Answered step by step

Verified Expert Solution

Question

1 Approved Answer

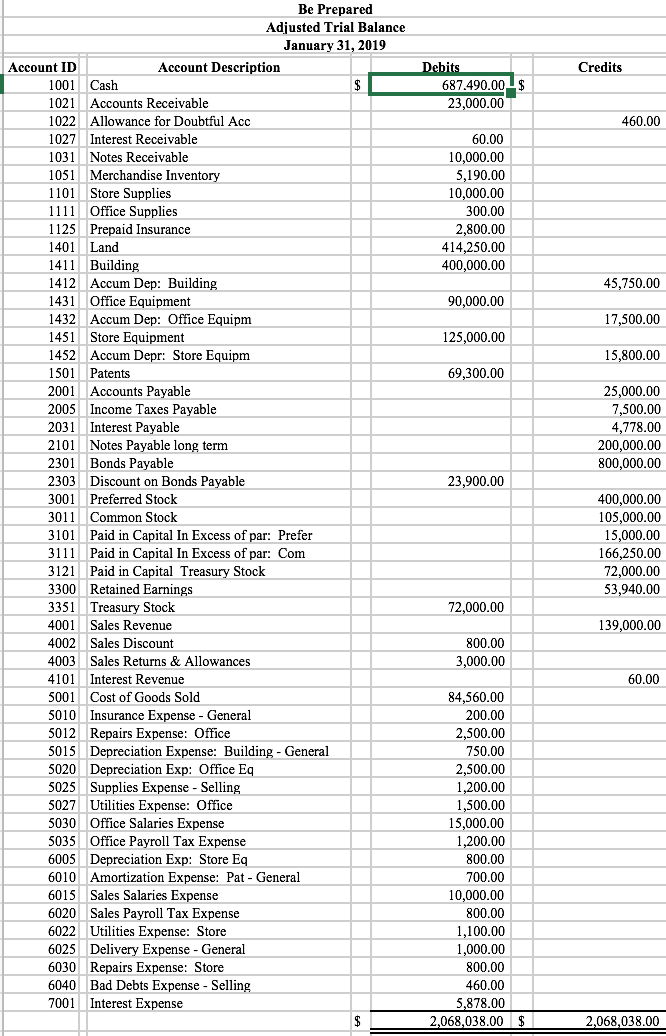

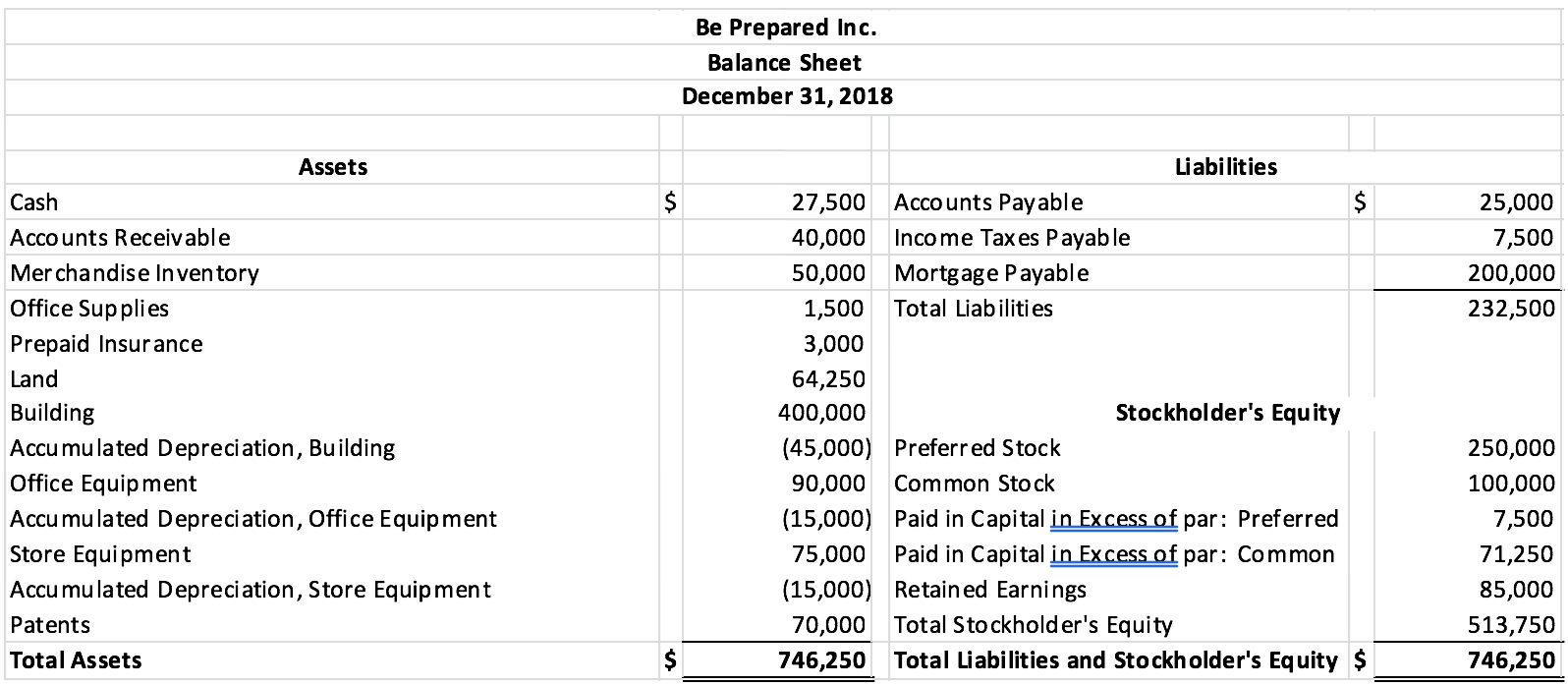

Phase #1 Using Be Prepared, Inc.s adjusted trial balance and prior periods balance sheet (see pages 5 and 6 of this document), prepare the following

Phase #1

Using Be Prepared, Inc.s adjusted trial balance and prior periods balance sheet (see pages 5 and 6 of this document), prepare the following Financial Reports in good form using Microsoft Excel:

Multi-Step Income Statement for the month of January 2019 (see page 210 in your textbook for guidance).

Statement of Retained Earnings for the month of January 2019 (see page 562 in your textbook for guidance). Note: There are no prior period adjustments and all dividends declared are cash dividends in the amount of $31,060.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started