Petroleum Inc. (PI) controls off-shore oil leases. It is considering the construction of a deep-sea oil rig at a cost of $500 million. The

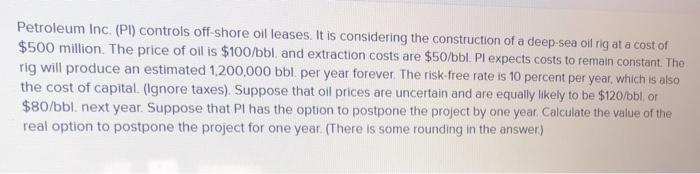

Petroleum Inc. (PI) controls off-shore oil leases. It is considering the construction of a deep-sea oil rig at a cost of $500 million. The price of oil is $100/bbl. and extraction costs are $50/bbl. Pl expects costs to remain constant. The rig will produce an estimated 1,200,000 bbl. per year forever. The risk-free rate is 10 percent per year, which is also the cost of capital. (Ignore taxes). Suppose that oil prices are uncertain and are equally likely to be $120/bbl. or $80/bbl. next year. Suppose that PI has the option to postpone the project by one year. Calculate the value of the real option to postpone the project for one year. (There is some rounding in the answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of the real option to postpone the project we can use a decision tree to model the outcomes and assess the value of waiting Ste...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started