Answered step by step

Verified Expert Solution

Question

1 Approved Answer

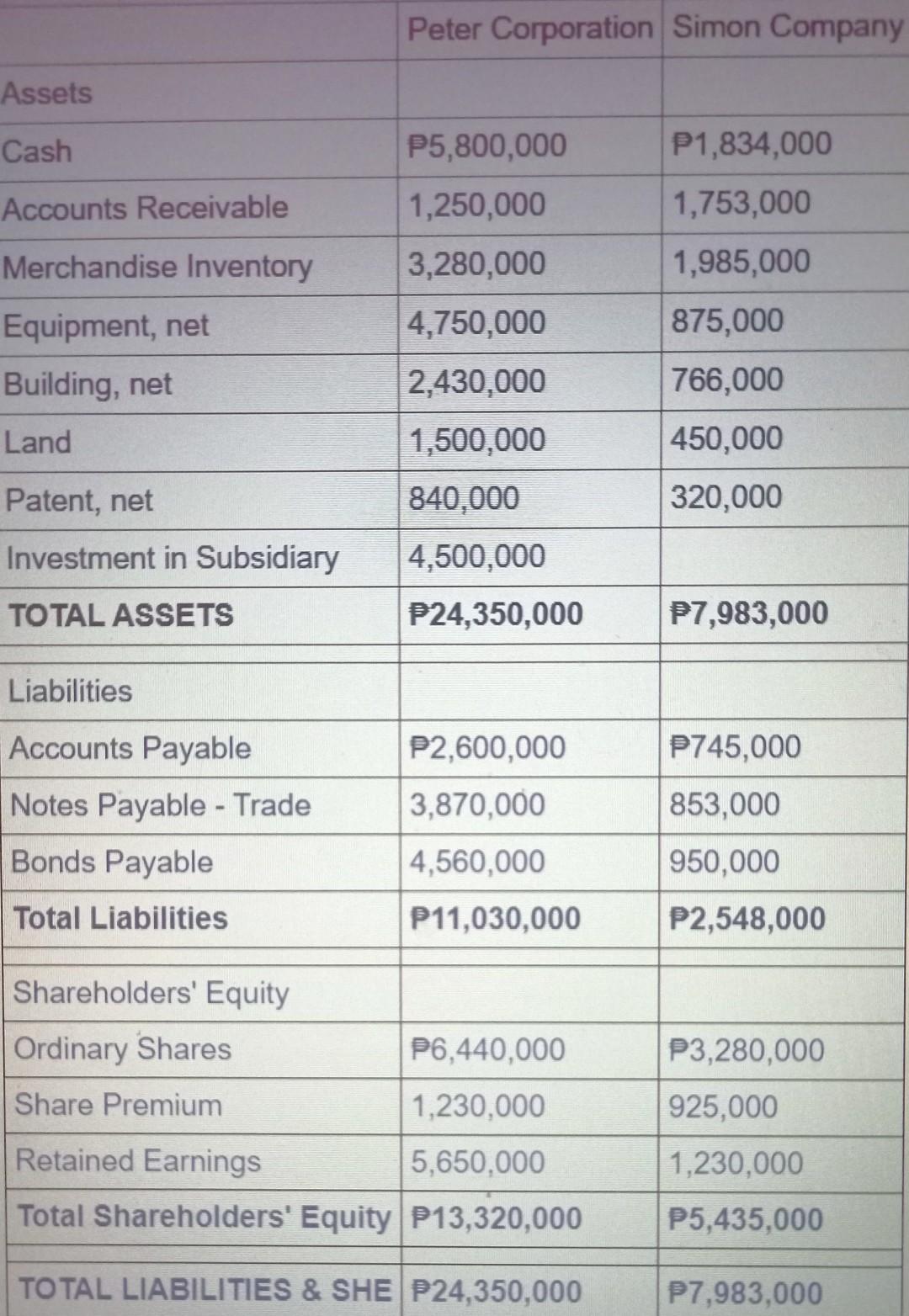

Pete corporation acquired 80% of the outstanding shares of Simo company for 4,500,000 cash. Non-controlling interest measured @FV. Following balances respective FS of Pete and

Pete corporation acquired 80% of the outstanding shares of Simo company for 4,500,000 cash. Non-controlling interest measured @FV. Following balances respective FS of Pete and Simo comp

BV of assets and liabilities of Simo company are equal their FV EXCEPT THE FOLLOWING

1. Merchandise inventory has FV of 1,650,000 2. Equipment BV overstated 30,000 3. Building FV amounted 948,000 4. Land and patent BV understated 115,000 and 30,000 5. Bond payable BV exceed FV 60,000

compute for CONSOLIDATED FINANCIAL STATEMENTS

Peter Corporation Simon Company Assets Cash P5,800,000 P1,834,000 Accounts Receivable 1,250,000 1,753,000 1,985,000 Merchandise Inventory 875,000 Equipment, net Building, net Land 3,280,000 4,750,000 2,430,000 1,500,000 840,000 766,000 450,000 320,000 Patent, net Investment in Subsidiary 4,500,000 P24,350,000 TOTAL ASSETS P7,983,000 Liabilities Accounts Payable P2,600,000 P745,000 Notes Payable - Trade 3,870,000 853,000 Bonds Payable 4,560,000 950,000 Total Liabilities P11,030,000 P2,548,000 Shareholders' Equity Ordinary Shares P6,440,000 P3,280,000 Share Premium 1,230,000 925,000 1,230,000 Retained Earnings 5,650,000 Total Shareholders' Equity P13,320,000 P5,435,000 TOTAL LIABILITIES & SHE P24,350,000 P7,983,000 Consolidated current assets Consolidated non-current assets Consolidated total liabilities Consolidated shareholders' equity Goodwill attributable to non-controlling interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started