Question

Pete is 65 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1 million annually.

Pete is 65 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1 million annually. He anticipates retiring completely from this position next year and relying solely on his portfolio to maintain his and wifes combined spending level of $400K annually. In addition to these portfolio assets, they also own a $2 million home in The Woodlands. Pete and his wife have no other financial assets or business interests. Beyond the value held in this portfolio, the only income they will receive is Social Security, which is not particularly impactful given their level of assets and spending.

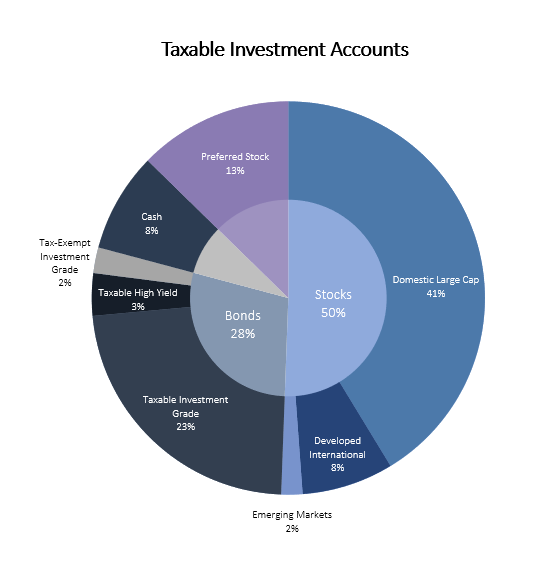

Preferred stocks are generally issued by banks and other financial institutions. While they often pay relatively high-interest rates compared to bonds from similar issuers, their total returns are capped at that yield. In other words, there is little opportunity for capital appreciation. Furthermore, the income received is taxable as ordinary income. Given what you know about Pete, is the allocation to preferred stocks appropriate? Why or why not? What recommendation would you make to increase his expected total return?

Taxable Investment Accounts Preferred Stock 13% Cash 8% Tax-Exempt Investment Grade 2% Taxable High Yield Domestic Large Cap 41% 3% Stocks 50% Bonds 28% Taxable Investment Grade 23% Developed International 896 Emerging MarketsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started