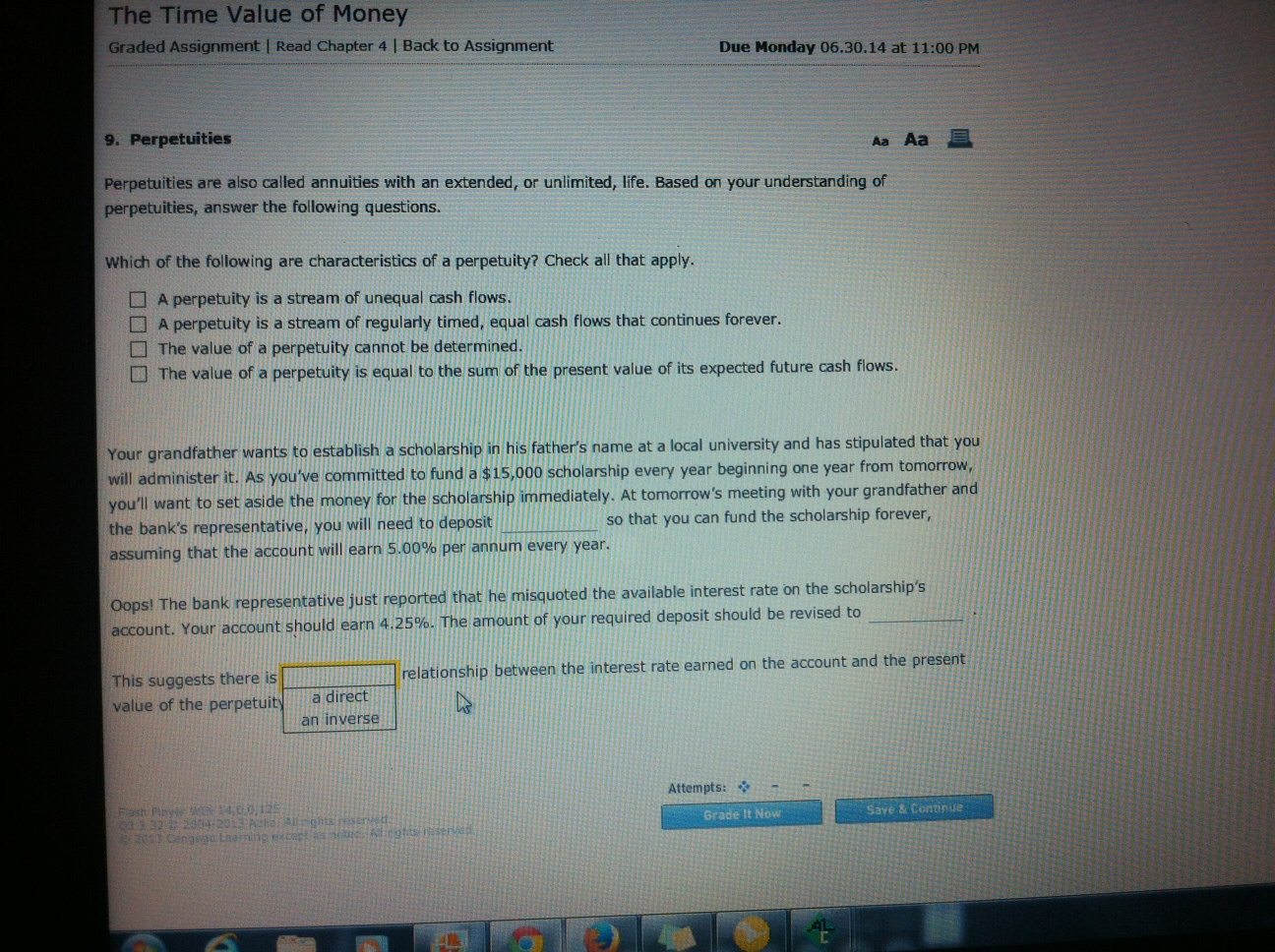

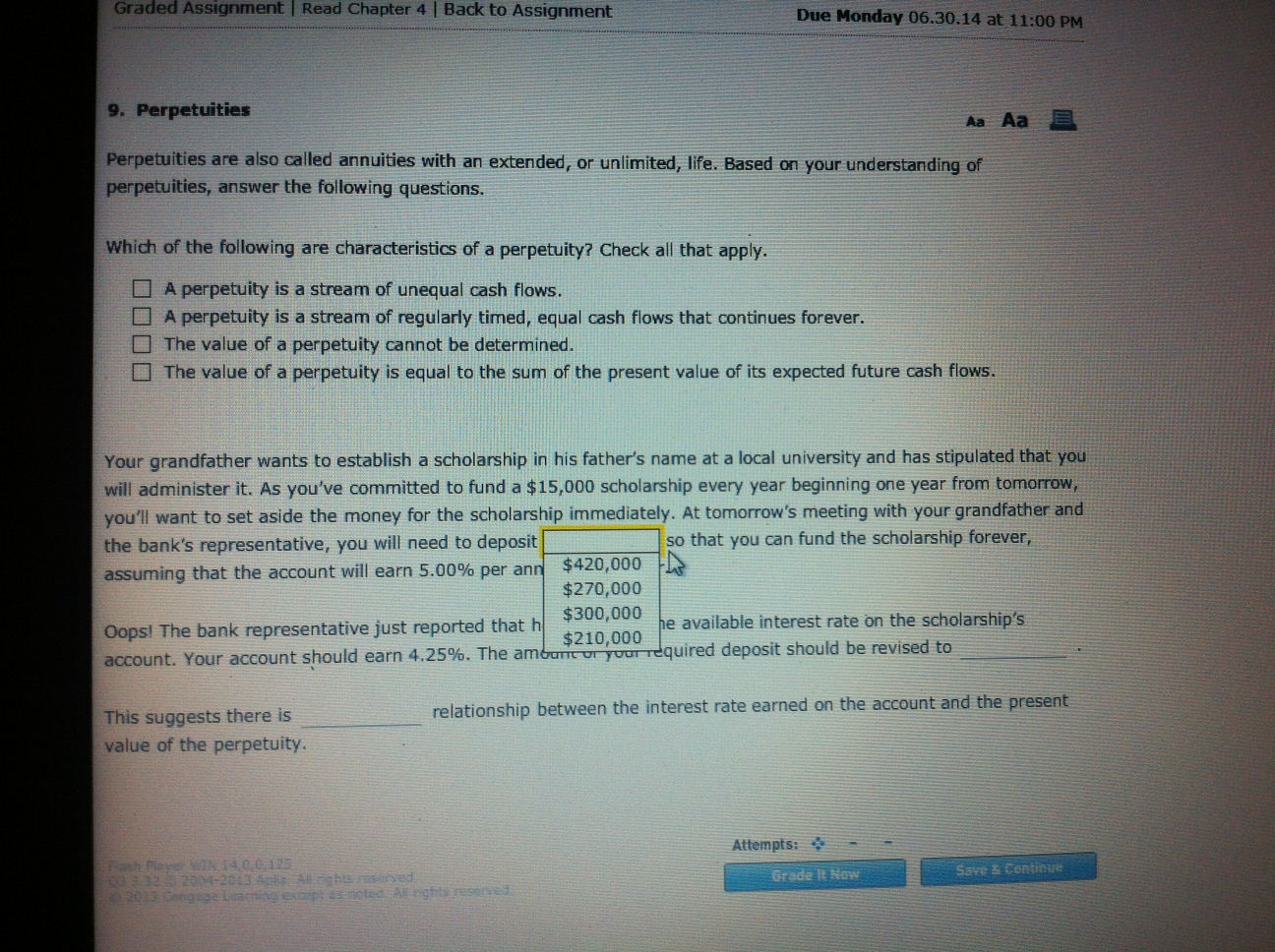

Perpetuities are also called annuities with an extended, or unlimited, life. Based or your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. A perpetuity is a stream of unequal cash flows. A perpetuity is a stream of regularly timed, equal cash flows that continues forever. The value of a perpetuity cannot be determined. The value of a perpetuity is equal to the sum of the present value of its expected future cash flows. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and the bank's representative, you will need to deposit so that you can fund the scholarship forever, assuming that the account will earn 5.00% per annum every year. Oops! The bank representative just reported that he misquoted the available interest rate bn the scholarship's account. Your account should earn 4.25%. The amount of your required deposit should be revised to Perpetuities are also called annuities with an extended, or unlimited, life. Based or your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. A perpetuity is a stream of unequal cash flows. A perpetuity is a stream of regularly timed, equal cash flows that continues forever. The value of a perpetuity cannot be determined. The value of a perpetuity is equal to the sum of the present value of its expected future cash flows. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and the bank's representative, you will need to deposit _ so you can scholarship forever, assuming that the account will earn 5.00% per annum every year. Oops1 The bank representative just reported that he misquoted the available interest rate on the scholarship's account. Your account should earn 4.25%. The amount of your required deposit should be revised to Perpetuities are also called annuities with an extended, or unlimited, life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. A perpetuity is a stream of unequal cash flows. A perpetuity is a stream of regularly timed, equal cash flows that continues forever. The value of a perpetuity cannot be determined. The value of a perpetuity is equal to the sum of the present value of its expected future cash flows. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and