Phase #4

Prepare the following Ratios for January 2022:

- Current Ratio

- Acid-Test Ratio

- Debt Ratio

- Profit Margin Ratio

- Gross Margin Ratio

Due Date: Thursday, April 29, 2021 8:00 am

Submission method: Please upload your Excel file to the submission folder in D2L using the assignment link provided for you

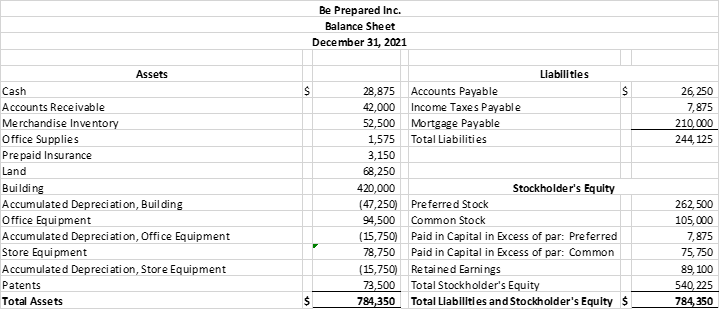

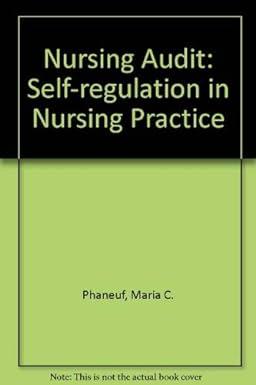

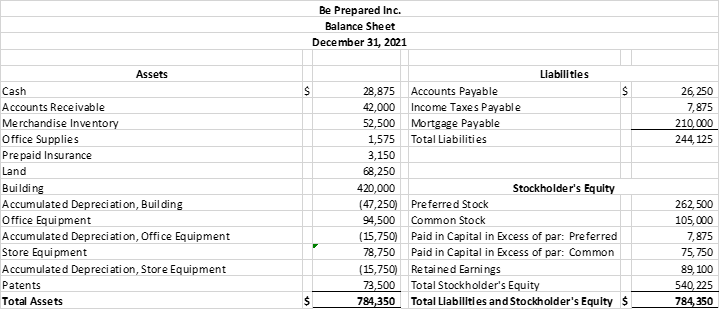

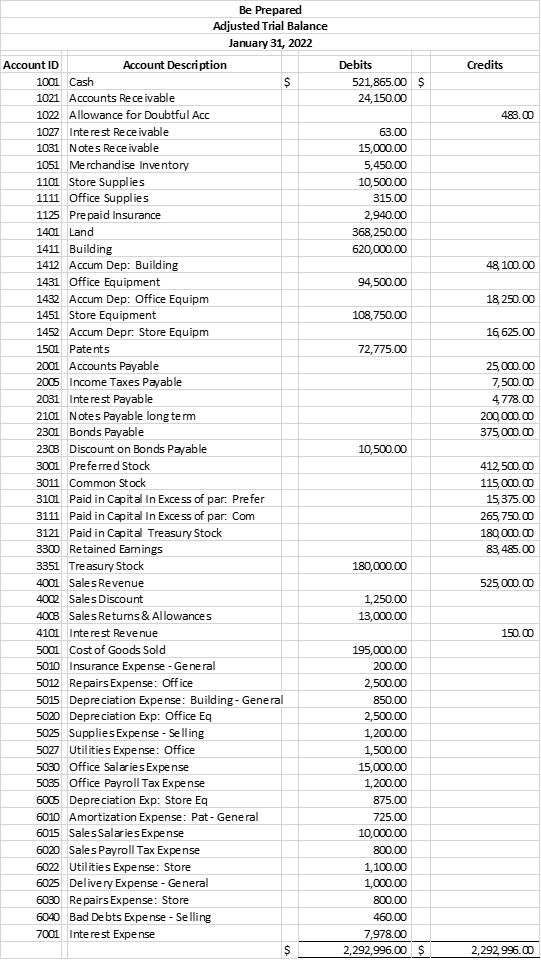

Be Prepared Inc. Balance Sheet December 31, 2021 $ 26,250 7,875 210,000 244, 125 Assets Cash Accounts Receivable Merchandise Inventory Office Supplies Prepaid Insurance Land Building Accumulated Depreciation, Building Office Equipment Accumulated Depreciation, Office Equipment Store Equipment Accumulated Depreciation, Store Equipment Patents Total Assets Liabilities 28,875 Accounts Payable $ 42,000 Income Taxes Payable 52,500 Mortgage Payable 1,575 Total Liabilities 3,150 68,250 420,000 Stockholder's Equity (47,250) Preferred Stock 94,500 Common Stock (15,750) Paid in Capital in Excess of par: Preferred 78,750 Paid in Capital in Excess of par: Common (15,750) Retained Earnings 73,500 Total Stockholder's Equity 784,350 Total Liabilities and Stockholder's Equity $ 262,500 105,000 7,875 75,750 89, 100 540,225 784,350 $ Credits Debits 521,865.00 $ 24,150.00 483.00 63.00 15,000.00 5,450.00 10,500.00 315.00 2,940.00 368,250.00 620,000.00 48, 100.00 94,500.00 18 250.00 108,750.00 16,625.00 72,775.00 25,000.00 7,500.00 4,778.00 200,000.00 375,000.00 10,500.00 Be Prepared Adjusted Trial Balance January 31, 2022 Account ID Account Description 1001 Cash S 1021 Accounts Receivable 1022 Allowance for Doubtful Acc 1027 Interest Receivable 1031 Notes Receivable 1051 Merchandise Inventory 1101 Store Supplies 1111 Office Supplies 1125 Prepaid Insurance 1401 Land 1411 Building 1412 Accum Dep: Building 1431 Office Equipment 1432 Accum Dep: Office Equipm 1451 Store Equipment 1452 Accum Depr: Store Equipm 1501 Patents 2001 Accounts Payable 2005 Income Taxes Payable 2031 Interest Payable 2101 Notes Payable long term 2301 Bonds Payable 2308 Discount on Bonds Payable 3001 Preferred Stock 3011 Common Stock 3101 Paid in Capital In Excess of par. Prefer 3111 Paid in Capital In Excess of par. Com 3121 Paid in Capital Treasury Stock 3300 Retained Earnings 3351 Treasury Stock 4001 Sales Revenue 4002 Sales Discount 4008 Sales Returns & Allowances 4101 Interest Revenue 5001 Cost of Goods Sold 5010 Insurance Expense - General 5012 Repairs Expense: Office 5015 Depreciation Expense: Building - General 5020 Depreciation Exp: Office Eq 5035 Supplies Expense - Selling 5027 Utilities Expense: Office 5030 Office Salaries Expense 5035 Office Payroll Tax Expense 6005 Depreciation Exp: Store Eq 6010 Amortization Expense: Pat - General 6015 SalesSalaries Expense 6020 Sales Payroll Tax Expense 6022 Utilities Expense: Store 6035 Delivery Expense - General 6030 Repairs Expense: Store 6040 Bad De bts Expense - Selling 7001 Interest Expense $ 412,500.00 115,000.00 15,375.00 265, 750.00 180,000.00 83,485.00 180,000.00 525,000.00 1,250.00 13,000.00 150.00 195,000.00 200.00 2,500.00 850.00 2,500.00 1,200.00 1,500.00 15,000.00 1,200.00 875.00 725.00 10,000.00 800.00 1,100.00 1,000.00 800.00 460.00 7,978.00 2,292,996.00 $ 2,292, 996.00