Answered step by step

Verified Expert Solution

Question

1 Approved Answer

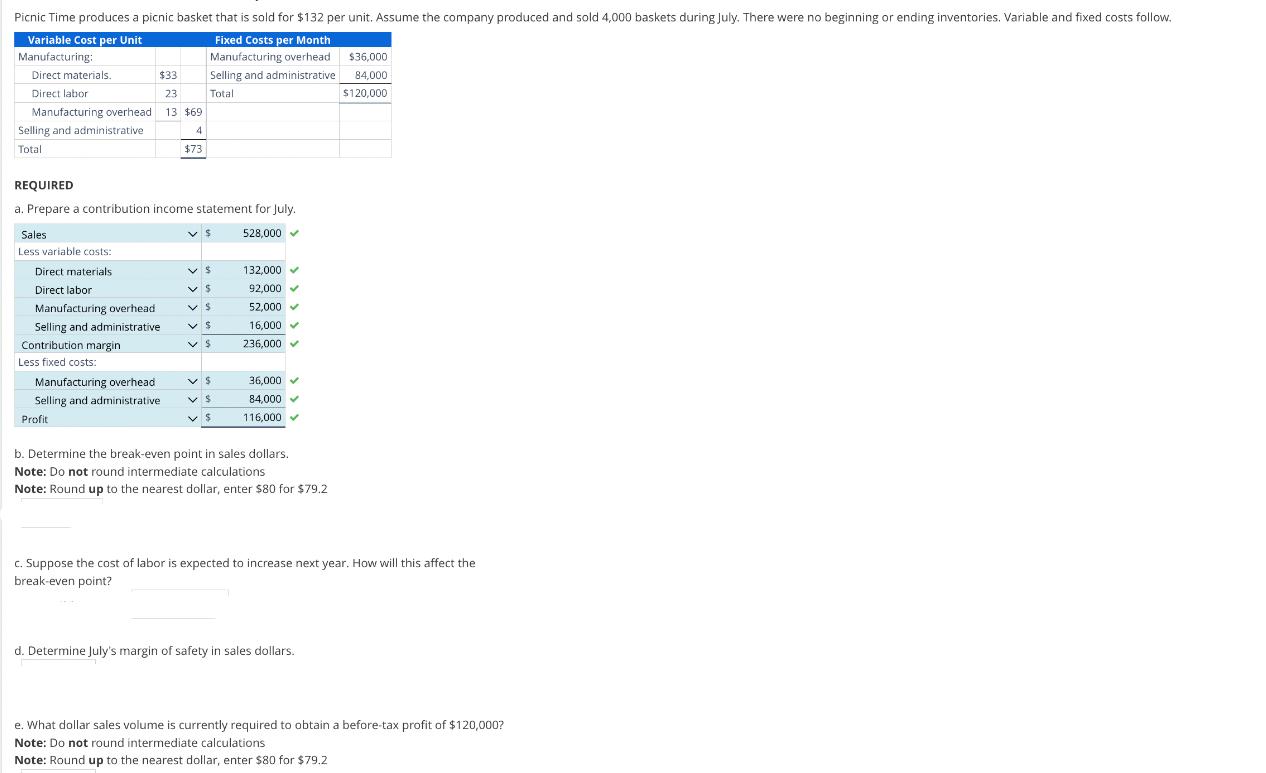

Picnic Time produces a picnic basket that is sold for $132 per unit. Assume the company produced and sold 4,000 baskets during July. There

Picnic Time produces a picnic basket that is sold for $132 per unit. Assume the company produced and sold 4,000 baskets during July. There were no beginning or ending inventories. Variable and fixed costs follow. Variable Cost per Unit Fixed Costs per Month Manufacturing: Direct materials. Direct labor $33 Manufacturing overhead Selling and administrative $36,000 84,000 23 Total $120,000 Manufacturing overhead 13 $69 Selling and administrative Total 4 $73 REQUIRED a. Prepare a contribution income statement for July. Sales Less variable costs: 528,000 Direct materials 132,000 Direct labor 92,000 Manufacturing overhead $ 52,000 Selling and administrative $ 16,000 Contribution margin $ 236,000 Less fixed costs: Manufacturing overhead 36,000 Selling and administrative $ 84,000 Profit 116,000 b. Determine the break-even point in sales dollars. Note: Do not round intermediate calculations Note: Round up to the nearest dollar, enter $80 for $79.2 c. Suppose the cost of labor is expected to increase next year. How will this affect the break-even point? d. Determine July's margin of safety in sales dollars. e. What dollar sales volume is currently required to obtain a before-tax profit of $120,000? Note: Do not round intermediate calculations Note: Round up to the nearest dollar, enter $80 for $79.2

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Contribution Income Statement for July Amount Sales 528000 Less Variable Costs Direct mater...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started