Answered step by step

Verified Expert Solution

Question

1 Approved Answer

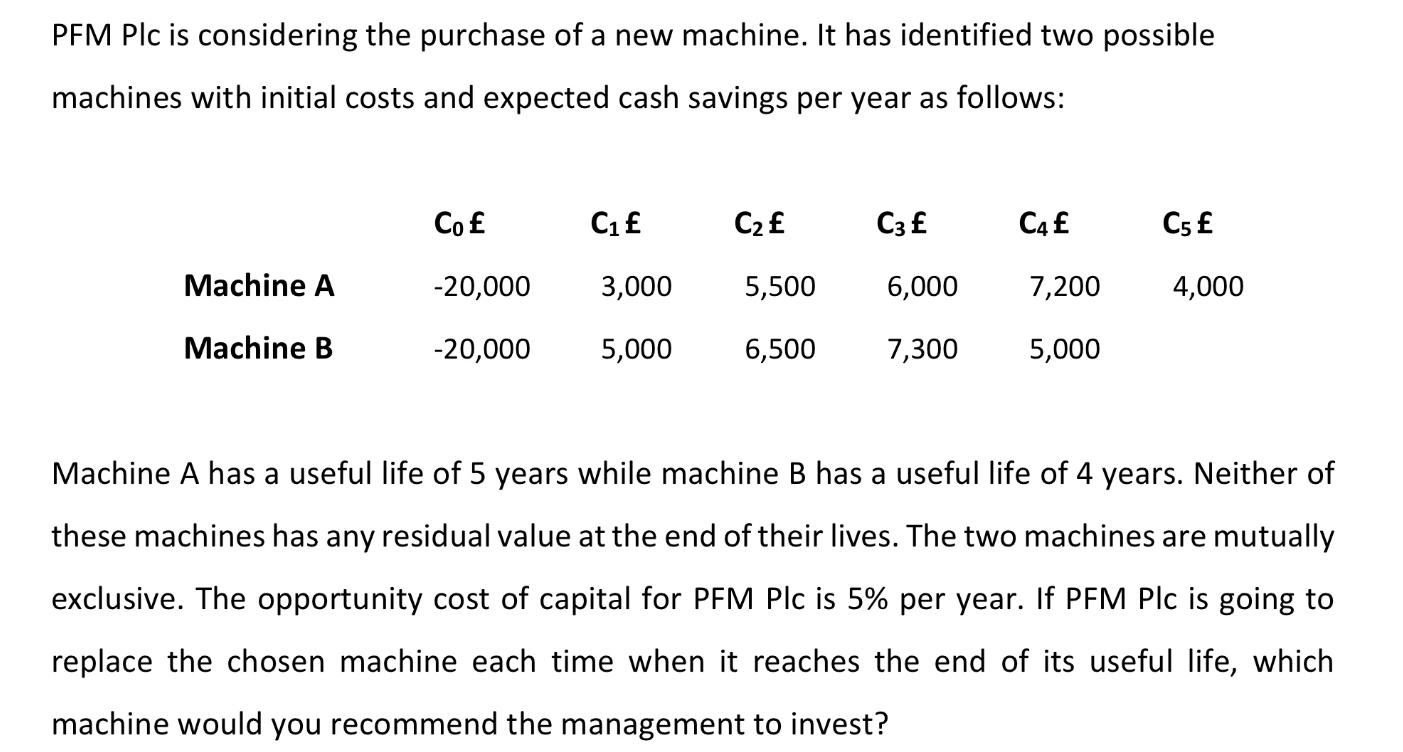

PFM Plc is considering the purchase of a new machine. It has identified two possible machines with initial costs and expected cash savings per

PFM Plc is considering the purchase of a new machine. It has identified two possible machines with initial costs and expected cash savings per year as follows: Machine A Machine B Co -20,000 -20,000 C C C3 3,000 5,500 6,000 5,000 6,500 7,300 C4 7,200 5,000 C5 4,000 Machine A has a useful life of 5 years while machine B has a useful life of 4 years. Neither of these machines has any residual value at the end of their lives. The two machines are mutually exclusive. The opportunity cost of capital for PFM Plc is 5% per year. If PFM Plc is going to replace the chosen machine each time when it reaches the end of its useful life, which machine would you recommend the management to invest? return of machine A? using the discount rate 6% and 20%, what is the internal rate of

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine which machine to recommend we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started