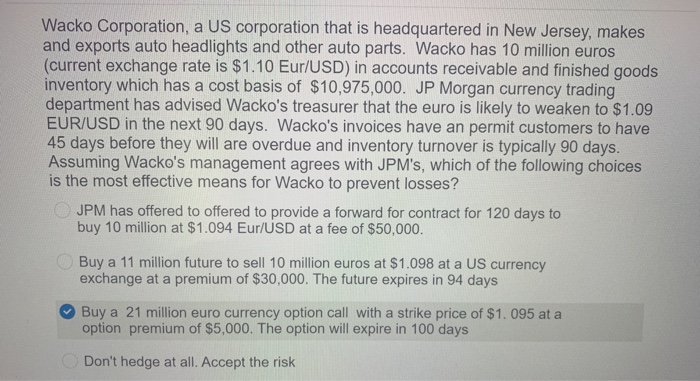

Wacko Corporation, a US corporation that is headquartered in New Jersey, makes and exports auto headlights and other auto parts. Wacko has 10 million euros (current exchange rate is $1.10 Eur/USD) in accounts receivable and finished goods inventory which has a cost basis of $10,975,000. JP Morgan currency trading department has advised Wacko's treasurer that the euro is likely to weaken to $1.09 EUR/USD in the next 90 days. Wacko's invoices have an permit customers to have 45 days before they will are overdue and inventory turnover is typically 90 days. Assuming Wacko's management agrees with JPM's, which of the following choices is the most effective means for Wacko to prevent losses? JPM has offered to offered to provide a forward for contract for 120 days to buy 10 million at $1.094 Eur/USD at a fee of $50,000. Buy a 11 million future to sell 10 million euros at $1.098 at a US currency exchange at a premium of $30,000. The future expires in 94 days Buy a 21 million euro currency option call with a strike price of $1.095 at a option premium of $5,000. The option will expire in 100 days! Don't hedge at all. Accept the risk Wacko Corporation, a US corporation that is headquartered in New Jersey, makes and exports auto headlights and other auto parts. Wacko has 10 million euros (current exchange rate is $1.10 Eur/USD) in accounts receivable and finished goods inventory which has a cost basis of $10,975,000. JP Morgan currency trading department has advised Wacko's treasurer that the euro is likely to weaken to $1.09 EUR/USD in the next 90 days. Wacko's invoices have an permit customers to have 45 days before they will are overdue and inventory turnover is typically 90 days. Assuming Wacko's management agrees with JPM's, which of the following choices is the most effective means for Wacko to prevent losses? JPM has offered to offered to provide a forward for contract for 120 days to buy 10 million at $1.094 Eur/USD at a fee of $50,000. Buy a 11 million future to sell 10 million euros at $1.098 at a US currency exchange at a premium of $30,000. The future expires in 94 days Buy a 21 million euro currency option call with a strike price of $1.095 at a option premium of $5,000. The option will expire in 100 days! Don't hedge at all. Accept the risk