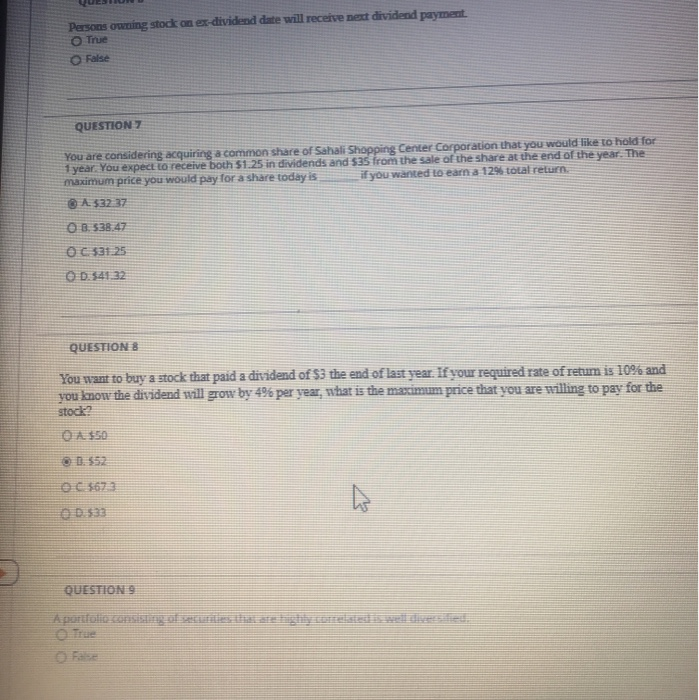

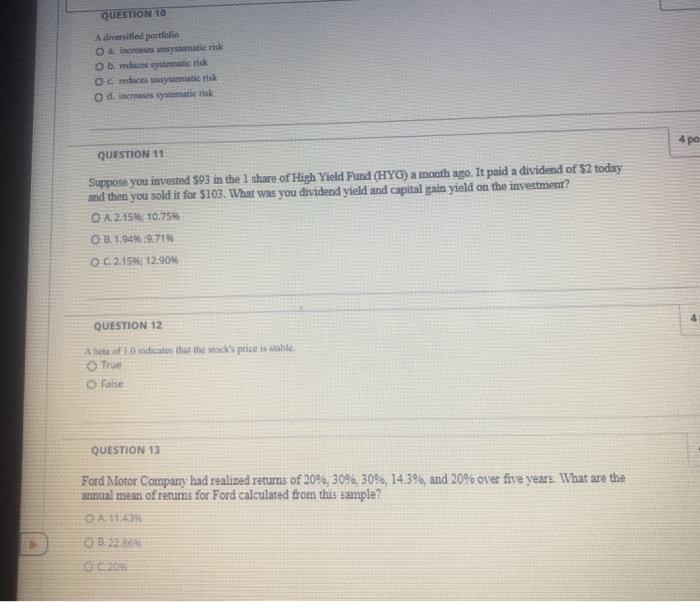

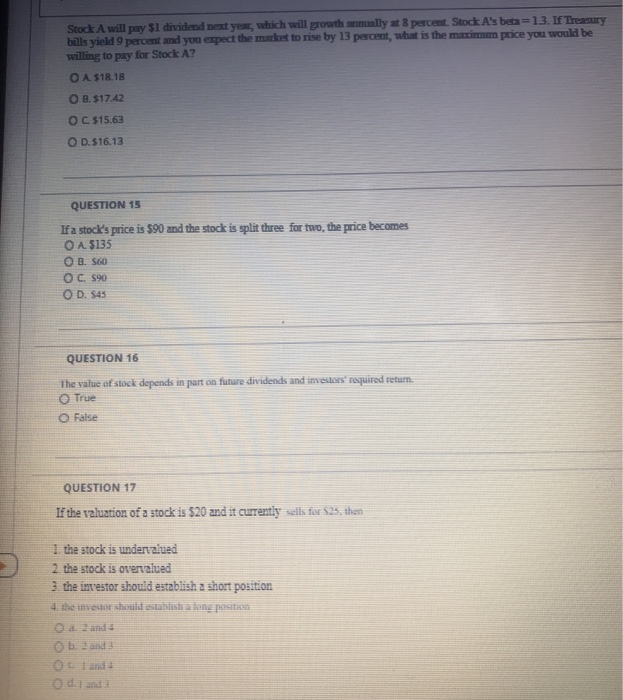

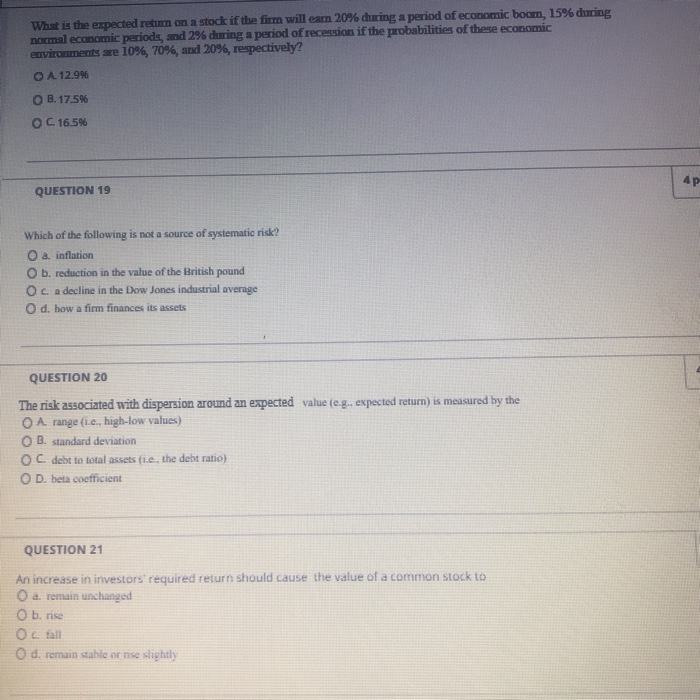

Persons owning stock on ex dividend date will receive next dividend payment True False QUESTION Z You are considering acquiring a common share of Sahali Shopping Center Corporation that you would like to hold for 1 year. You expect to receive both 51.25 in dividends and 535 from the sale of the share at the end of the year. The maximum price you would pay for a share today is if you wanted to earn a 1295 total return A 532337 O 8. 538,47 O C 531:25 OD.34132 QUESTIONS You want to buy a stock that paid a dividend of $3 the end of last year. If your required rate of retum is 10% and you know the dividend will grow by 4% per year, what is the maximum price that you are willing to pay for the stock? O $50 O 03673 033 QUESTIONS A portfolio consigo QUESTION 10 A diversified portfolio O increases unsystematic risk Obredeces systematic risk O reduces unsystematic risk od increases systematic risk QUESTION 11 Suppose you invested 593 in the 1 share of High Yield Fund (HYC) a month ago. It paid a dividend of $2 today and then you sold it for $103. What was you dividend yield and capital gain yield on the investment? O 12.15%: 10.75% .1.9496:9.719 OC. 2.154, 12.90% QUESTION 12 indicates that the stock's price is stable A bete of True False QUESTION 13 Ford Motor Company had realized retums of 20%, 30%, 309, 14.3%, and 20% over five years. What are the annual mean of returns for Ford calculated from this sample? OC. 20 Stock A will pay $1 dividend next year, which will growth annually at 8 percent. Stock A's beta = 13. If Treasury bills yield 9 percent and you expect the market to rise by 13 percent, what is the maximum price you would be willing to pay for Stock A? O A $18.18 O B. 517.42 OC 15.63 O D.516.13 QUESTION 15 If a stock's price is $90 and the stock is split three for two, the price becomes O A. 135 OB. 560 O C. $90 OD. $45 QUESTION 16 the value of stock depends in part on future dividends and investors required return True False QUESTION 17 If the valuation of a stock is $20 and it currently sells for $25, then 1 the stock is undervalued 2 the stock is overvalued 3. the investor should establish a short position 4 the investor should establish a long position b. 2 and OL I and di 1 and What is the expected return on a stock if the firm will earn 20% during a period of economic boom, 15% during normal economic periods, and 2% during a period of recession if the probabilities of these economic environments are 10%, 70%, and 20%, respectively? O A 12.9% OB. 17.5% OC 16.5% QUESTION 19 Which of the following is not a source of systematic risk? O a inflation b. reduction in the value of the British pound Oc a decline in the Dow Jones industrial average d. how a firm finances its assets QUESTION 20 value (e.g., expected return) is measured by the The risk associated with dispersion around an expected O A range (1.e., high-low values) O B. standard deviation OC debt to total assets i... the debt ratio) O D. beta coefficient QUESTION 21 An increase in investors' required return should cause the value of a common stock to O a remain unchanged Ob. OC fall O d. remain stable or ne slightly