Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Petrobras Petroleo Brasileiro S.A. or Petrobras is the national oil company of Brazil. It is publicly traded, but the government of Brazil holds the controlling

Petrobras Petroleo Brasileiro S.A. or Petrobras is the national oil company of Brazil. It is publicly traded, but the government of Brazil holds the controlling share. It is the largest company in the Southern Hemisphere by market capitalization and the largest m all of Latin America. As an oil company, the primary product of its production has a price set on global markets-the price of oil-and much of its business is conducted in the global currency of oil, the U.S. dollar.

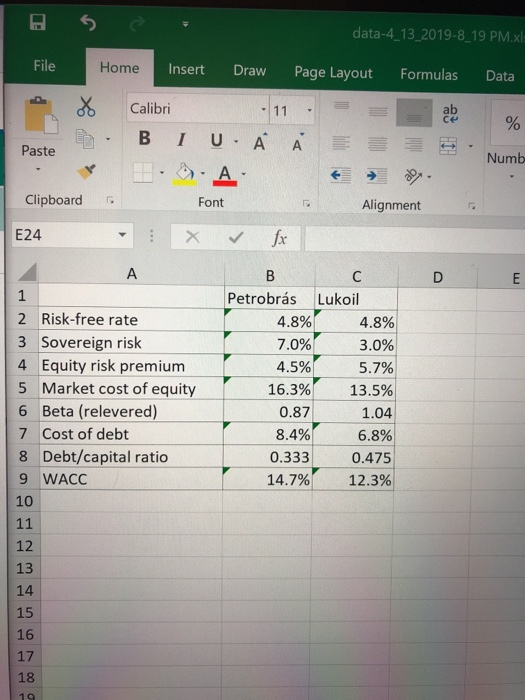

data-4 13 2019-8.19 PM.xl File Home Insert Draw Page Layout Formulas Data Calibri ab BU.AA . Paste Numb Clipboard Font Alignment E24 Petrobrs Lukoil 1 2 Risk-free rate 3 Sovereign risk 4 Equity risk premium 5 Market cost of equity 6 Beta (relevered) 7 Cost of debt 8 Debt/capital ratio 9 WACC 10 8% 70% 4.5% 16.3%(- 0.87 8.4% 0.333 14.7% 4.8% 3,0% 5.7%| 13.5% 1.04 6.8%, 0.475 12.3%; r- r 12 13 14 15 16 17 18 1 9 J.P. Morgans Latin American Equity Research department produced the following WAAC calculation for Petrobras of Brazil versus Lukoil of Russia. Evaluate the methodology and assumptions used in the calculation. Assume a 28% tax rate for both companies.

which of the following is correct?

A. This approach applies the sovereign risk premium to the cost of equity for both companies and the WACC calculation is based in U.S. dollars.

B. This approach applies the sovereign risk premium to the cost of debt for both companies and the WACC calculation is based in U.S. dollars.

C. This approach excludes the sovereign risk premium to the cost of equity amd cost of debt for both companies and the WACC calculation is based in Brazilian reais.

D. This approach applies the sovereign risk premium to the cost of debt for both companies and the WACC calculation is based in Brazilian reais.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started