Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PI:2-47 (similar to) Anne is 17 years old and a dependent of her parents. She receives $8,800 of wages from a part-time job and $9,200

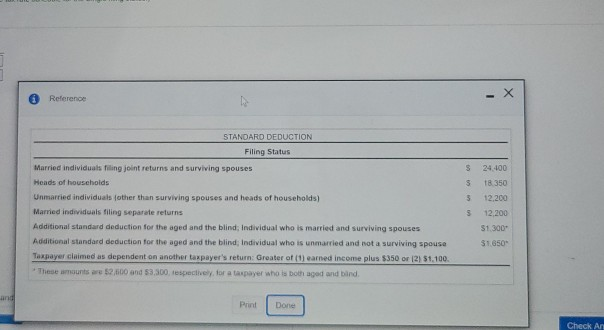

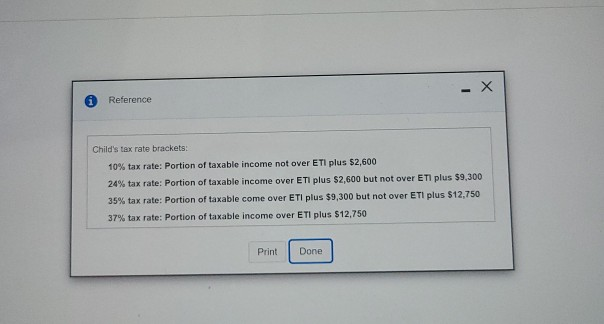

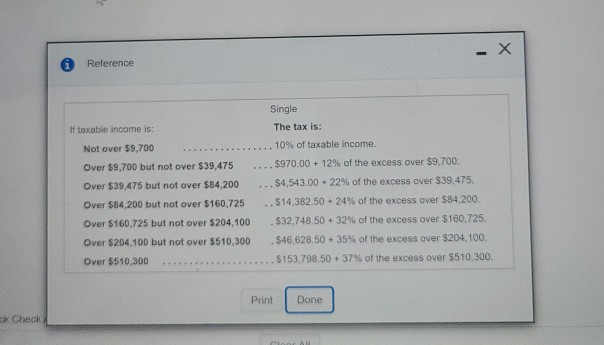

PI:2-47 (similar to) Anne is 17 years old and a dependent of her parents. She receives $8,800 of wages from a part-time job and $9,200 of taxable interest from bonds she inherited. (The tax year is 2019.) (Click the icon to view the standard deduction amounts.) (Click the icon to view the child tax rate brackets.) (Click the icon to view the 2019 tax rate schedule for the Single filing status.) Read the requirement Amount Taxable income Tax - X Reference s 24,400 18.350 5 5 STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind, Individual who is married and surviving spouses Additional standard deduction for the aged and the blind, Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or 12) 51.100. These amounts we $2.000 and 53.300 espectively for a taxpayer who is both aged and band 3 12.200 12,200 $1.300 $1.650 Print Done Check An - Reference Child's tax rate brackets: 10% tax rate: Portion of taxable income not over ETI plus $2,600 24% tax rate: Portion of taxable income over E TI plus $2,600 but not over ETI plus $9,300 35% tax rate: Portion of taxable come over ETI plus $9,300 but not over ETI plus $12,750 37% tax rate: Portion of taxable income over E TI plus $12.750 Print Done - X 0 Reference Single If taxable income is: The tax is: Not over $9,700 10% of taxable income. Over $9.700 but not over $39,475 . . . . $970.00 + 12% of the excess over $9.700. Over $39,475 but not over $84,200 ... $4,543.00 -22% of the excess over $39,475. Over $84,200 but not over $160,725 . . $14,382.50 -24% of the excess over $84.200. Over $160,725 but not over $204,100 . $32,748.50 + 32% of the excess over $160,725. Over $204,100 but not over $510,300 $46.628.50 + 35% of the excess over $204.100. Over $510,300 $153.798,50 + 37% of the excess over $510,300 Print Done ck Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started