Answered step by step

Verified Expert Solution

Question

1 Approved Answer

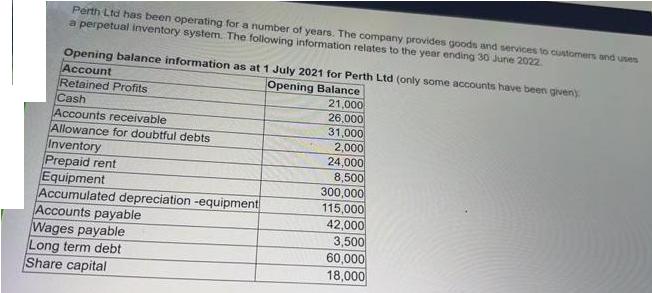

Perth Ltd has been operating for a number of years. The company provides goods and services to customers and uses a perpetual inventory system.

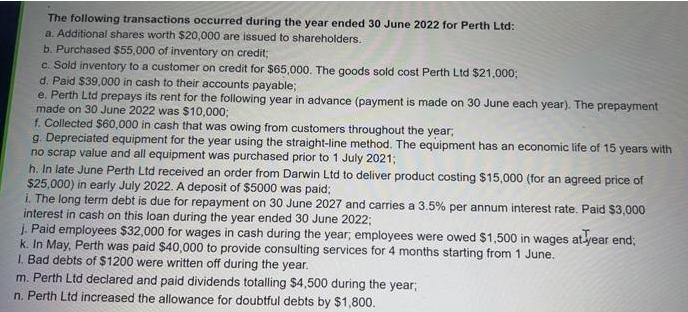

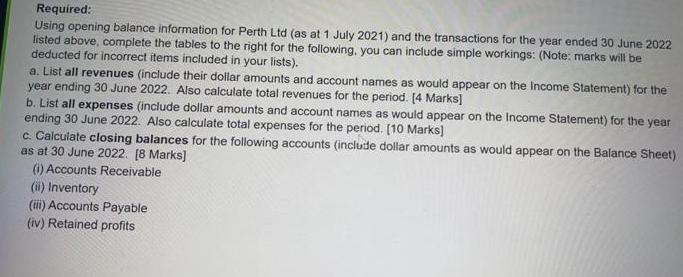

Perth Ltd has been operating for a number of years. The company provides goods and services to customers and uses a perpetual inventory system. The following information relates to the year ending 30 Junie 2022 Opening balance information as at 1 July 2021 for Perth Ltd (only some accounts have been given) Account Opening Balance Retained Profits Cash Accounts receivable Allowance for doubtful debts Inventory Prepaid rent Equipment Accumulated depreciation -equipment Accounts payable Wages payable Long term debt Share capital 21,000 26,000 31,000 2,000 24,000 8,500 300,000 115,000 42,000 3,500 60,000 18,000 The following transactions occurred during the year ended 30 June 2022 for Perth Ltd: a. Additional shares worth $20,000 are issued to shareholders. b. Purchased $55,000 of inventory on credit; c. Sold inventory to a customer on credit for $65,000. The goods sold cost Perth Ltd $21,000; d. Paid $39,000 in cash to their accounts payable; e. Perth Ltd prepays its rent for the following year in advance (payment is made on 30 June each year). The prepayment made on 30 June 2022 was $10,000; f. Collected $60,000 in cash that was owing from customers throughout the year, g. Depreciated equipment for the year using the straight-line method. The equipment has an economic life of 15 years with no scrap value and all equipment was purchased prior to 1 July 2021; h. In late June Perth Ltd received an order from Darwin Ltd to deliver product costing $15,000 (for an agreed price of $25,000) in early July 2022. A deposit of $5000 was paid; i. The long term debt is due for repayment on 30 June 2027 and carries a 3.5% per annum interest rate. Paid $3,000 interest in cash on this loan during the year ended 30 June 2022; j. Paid employees $32,000 for wages in cash during the year, employees were owed $1,500 in wages at year end; k. In May, Perth was paid $40,000 to provide consulting services for 4 months starting from 1 June. 1. Bad debts of $1200 were written off during the year. m. Perth Ltd declared and paid dividends totalling $4,500 during the year; n. Perth Ltd increased the allowance for doubtful debts by $1,800. Required: Using opening balance information for Perth Ltd (as at 1 July 2021) and the transactions for the year ended 30 June 2022 listed above, complete the tables to the right for the following, you can include simple workings: (Note: marks will be deducted for incorrect items included in your lists). a. List all revenues (include their dollar amounts and account names as would appear on the Income Statement) for the year ending 30 June 2022. Also calculate total revenues for the period. [4 Marks] b. List all expenses (include dollar amounts and account names as would appear on the Income Statement) for the year ending 30 June 2022. Also calculate total expenses for the period. [10 Marks] c. Calculate closing balances for the following accounts (include dollar amounts as would appear on the Balance Sheet) as at 30 June 2022. [8 Marks] (1) Accounts Receivable (ii) Inventory (iii) Accounts Payable (iv) Retained profits

Step by Step Solution

★★★★★

3.25 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION STEP 1 NB Deposit received in item h is unearned revenue as the goods will be delivered in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started