Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perseus, a manufacturer of luxury clothes wholly owned by its owner-manager, is considering introducing a new range of coats made from baby sea lions.

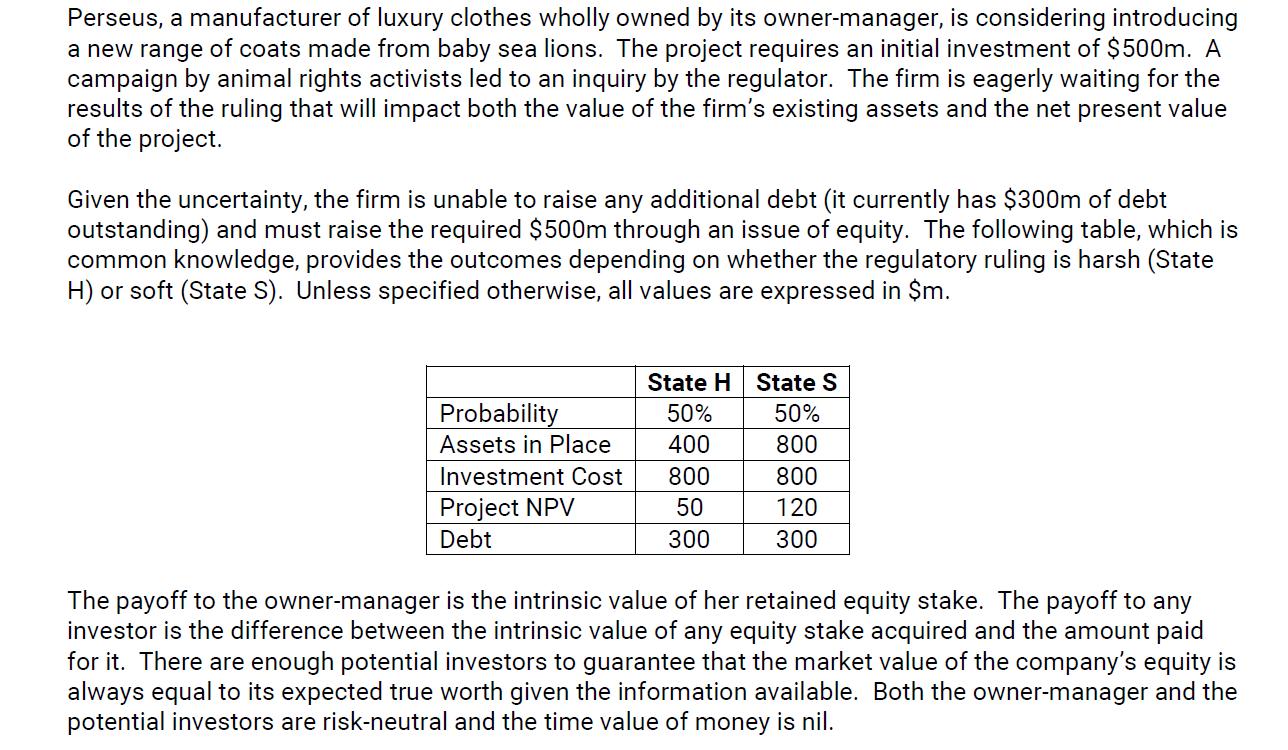

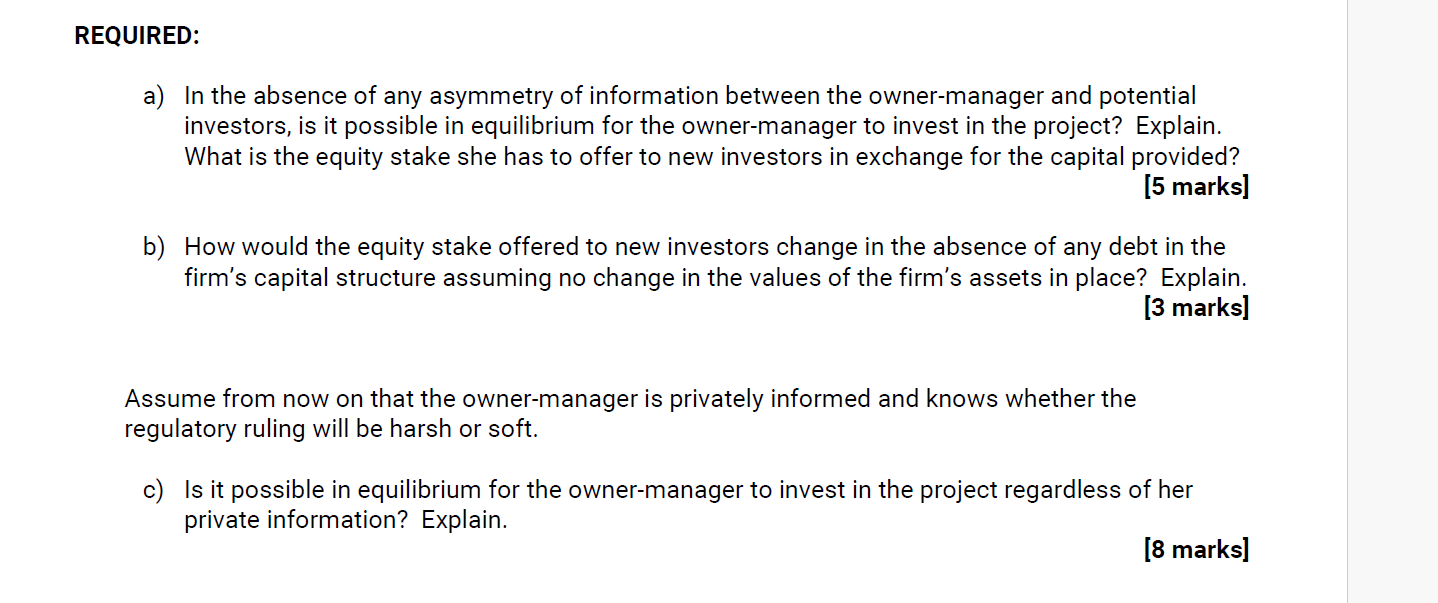

Perseus, a manufacturer of luxury clothes wholly owned by its owner-manager, is considering introducing a new range of coats made from baby sea lions. The project requires an initial investment of $500m. A campaign by animal rights activists led to an inquiry by the regulator. The firm is eagerly waiting for the results of the ruling that will impact both the value of the firm's existing assets and the net present value of the project. Given the uncertainty, the firm is unable to raise any additional debt (it currently has $300m of debt outstanding) and must raise the required $500m through an issue of equity. The following table, which is common knowledge, provides the outcomes depending on whether the regulatory ruling is harsh (State H) or soft (State S). Unless specified otherwise, all values are expressed in $m. State H State S Probability 50% 50% Assets in Place 400 800 Investment Cost Project NPV Debt 800 800 50 120 300 300 The payoff to the owner-manager is the intrinsic value of her retained equity stake. The payoff to any investor is the difference between the intrinsic value of any equity stake acquired and the amount paid for it. There are enough potential investors to guarantee that the market value of the company's equity is always equal to its expected true worth given the information available. Both the owner-manager and the potential investors are risk-neutral and the time value of money is nil. REQUIRED: a) In the absence of any asymmetry of information between the owner-manager and potential investors, is it possible in equilibrium for the owner-manager to invest in the project? Explain. What is the equity stake she has to offer to new investors in exchange for the capital provided? [5 marks] b) How would the equity stake offered to new investors change in the absence of any debt in the firm's capital structure assuming no change in the values of the firm's assets in place? Explain. [3 marks] Assume from now on that the owner-manager is privately informed and knows whether the regulatory ruling will be harsh or soft. c) Is it possible in equilibrium for the owner-manager to invest in the project regardless of her private information? Explain. [8 marks]

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answers a In the absence of any asymmetry of information between the ownermanager and potential inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started