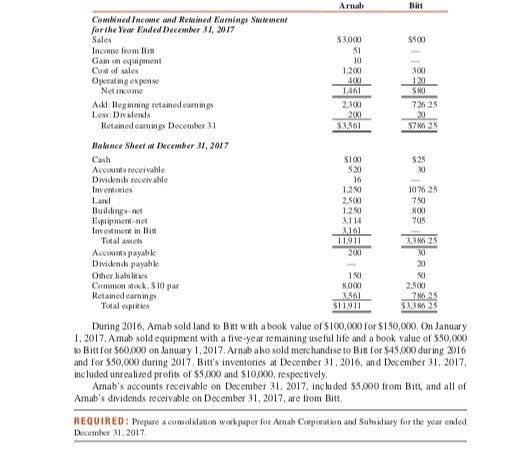

PG-3 Workpaper (downstream sale and intercompany receivable/payable) Arnab Corporation acquired an 80 percent interest in Bit Corporation on January 1, 2016, for SHAXXXXX) in cash. Bitt's common stock and retained earnings on this date were at $2,8XXXX) and 5500/XX), respe tively. The two value of Biti's net assets equals fair value. The financial statements of Arnab and Bitt at and for the year ended December 31, 2017, are summarized as follows (in thousands): Combined Income and Refined Earnings Striment forthelew Ended December 31, 2017 Sales Income from Bis S2000 Cadoles Operating Netime A Beginning reamed earnings Lew Dividends Retained earnings December 31 S15 S725 Nalunce Sheet Ihcember 31, 2017 S100 SI 10M2 70 1.29 2.50K 1.21 3114 3,161 205 Accs receivable Dividends receivable Inventaries and Buildings.net Equipment Inverein Bill Totalandets Acts payable Dividend payable Other listes Comme Mack, S10 par Retained earnings Totale 190 NOCKI 1.561 250 7625 511911 During 2016, Amab sold land to Bit with a book value of $100.0XXO for $150.0XX. On January 1, 2017. Amab sold equipment with a five-year remaining useful life and a book value of $50,0XX to Bitt for 560XX) on January 1, 2017. Arnab also sold merchandise to Bitt for $45.XXI during 2016 and for $50.0XX) during 2017. Bitt's inventories at December 31, 2016, and December 31, 2017 included unrealized profits of $5,0XX0 and $10,000, respectively Amab's accounts receivable on December 31, 2017, included 55.000 from Bitt, and all of Ama's dividends receivable on December 31, 2017, are from Bitt. REQUIRED: Prepare a consolidation work paper for Arab Corporation and Subsidiary for the year ended 1 .2017 D PG-3 Workpaper (downstream sale and intercompany receivable/payable) Arnab Corporation acquired an 80 percent interest in Bit Corporation on January 1, 2016, for SHAXXXXX) in cash. Bitt's common stock and retained earnings on this date were at $2,8XXXX) and 5500/XX), respe tively. The two value of Biti's net assets equals fair value. The financial statements of Arnab and Bitt at and for the year ended December 31, 2017, are summarized as follows (in thousands): Combined Income and Refined Earnings Striment forthelew Ended December 31, 2017 Sales Income from Bis S2000 Cadoles Operating Netime A Beginning reamed earnings Lew Dividends Retained earnings December 31 S15 S725 Nalunce Sheet Ihcember 31, 2017 S100 SI 10M2 70 1.29 2.50K 1.21 3114 3,161 205 Accs receivable Dividends receivable Inventaries and Buildings.net Equipment Inverein Bill Totalandets Acts payable Dividend payable Other listes Comme Mack, S10 par Retained earnings Totale 190 NOCKI 1.561 250 7625 511911 During 2016, Amab sold land to Bit with a book value of $100.0XXO for $150.0XX. On January 1, 2017. Amab sold equipment with a five-year remaining useful life and a book value of $50,0XX to Bitt for 560XX) on January 1, 2017. Arnab also sold merchandise to Bitt for $45.XXI during 2016 and for $50.0XX) during 2017. Bitt's inventories at December 31, 2016, and December 31, 2017 included unrealized profits of $5,0XX0 and $10,000, respectively Amab's accounts receivable on December 31, 2017, included 55.000 from Bitt, and all of Ama's dividends receivable on December 31, 2017, are from Bitt. REQUIRED: Prepare a consolidation work paper for Arab Corporation and Subsidiary for the year ended 1 .2017 D