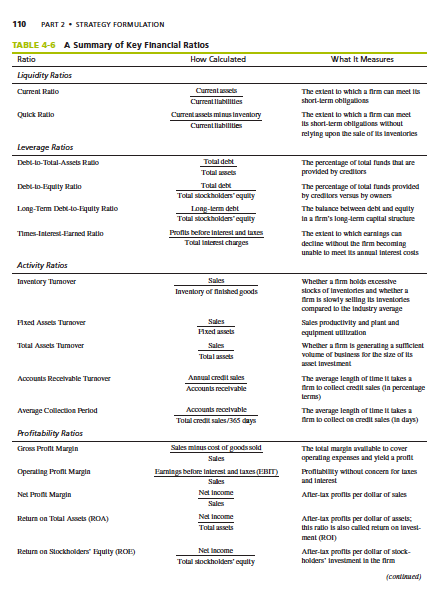

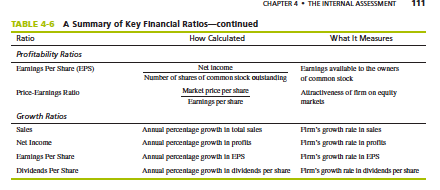

110 PART 2. STRATEGY FORMULATION What It Measures TABLE 4-6 A Summary of Key Financial Ratios Ratio How Calculated Liquidity Ratios Current Ratio Cuments Current liabilities Quick Ratio Current assets minas inventory Current liabilities The extent to which a firm can meet Ils short-term chllgallons The extent to which a firm can meet Ils short-term obligations without relying upon the sale of its inventories Leverage Ratios Debt-to-Total-Assets Rato Total de Total sets Debt--Equity Ratio Long-Term Debeloqully Ratio Total dett Total stockholders' equilty Long-term deht Total stockholders' equity Profits before interest and lates Total Interest charges The percentage of total funds that are provided by creditors The percentage of total funds provided by creditors versus by owners The balance between debt and equity In a firm's long-term capital structure The extent to which earnings can decline without the firm becoming unable to meet its annual Interest costs Times-Interest-Barned Ratio Activity Ratios Inventory Tumover Sales Inventory of finished goods Mixed Assets Turnover Sales Hxed assets Sales Total assets Total Assets Tumaver Whether a firm holds excessive slocks of Inventories and whether firm is slowly selling its inventories compared to the industry avenge Sales productivity and plant and equipment utilization Whether a firm is generating a sufficient volume of business for the size of its set investment The average length of time it takes a firm to collect credit sales (In percentage terms) The average length of time it takes a firm to collect on credit sales (in days) Accounts Receivable Turnover Annual credit sales Accounts receivable Avenge Collection Period Accounts receivable Total credit sales/365 days Profitability Ratios Giros Prolt Margin Operating Pront Margin Sales minus cost of goods sold Sales Earnings before interest and taxes (EBIT) Sales Net Income Sales Net Income Total assets The total margie available to cover operating expenses and yield a profit Profitability without concern for lates and interest Aller-tax profilis per dollar of sales Net Pro Margin Return on Total Assets (RCA) Afler-bas profils per dollar of assets; this ratio is also called return on invest ment (RON) Afler-tax proflis per dollar of stock- holders' Investment in the firm Return on Stockholders' qully (ROM Net Income Total stockholders' equity (cond) 111 CHAPTER 4. THE INTERNAL ASSESSMENT TABLE 4-6 A Summary of Key Financial Ratios-continued Ratio How Calculated What It Measures Profitability Ratias Famnings Per Shure (EPS) Net Income Earnings available to the owners Number of shares of common stock outstanding of common stock PriceVarnings Ratio Market price per share Allractiveness of firmon equilty Famnings per share markets Growth Ratios Sales Annual percentage growth in total sales Hrm's growth rate in sales Net Income Annual percentage growth in profits Hom's growth rate in profiles Famings Per Share Annual percentage growth in EPS Hrm's growth rate in EPS Dividends Per Share Annual percentage growth in dividends per share Hom's growth rate in dividends per share 110 PART 2. STRATEGY FORMULATION What It Measures TABLE 4-6 A Summary of Key Financial Ratios Ratio How Calculated Liquidity Ratios Current Ratio Cuments Current liabilities Quick Ratio Current assets minas inventory Current liabilities The extent to which a firm can meet Ils short-term chllgallons The extent to which a firm can meet Ils short-term obligations without relying upon the sale of its inventories Leverage Ratios Debt-to-Total-Assets Rato Total de Total sets Debt--Equity Ratio Long-Term Debeloqully Ratio Total dett Total stockholders' equilty Long-term deht Total stockholders' equity Profits before interest and lates Total Interest charges The percentage of total funds that are provided by creditors The percentage of total funds provided by creditors versus by owners The balance between debt and equity In a firm's long-term capital structure The extent to which earnings can decline without the firm becoming unable to meet its annual Interest costs Times-Interest-Barned Ratio Activity Ratios Inventory Tumover Sales Inventory of finished goods Mixed Assets Turnover Sales Hxed assets Sales Total assets Total Assets Tumaver Whether a firm holds excessive slocks of Inventories and whether firm is slowly selling its inventories compared to the industry avenge Sales productivity and plant and equipment utilization Whether a firm is generating a sufficient volume of business for the size of its set investment The average length of time it takes a firm to collect credit sales (In percentage terms) The average length of time it takes a firm to collect on credit sales (in days) Accounts Receivable Turnover Annual credit sales Accounts receivable Avenge Collection Period Accounts receivable Total credit sales/365 days Profitability Ratios Giros Prolt Margin Operating Pront Margin Sales minus cost of goods sold Sales Earnings before interest and taxes (EBIT) Sales Net Income Sales Net Income Total assets The total margie available to cover operating expenses and yield a profit Profitability without concern for lates and interest Aller-tax profilis per dollar of sales Net Pro Margin Return on Total Assets (RCA) Afler-bas profils per dollar of assets; this ratio is also called return on invest ment (RON) Afler-tax proflis per dollar of stock- holders' Investment in the firm Return on Stockholders' qully (ROM Net Income Total stockholders' equity (cond) 111 CHAPTER 4. THE INTERNAL ASSESSMENT TABLE 4-6 A Summary of Key Financial Ratios-continued Ratio How Calculated What It Measures Profitability Ratias Famnings Per Shure (EPS) Net Income Earnings available to the owners Number of shares of common stock outstanding of common stock PriceVarnings Ratio Market price per share Allractiveness of firmon equilty Famnings per share markets Growth Ratios Sales Annual percentage growth in total sales Hrm's growth rate in sales Net Income Annual percentage growth in profits Hom's growth rate in profiles Famings Per Share Annual percentage growth in EPS Hrm's growth rate in EPS Dividends Per Share Annual percentage growth in dividends per share Hom's growth rate in dividends per share