Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perrot Industries has $ 3 4 5 , 0 0 0 to invest. The company is trying to decide between two alternative uses of the

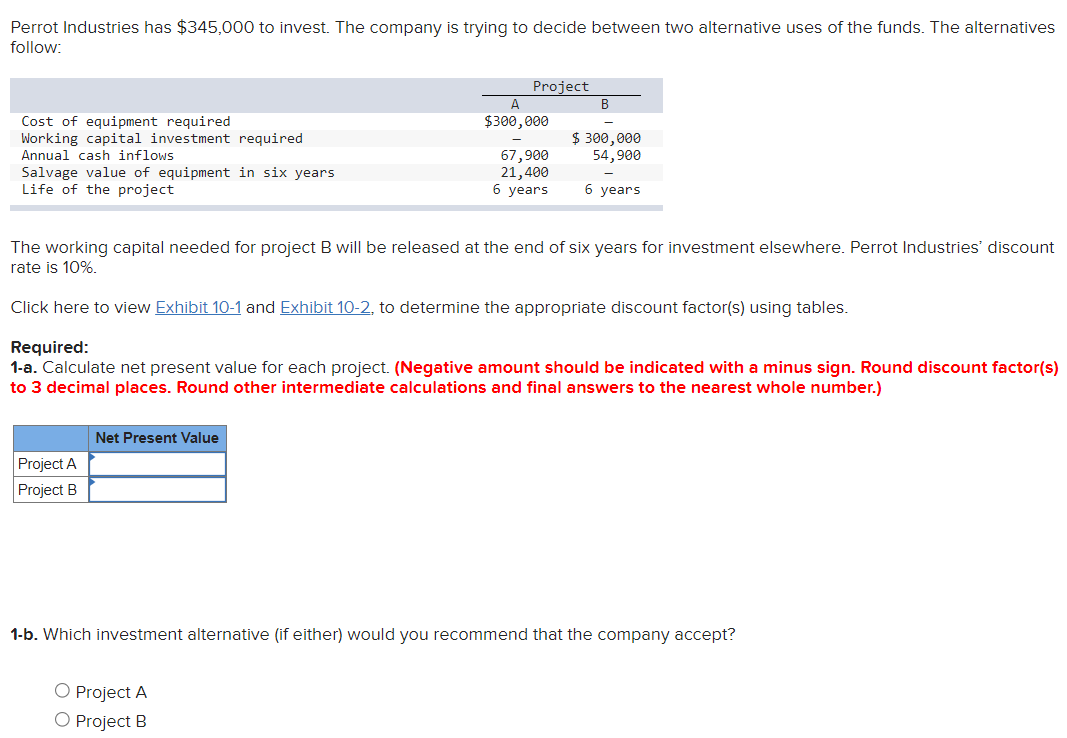

Perrot Industries has $ to invest. The company is trying to decide between two alternative uses of the funds. The alternatives

follow:

The working capital needed for project B will be released at the end of six years for investment elsewhere. Perrot Industries' discount

rate is

Click here to view Exhibit and Exhibit to determine the appropriate discount factors using tables.

Required:

a Calculate net present value for each project. Negative amount should be indicated with a minus sign. Round discount factors

to decimal places. Round other intermediate calculations and final answers to the nearest whole number.

b Which investment alternative if either would you recommend that the company accept?

Project A

Project B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started