Answered step by step

Verified Expert Solution

Question

1 Approved Answer

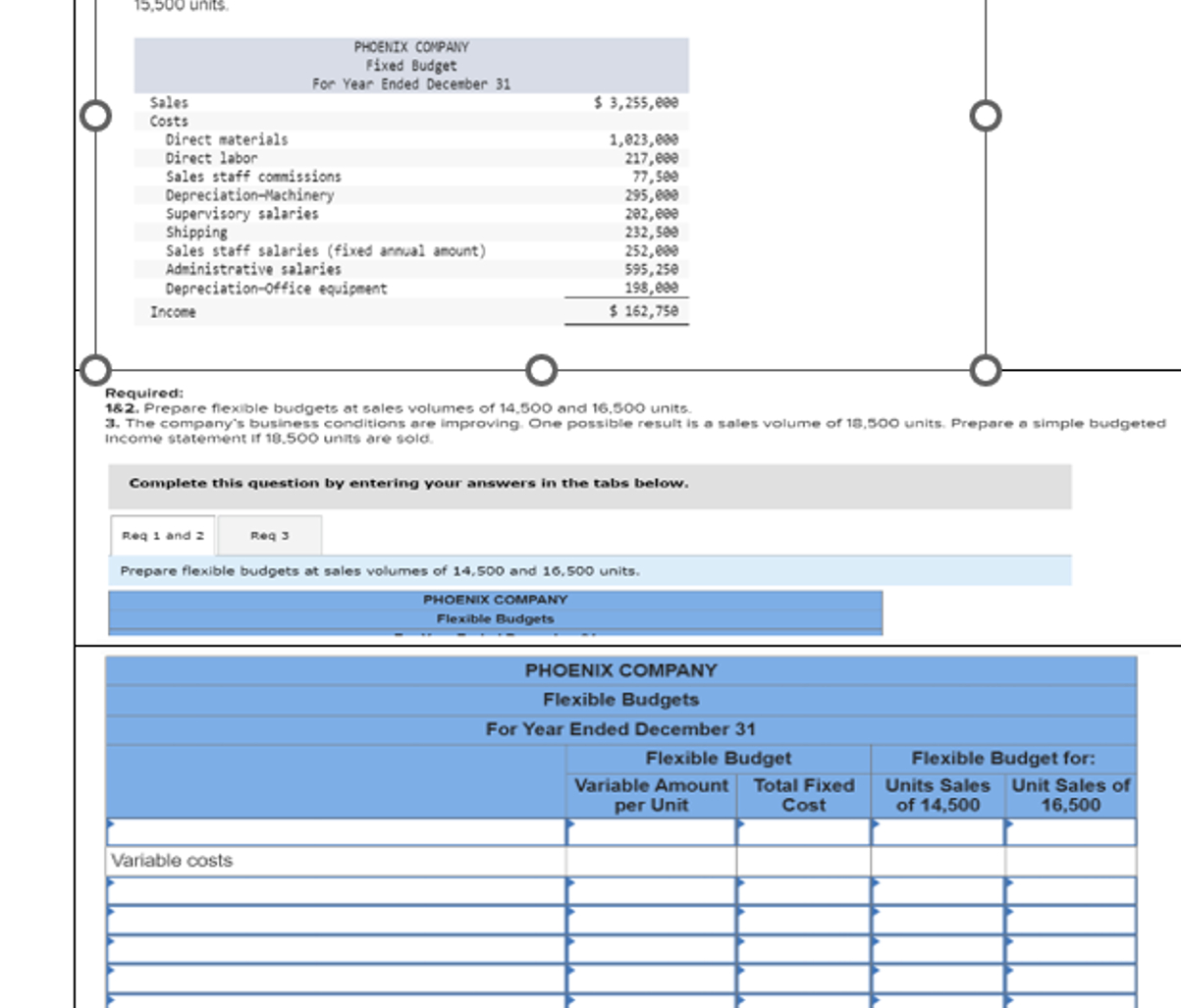

Phoenix company report the following fix budget. It based on an expected production and sales volume of 15,000 units. 15,500 units. Sales PHOENIX COMPANY Fixed

Phoenix company report the following fix budget. It based on an expected production and sales volume of 15,000 units.

15,500 units. Sales PHOENIX COMPANY Fixed Budget For Year Ended December 31 Costs Direct materials Direct labor Sales staff commissions Depreciation-Machinery Supervisory salaries Shipping Sales staff salaries (fixed annual amount) Administrative salaries Depreciation-office equipment Income $ 3,255,000 1,023,000 217,000 77,500 295,000 202,000 232,500 252,000 595,250 198,000 $ 162,750 Required: 1&2. Prepare flexible budgets at sales volumes of 14,500 and 16,500 units. 3. The company's business conditions are improving. One possible result is a sales volume of 18,500 units. Prepare a simple budgeted Income statement if 18.500 units are sold. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Prepare flexible budgets at sales volumes of 14,500 and 16,500 units. Variable costs PHOENIX COMPANY Flexible Budgets PHOENIX COMPANY Flexible Budgets For Year Ended December 31 Flexible Budget Variable Amount per Unit Total Fixed Cost Flexible Budget for: Units Sales Unit Sales of of 14,500 16,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started