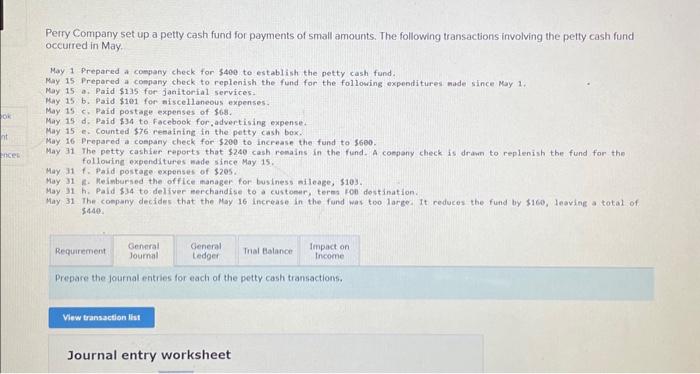

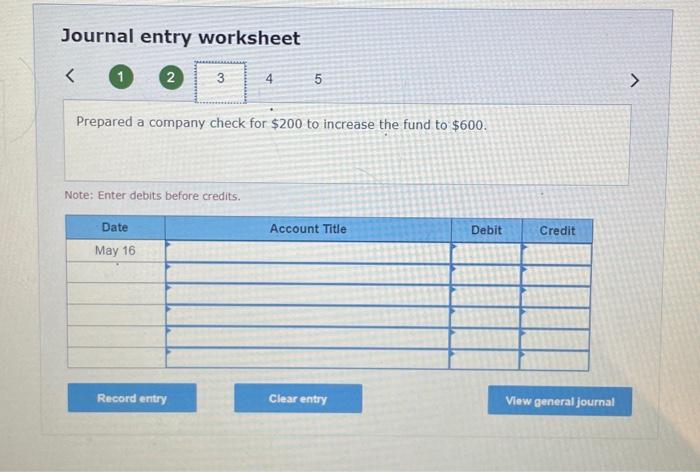

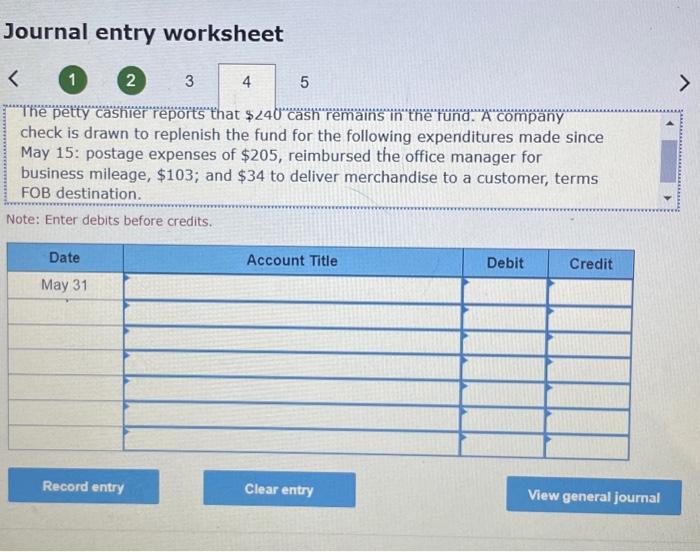

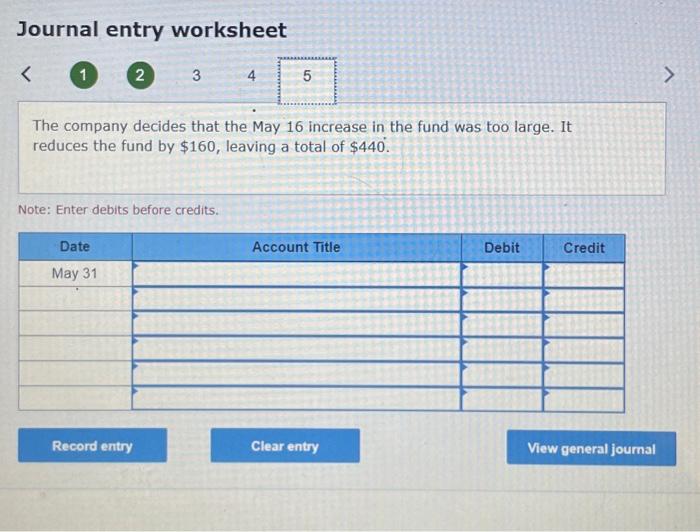

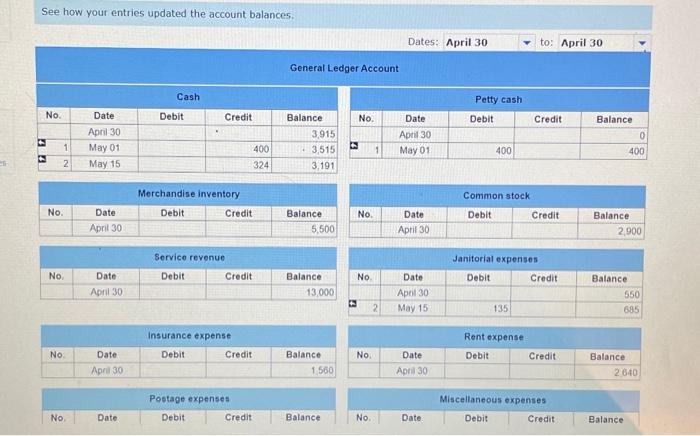

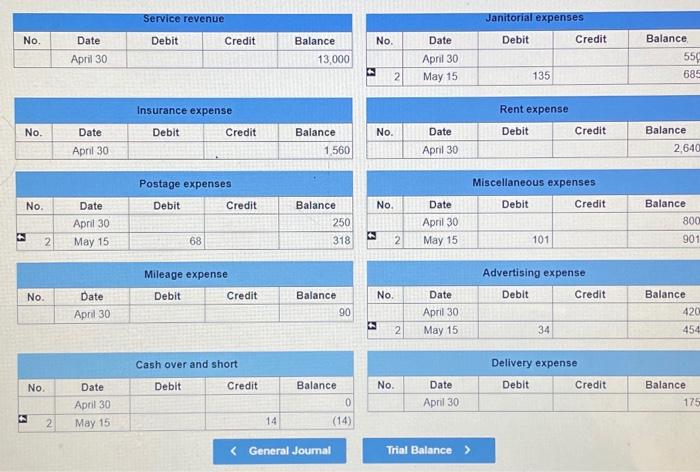

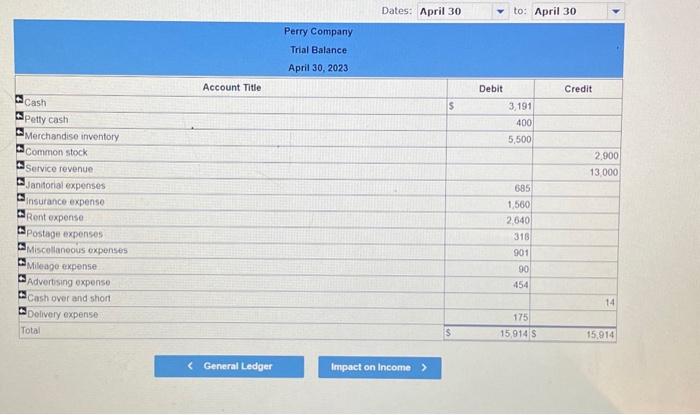

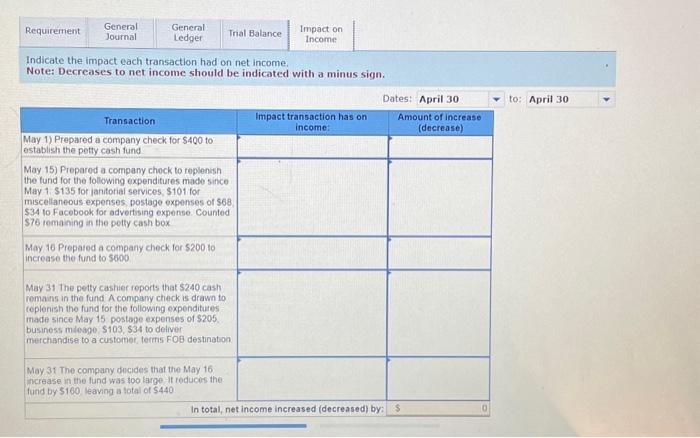

Perry Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for 3400 to establish the petty cash fund. May 15. Prepared a conpany cbeck to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $135 for janitorial services. May 15 b. Paid $101 for siscellaneous expenses. May 15 c. Paid postage expenses of $69. May 15 d. Paid $34 to Facebook for advertising expense. May 15e - Counted $76 renainine in the petty cash box. May 16 Prepared a coepany check for $200 to increase the fund to 5690 . May 31 The petty cashier reports that $240 cash rewains in the fund. A conpany check is drawn to replenish the fund for the following expenditures sade since May 15. May 31f. Paid postage expenses of $205. May 31 R. Neinbursed the office manager for business mileage, $103. May 31 h. Pald $34 to deliver eerchandise to a customer, terms roe dostination. May 31 The company decides that the Moy 16 increase. In the fund was too large. It reduces the fund by $160, leaving a total of. 544ei Prepare the journal entries for each of the petty cash transactioms. Journal entry worksheet Journal entry worksheet 1 5 Prepared a company check for $200 to increase the fund to $600. Note: Enter debits before credits. Journal entry worksheet check is drawn to replenish the fund for the following expenditures made since May 15: postage expenses of $205, reimbursed the office manager for business mileage, $103; and $34 to deliver merchandise to a customer, terms FOB destination. Note: Enter debits before credits. Journal entry worksheet The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160, leaving a total of $440. Note: Enter debits before credits. See how your entries updated the account balances. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Service revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 13,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Janitorial expenses } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 554 \\ \hline 2 & May 15 & 135 & 685 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{} & Insurance expense \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apri 30 & & & 1,560 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Rent expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 2,640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Postage expenses } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 250 \\ \hline 2 & May 15 & 68 & & 318 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|} \hline \multicolumn{5}{|c|}{ Miscellaneous expenses } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 800 \\ \hline 2 & May 15 & 101 & & 901 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|r|} \hline \multicolumn{5}{|c|}{ Advertising expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 420 \\ \hline 2 & May 15 & 34 & 454 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Delivery expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & April 30 & & & 175 \\ \hline \end{tabular} General Joumal Trial Balance > General Ledger Impact on Income Indicate the impact each transaction had on net income. Note: Decreases to net income should be indicated with a mints sign