Answered step by step

Verified Expert Solution

Question

1 Approved Answer

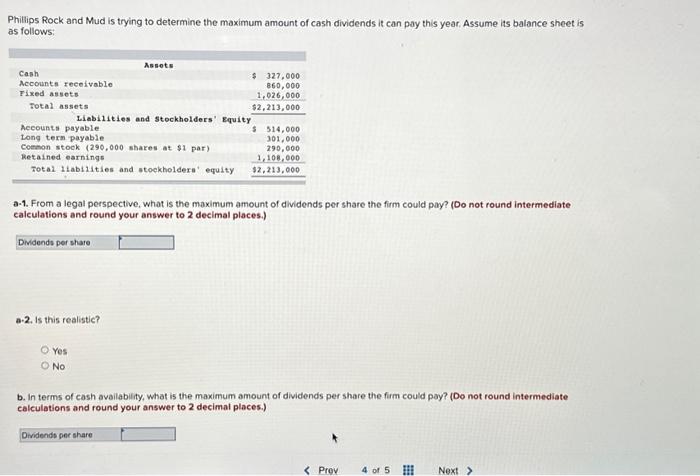

Phillips Rock and Mud is trying to determine the maximum amount of cash dividends it can pay this year. Assume its balance sheet is as

Phillips Rock and Mud is trying to determine the maximum amount of cash dividends it can pay this year. Assume its balance sheet is as follows: Cash Accounts receivable Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Long term payable Common stock (290,000 shares at $1 par) Retained earnings Total liabilities and stockholders' equity Dividends per share Assets a-2. Is this realistic? O Yes O No $ a-1. From a legal perspective, what is the maximum amount of dividends per share the firm could pay? (Do not round intermediate calculations and round your answer to 2 decimal places.) Dividends per share 327,000 860,000 1,026,000 $2,213,000 $ 514,000 301,000 290,000 1,108,000 $2,213,000 b. In terms of cash availability, what is the maximum amount of dividends per share the firm could pay? (Do not round intermediate calculations and round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started