Answered step by step

Verified Expert Solution

Question

1 Approved Answer

personal taxation questions F is employed by a public corporation. In year 1, F was granted a stock option to acquire 4,000 shares from the

personal taxation questions

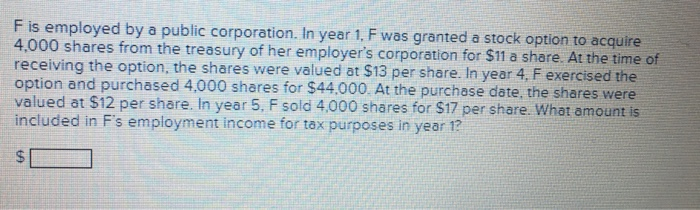

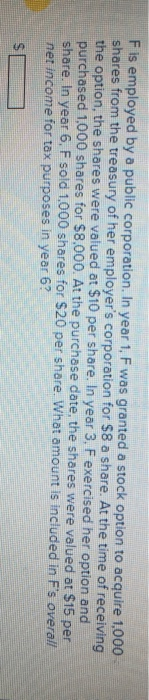

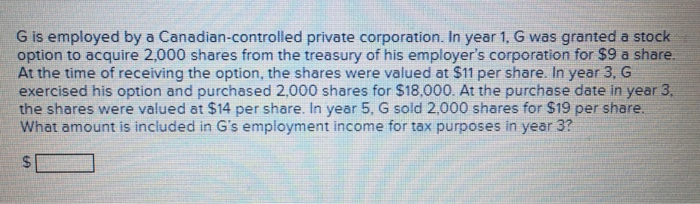

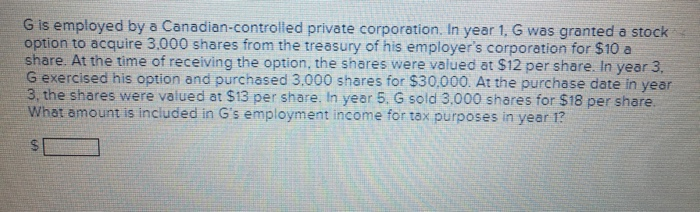

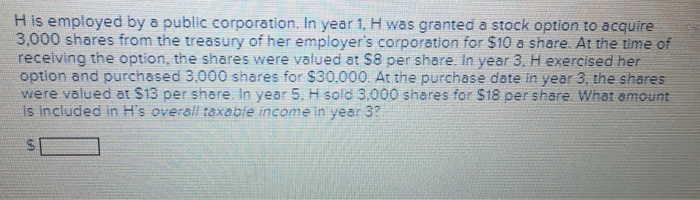

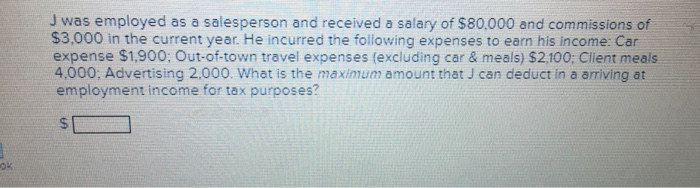

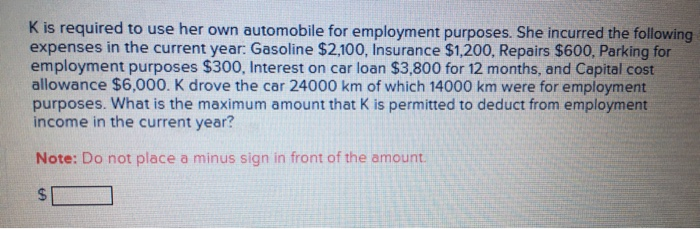

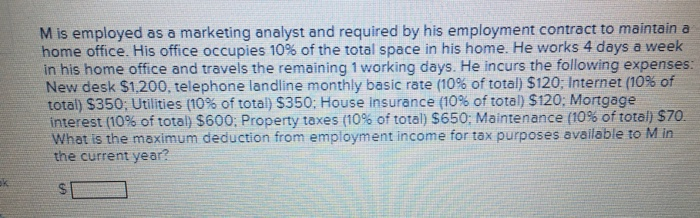

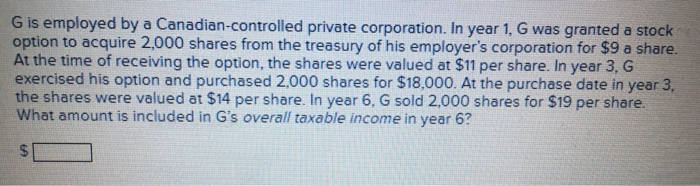

F is employed by a public corporation. In year 1, F was granted a stock option to acquire 4,000 shares from the treasury of her employer's corporation for $11 a share. At the time of receiving the option, the shares were valued at $13 per share. In year 4. F exercised the option and purchased 4,000 shares for $44.000. At the purchase date, the shares were valued at $12 per share. In year 5, F sold 4,000 shares for $17 per share. What amount is included in F's employment income for tax purposes in year 1? $ F is employed by a public corporation. In year 1, F was granted a stock option to acquire 1,000 shares from the treasury of her employer's corporation for $8 a share. At the time of receiving the option, the shares were valued at $10 per share. In year 3. F exercised her option and purchased 1,000 shares for $8,000. At the purchase date, the shares were valued at $15 per share. In year 6. F sold 1.000 shares for $20 per share. What amount is included in F's overall net income for tax purposes in year 6? G is employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 2,000 shares from the treasury of his employer's corporation for $9 a share. At the time of receiving the option, the shares were valued at $11 per share. In year 3, G exercised his option and purchased 2,000 shares for $18,000. At the purchase date in year 3. the shares were valued at $14 per share. In year 5. G sold 2,000 shares for $19 per share. What amount is included in G's employment income for tax purposes in year 3? $ G is employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 3.000 shares from the treasury of his employer's corporation for $10 a share. At the time of receiving the option, the shares were valued at $12 per share. In year 3. Gexercised his option and purchased 3,000 shares for $30,000. At the purchase date in year 3, the shares were valued at $13 per share. In year 5. G sold 3.000 shares for $18 per share. What amount is included in G's employment income for tax purposes in year 12 SC His employed by a public corporation. In year 1, H was granted a stock option to acquire 3,000 shares from the treasury of her employer's corporation for $10 a share. At the time of receiving the option, the shares were valued at $8 per share. In year 3. H exercised her option and purchased 3.000 shares for $30.000. At the purchase date in year 3, the shares were valued at $13 per share. In year 5. H sold 3.000 shares for S18 per share. What amount is included in H's overall taxable income in year 3? J was employed as a salesperson and received a salary of $80,000 and commissions of $3,000 in the current year. He incurred the following expenses to earn his income: Car expense $1,900: Out-of-town travel expenses (excluding car & meals) $2,100; Client meals 4.000, Advertising 2.000. What is the maximum amount that J can deduct in a arriving at employment income for tax purposes? $ K is required to use her own automobile for employment purposes. She incurred the following expenses in the current year: Gasoline $2,100. Insurance $1,200, Repairs $600. Parking for employment purposes $300, Interest on car loan $3,800 for 12 months, and Capital cost allowance $6,000. K drove the car 24000 km of which 14000 km were for employment purposes. What is the maximum amount that K is permitted to deduct from employment income in the current year? Note: Do not place a minus sign in front of the amount $ M is employed as a marketing analyst and required by his employment contract to maintain a home office. His office occupies 10% of the total space in his home. He works 4 days a week in his home office and travels the remaining 1 working days. He incurs the following expenses: New desk $1,200, telephone landline monthly basic rate (10% of total) $120: Internet (10% of total) $350: Utilities (10% of total) $350: House insurance (10% of total) $120: Mortgage interest (10% of total) $600: Property taxes (10% of total) $650: Maintenance (10% of total) $70. What is the maximum deduction from employment income for tax purposes available to Min the current year? $ G is employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 2,000 shares from the treasury of his employer's corporation for $9 a share. At the time of receiving the option, the shares were valued at $11 per share. In year 3, G exercised his option and purchased 2,000 shares for $18,000. At the purchase date in year 3, the shares were valued at $14 per share. In year 6. G sold 2,000 shares for $19 per share. What amount is included in G's overall taxable income in year 6? $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started