Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PH Ltd. manufactures and sells two products, namely BXE and DXE. The company's investment in fixed assets is 2 lakhs. The working capital investment

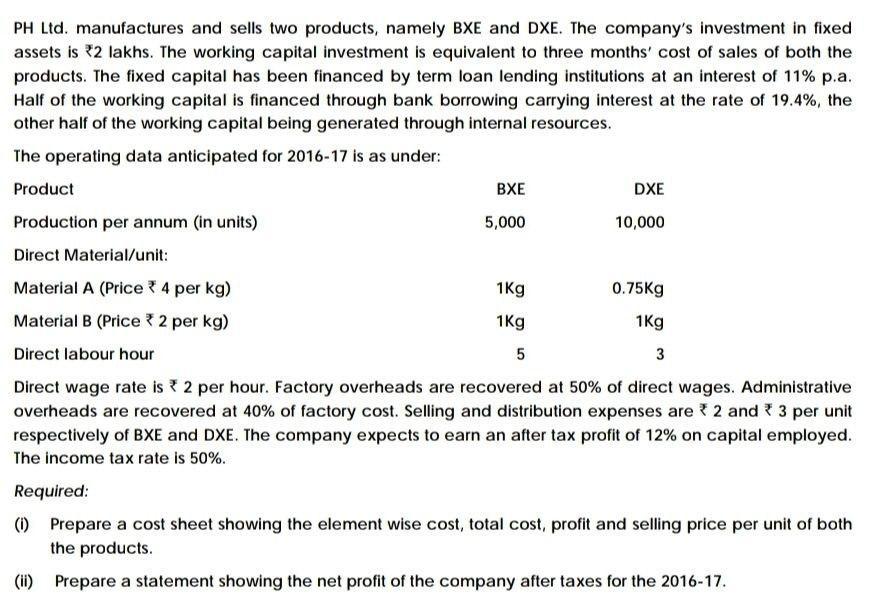

PH Ltd. manufactures and sells two products, namely BXE and DXE. The company's investment in fixed assets is 2 lakhs. The working capital investment is equivalent to three months' cost of sales of both the products. The fixed capital has been financed by term loan lending institutions at an interest of 11% p.a. Half of the working capital is financed through bank borrowing carrying interest at the rate of 19.4%, the other half of the working capital being generated through internal resources. The operating data anticipated for 2016-17 is as under: Product Production per annum (in units) Direct Material/unit: Material A (Price 4 per kg) Material B (Price 2 per kg) Direct labour hour BXE 5,000 DXE 10,000 1kg 1kg 5 0.75Kg 1kg 3 Direct wage rate is 2 per hour. Factory overheads are recovered at 50% of direct wages. Administrative overheads are recovered at 40% of factory cost. Selling and distribution expenses are 2 and * 3 per unit respectively of BXE and DXE. The company expects to earn an after tax profit of 12% on capital employed. The income tax rate is 50%. Required: (1) Prepare a cost sheet showing the element wise cost, total cost, profit and selling price per unit of both the products. (ii) Prepare a statement showing the net profit of the company after taxes for the 2016-17.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Cost sheet Direct material Direct wages Prime cost Factory OHS Factory cost Off...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started