Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peter Bouton of Tampa died two years ago. Among the assets he owned were Bouton Farm in Saint Leo, the farm is consisting of 20,000

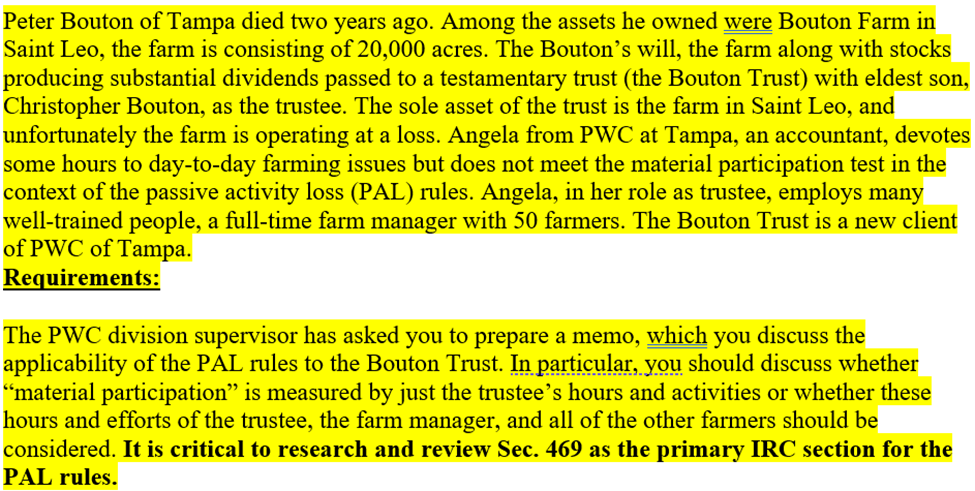

Peter Bouton of Tampa died two years ago. Among the assets he owned were Bouton Farm in Saint Leo, the farm is consisting of 20,000 acres. The Bouton's will, the farm along with stocks producing substantial dividends passed to a testamentary trust (the Bouton Trust) with eldest son, Christopher Bouton, as the trustee. The sole asset of the trust is the farm in Saint Leo, and unfortunately the farm is operating at a loss. Angela from PWC at Tampa, an accountant, devotes some hours to day-to-day farming issues but does not meet the material participation test in the context of the passive activity loss (PAL) rules. Angela, in her role as trustee, employs many well-trained people, a full-time farm manager with 50 farmers. The Bouton Trust is a new client of PWC of Tampa. Requirements: The PWC division supervisor has asked you to prepare a memo, which you discuss the applicability of the PAL rules to the Bouton Trust. In particular, you should discuss whether "material participation" is measured by just the trustee's hours and activities or whether these hours and efforts of the trustee, the farm manager, and all of the other farmers should be considered. It is critical to research and review Sec. 469 as the primary IRC section for the PAL rules

Peter Bouton of Tampa died two years ago. Among the assets he owned were Bouton Farm in Saint Leo, the farm is consisting of 20,000 acres. The Bouton's will, the farm along with stocks producing substantial dividends passed to a testamentary trust (the Bouton Trust) with eldest son, Christopher Bouton, as the trustee. The sole asset of the trust is the farm in Saint Leo, and unfortunately the farm is operating at a loss. Angela from PWC at Tampa, an accountant, devotes some hours to day-to-day farming issues but does not meet the material participation test in the context of the passive activity loss (PAL) rules. Angela, in her role as trustee, employs many well-trained people, a full-time farm manager with 50 farmers. The Bouton Trust is a new client of PWC of Tampa. Requirements: The PWC division supervisor has asked you to prepare a memo, which you discuss the applicability of the PAL rules to the Bouton Trust. In particular, you should discuss whether "material participation" is measured by just the trustee's hours and activities or whether these hours and efforts of the trustee, the farm manager, and all of the other farmers should be considered. It is critical to research and review Sec. 469 as the primary IRC section for the PAL rules

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started