Question

Pierce Corp. has a December 31 year end. It received its property tax invoice of $57,000 for the calendar year on April 30. The

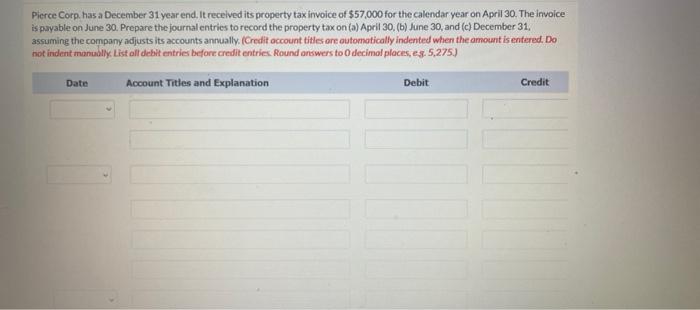

Pierce Corp. has a December 31 year end. It received its property tax invoice of $57,000 for the calendar year on April 30. The invoice is payable on June 30. Prepare the journal entries to record the property tax on (a) April 30, (b) June 30, and (c) December 31, assuming the company adjusts its accounts annually. (Credit account titles ore automatically indented when the omount is entered. Do not indent manuolly. List all debit entries before credit entries. Round onswers to O decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A C D 4 Date Account title and explanation Debit Credit 5 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

5th Edition

9781118560952, 1118560957, 978-0470239803

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App