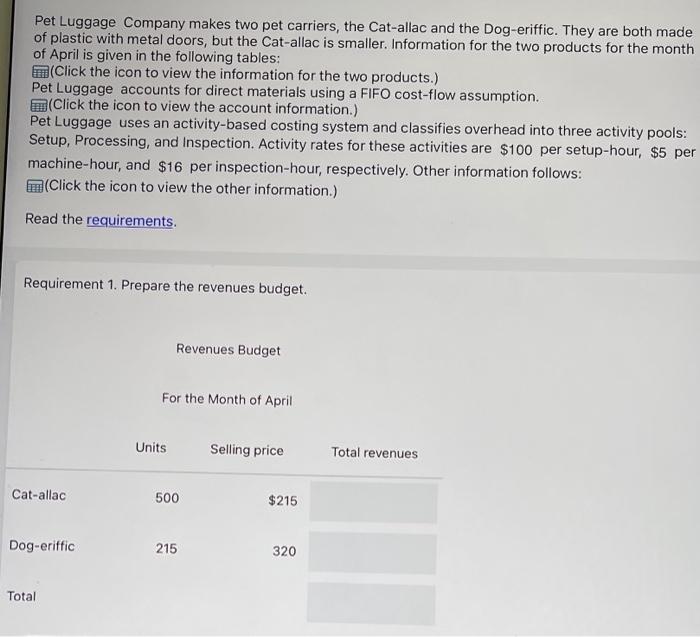

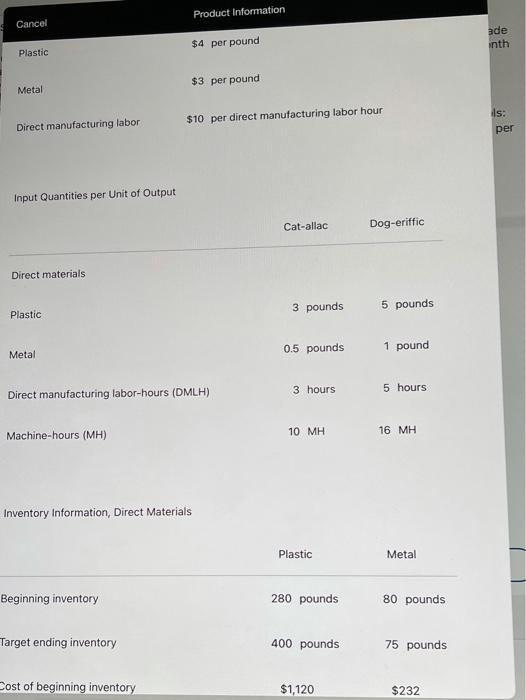

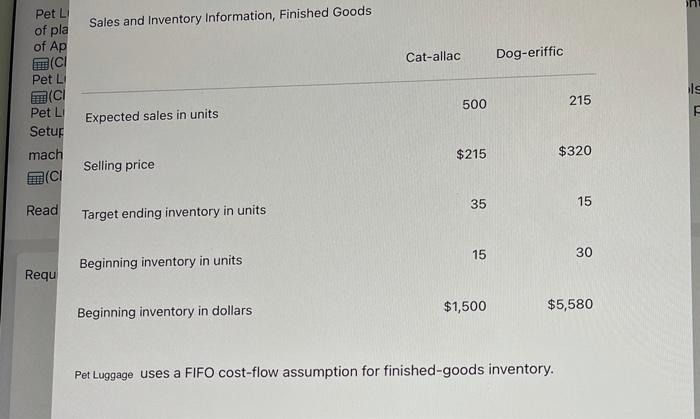

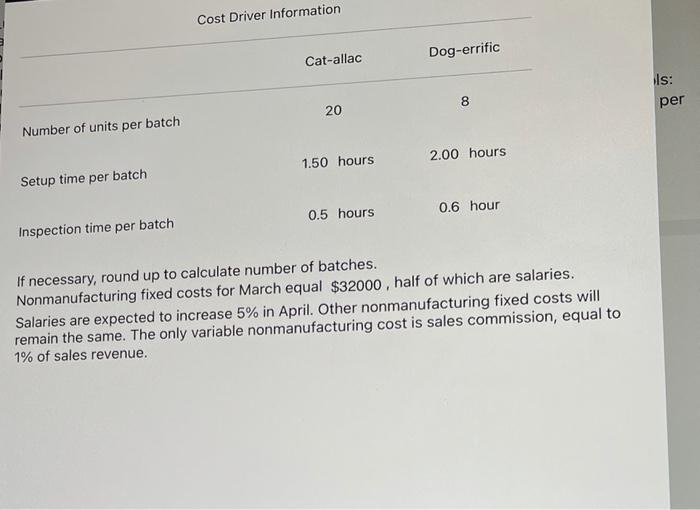

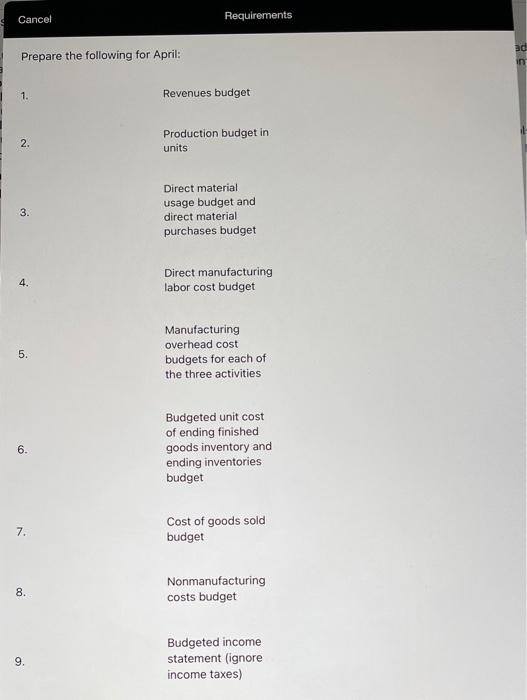

Pet Luggage Company makes two pet carriers, the Cat-allac and the Dog-eriffic. They are both made of plastic with metal doors, but the Cat-allac is smaller. Information for the two products for the month of April is given in the following tables: (Click the icon to view the information for the two products.) Pet Luggage accounts for direct materials using a FIFO cost-flow assumption. (Click the icon to view the account information.) Pet Luggage uses an activity-based costing system and classifies overhead into three activity pools: Setup, Processing, and Inspection. Activity rates for these activities are $100 per setup-hour, $5 per machine-hour, and $16 per inspection-hour, respectively. Other information follows: (Click the icon to view the other information.) Read the requirements. Requirement 1. Prepare the revenues budget. Revenues Budget For the Month of April Units Selling price Total revenues Cat-allac 500 $215 Dog-eriffic 215 320 Total Product Information Cancel ade inth $4 per pound Plastic $3 per pound Metal $10 per direct manufacturing labor hour Direct manufacturing labor is: per Input Quantities per Unit of Output Cat-allac Dog-eriffic Direct materials 3 pounds 5 pounds Plastic 0.5 pounds 1 pound Metal 3 hours 5 hours Direct manufacturing labor-hours (DMLH) 10 MH 16 MH Machine-hours (MH) Inventory Information, Direct Materials Plastic Metal Beginning inventory 280 pounds 80 pounds Target ending inventory 400 pounds 75 pounds Cost of beginning inventory $1,120 $232 in Sales and Inventory Information, Finished Goods Cat-allac Dog-eriffic Pet L of pla of Ap (CI Pet L (CI Pet L Setup mach 500 215 UJU Expected sales in units $215 $320 Selling price (CI 35 15 Read Target ending inventory in units 15 30 Beginning inventory in units Regu $1,500 $5,580 Beginning inventory in dollars Pet Luggage uses a FIFO cost-flow assumption for finished-goods inventory. Cost Driver Information Dog-errific Cat-allac Is: per 8 20 Number of units per batch 1.50 hours 2.00 hours Setup time per batch 0.6 hour 0.5 hours Inspection time per batch If necessary, round up to calculate number of batches. Nonmanufacturing fixed costs for March equal $32000, half of which are salaries. Salaries are expected to increase 5% in April. Other nonmanufacturing fixed costs will remain the same. The only variable nonmanufacturing cost is sales commission, equal to 1% of sales revenue. Cancel Requirements ad Prepare the following for April: in 1. Revenues budget 2. Production budget in units 3. Direct material usage budget and direct material purchases budget 4. Direct manufacturing labor cost budget 5. Manufacturing overhead cost budgets for each of the three activities 6. Budgeted unit cost of ending finished goods inventory and ending inventories budget 7. Cost of goods sold budget 8. Nonmanufacturing costs budget 9. Budgeted income statement (ignore income taxes)