need help with these

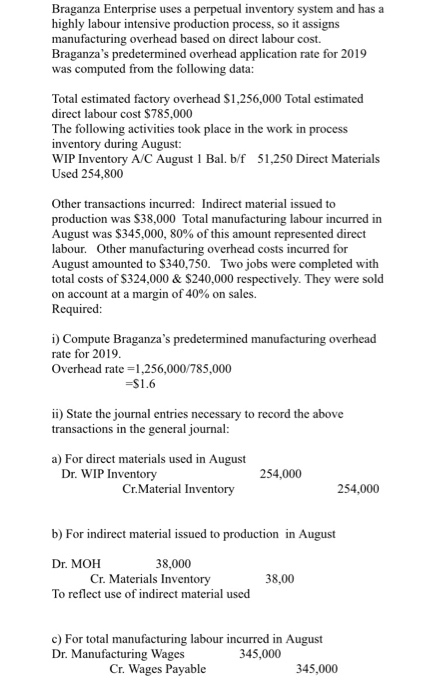

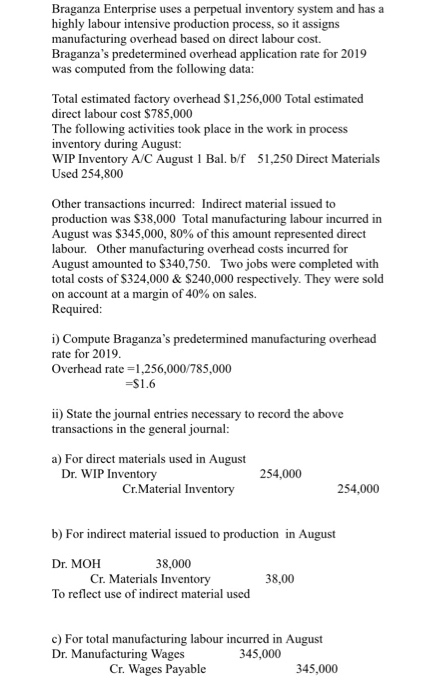

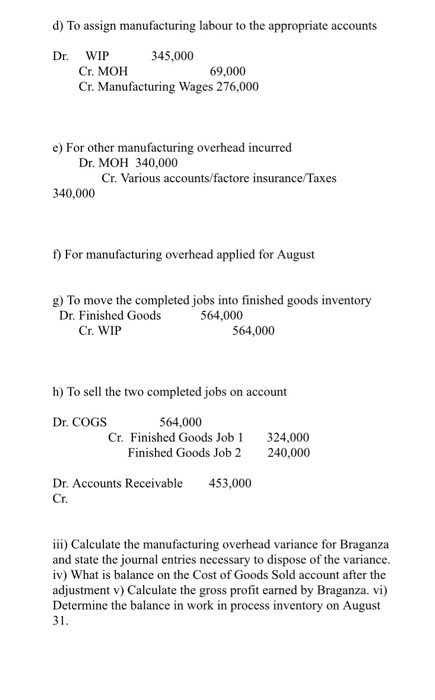

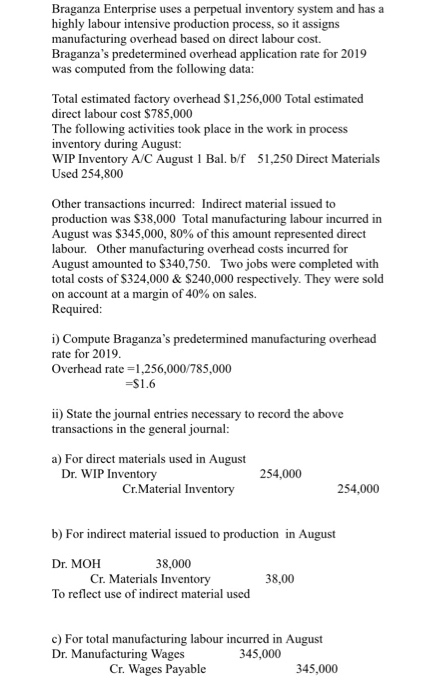

Braganza Enterprise uses a perpetual inventory system and has a highly labour intensive production process, so it assigns manufacturing overhead based on direct labour cost. Braganza's predetermined overhead application rate for 2019 was computed from the following data: Total estimated factory overhead $1,256,000 Total estimated direct labour cost $785,000 The following activities took place in the work in process inventory during August: WIP Inventory A/C August 1 Bal. b/f 51,250 Direct Materials Used 254,800 Other transactions incurred: Indirect material issued to production was S38,000 Total manufacturing labour incurred in August was $345,000, 80% of this amount represented direct labour. Other manufacturing overhead costs incurred for August amounted to $340,750. Two jobs were completed with total costs of $324,000 & $240,000 respectively. They were sold on account at a margin of 40% on sales. Required: i) Compute Braganza's predetermined manufacturing overhead rate for 2019 Overhead rate=1,256,000/785,000 =$1.6 ii) State the journal entries necessary to record the above transactions in the general journal: a) For direct materials used in August Dr. WIP Inventory Cr. Material Inventory 254,000 254,000 b) For indirect material issued to production in August Dr. MOH 38,000 Cr. Materials Inventory To reflect use of indirect material used 38,00 c) For total manufacturing labour incurred in August Dr. Manufacturing Wages 345,000 Cr. Wages Payable 345,000 d) To assign manufacturing labour to the appropriate accounts Dr. WIP 345,000 Cr. MOH 69,000 Cr. Manufacturing Wages 276,000 e) For other manufacturing overhead incurred Dr. MOH 340,000 Cr. Various accounts/factore insurance/Taxes 340,000 f) For manufacturing overhead applied for August g) To move the completed jobs into finished goods inventory Dr. Finished Goods 564.000 Cr. WIP 564,000 h) To sell the two completed jobs on account Dr. COGS 564,000 Cr. Finished Goods Job 1 Finished Goods Job 2 324,000 240,000 Dr. Accounts Receivable Cr. 453,000 iii) Calculate the manufacturing overhead variance for Braganza and state the journal entries necessary to dispose of the variance. iv) What is balance on the Cost of Goods Sold account after the adjustment v) Calculate the gross profit earned by Braganza. vi) Determine the balance in work in process inventory on August 31