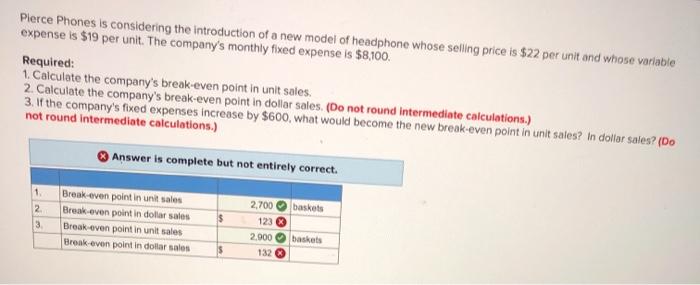

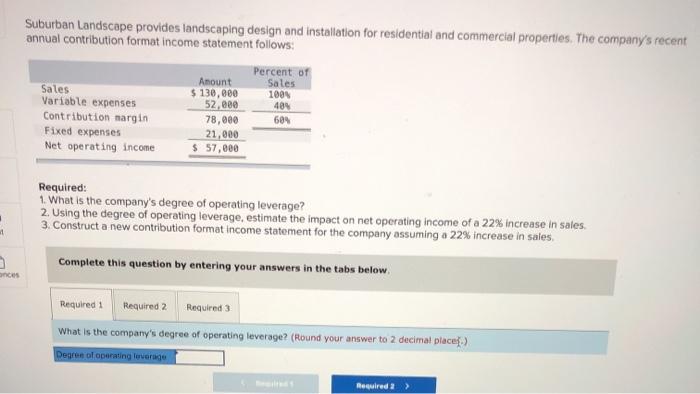

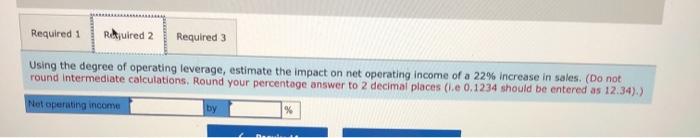

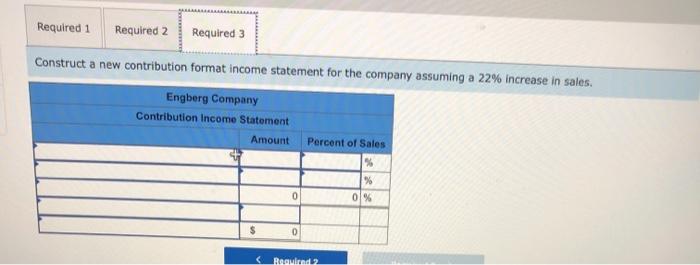

Pierce Phones is considering the introduction of a new model of headphone whose selling price is $22 per unit and whose variable expense is $19 per unit. The company's monthly fixed expense is $8,100. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) Answer is complete but not entirely correct. 1 2 3 2,700 baskets Break even point in unt sales Break even point in dollar sales Break even point in unt sales Break even point in dollar sales $ 123 2.900 132 baskets Suburban Landscape provides landscaping design and installation for residential and commercial properties. The company's recent annual contribution format income statement follows: Percent of Amount Sales Sales $ 130,000 100% Variable expenses 52,000 484 Contribution margin 78,000 604 Fixed expenses 21,000 Net operating income $ 57,800 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 22% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 22% increase in sales Complete this question by entering your answers in the tabs below ances Required 1 Required 2 Required 3 What is the company's degree of operating leverage? (Round your answer to 2 decimal place) Degree of operating loverige Required a Required 1 Ribuired 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 22% increase in sales. (Do not round Intermediate calculations, Round your percentage answer to 2 decimal places 1.6 0.1234 should be entered as 12.34). Net operating income by % Required 1 Required 2 Required 3 Construct a new contribution format income statement for the company assuming a 22% increase in sales. Engberg Company Contribution Income Statement Amount Percent of Sales % % 0 % 0 $ 0 Ragund 2