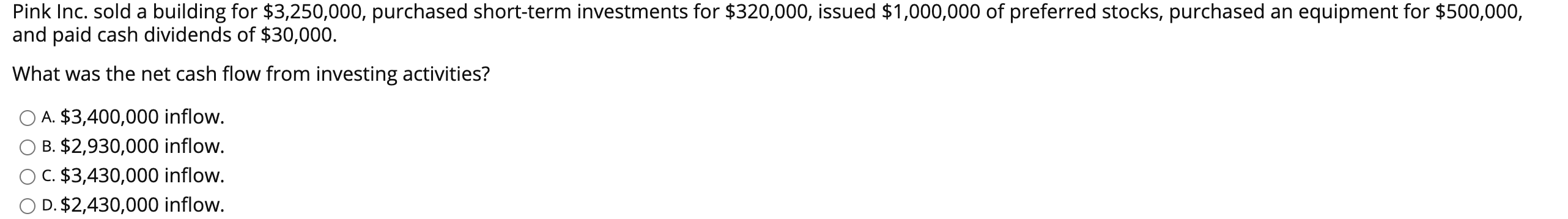

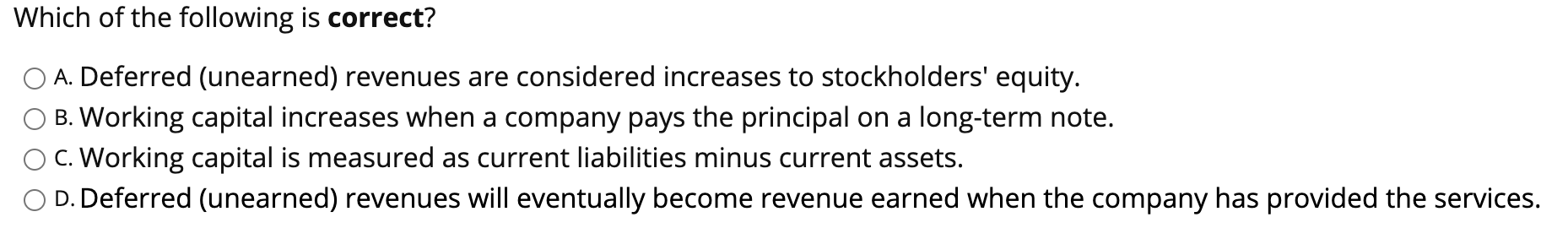

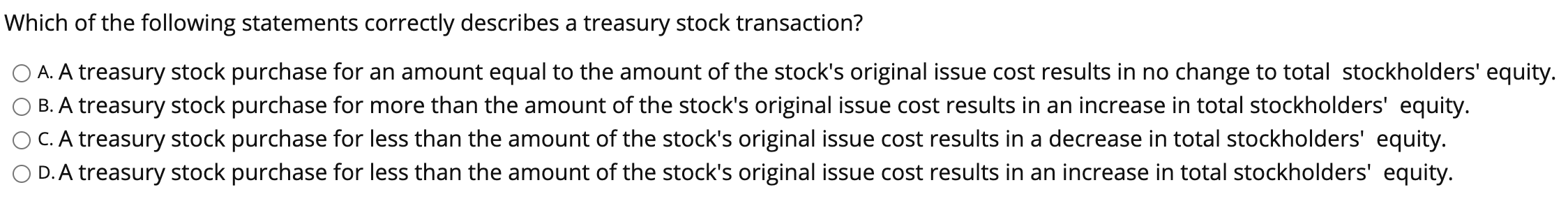

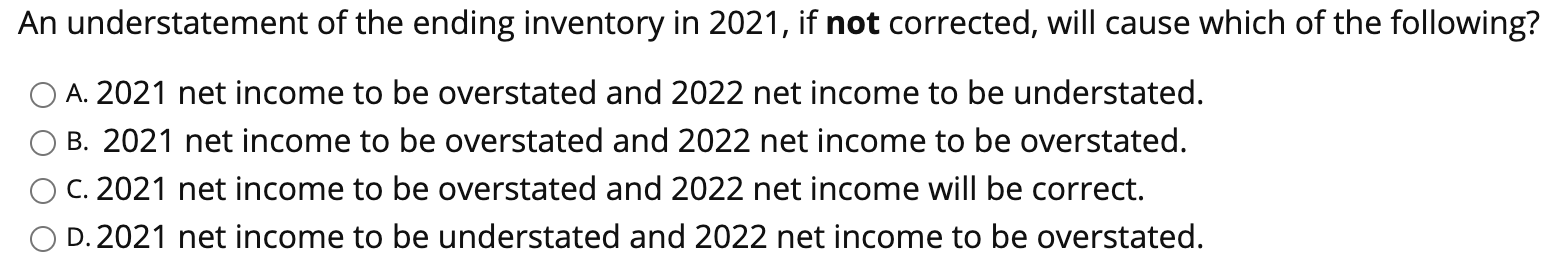

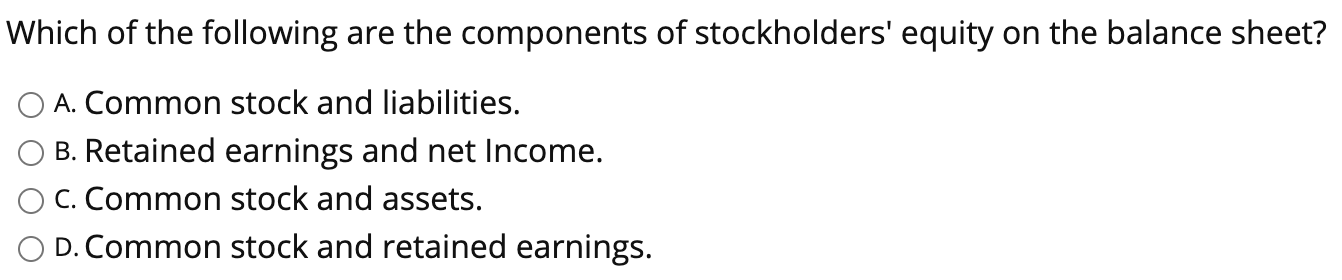

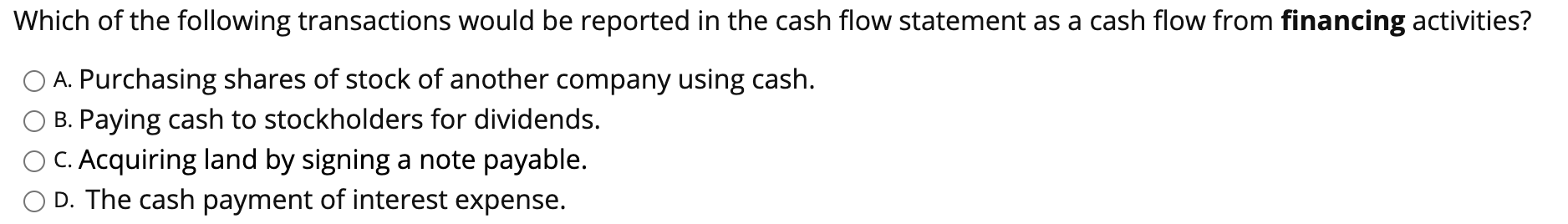

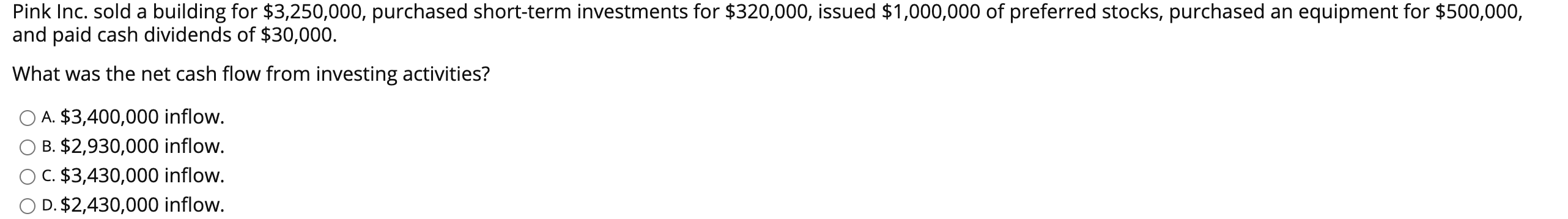

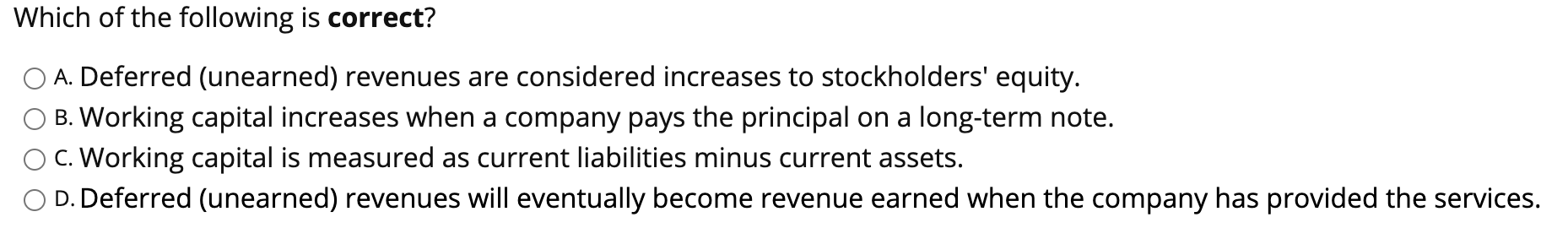

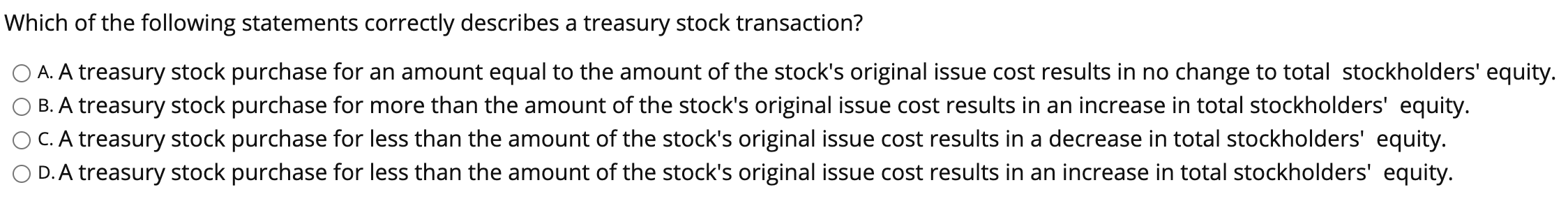

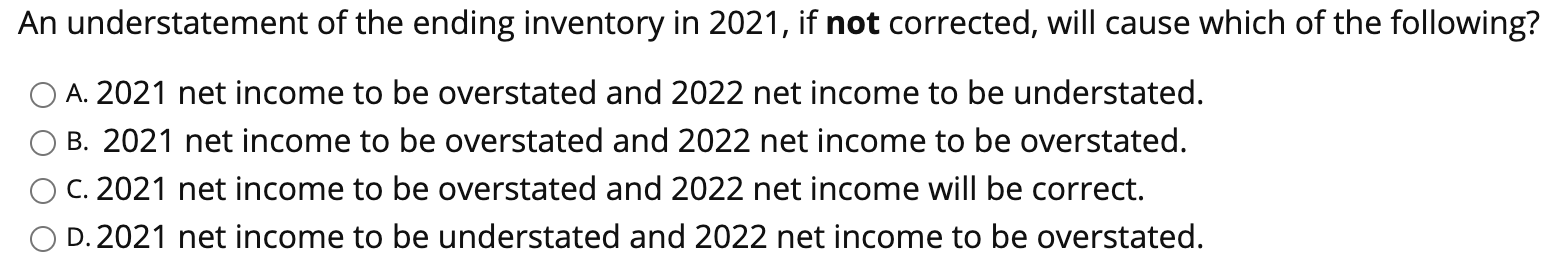

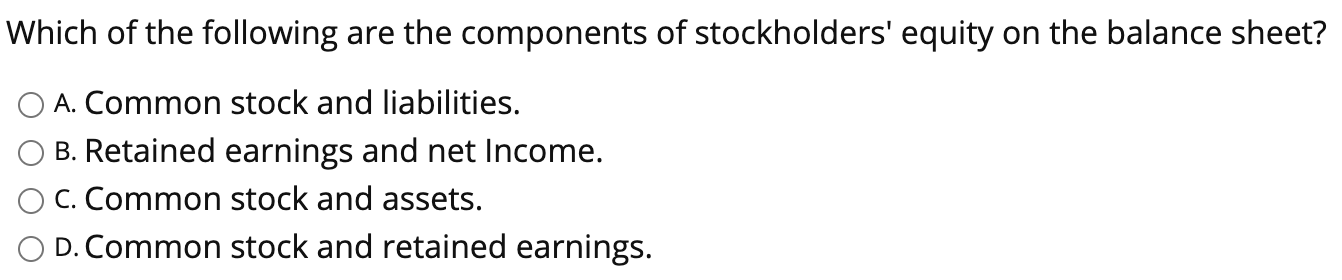

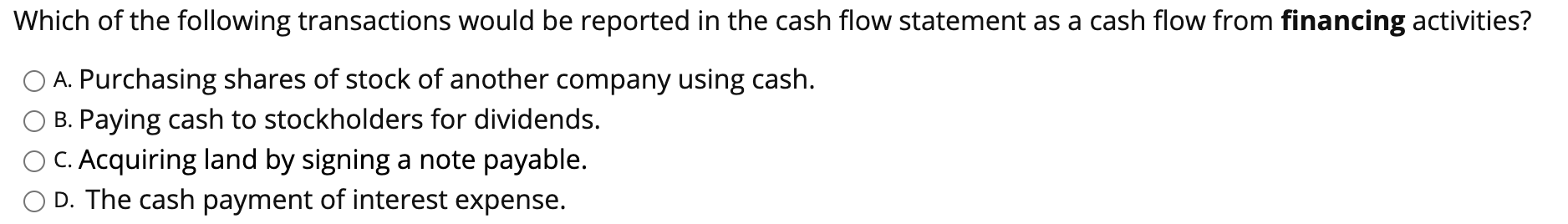

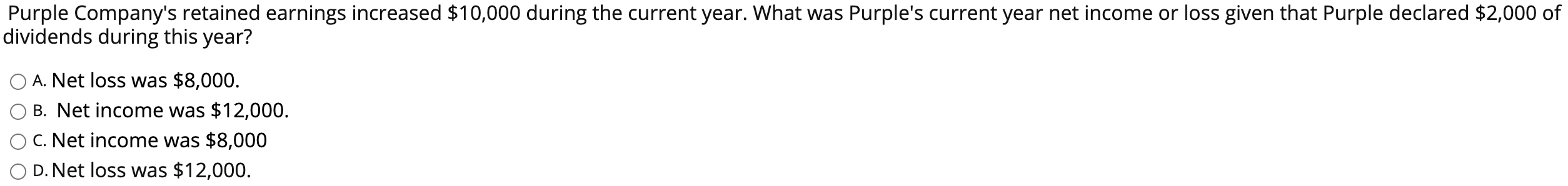

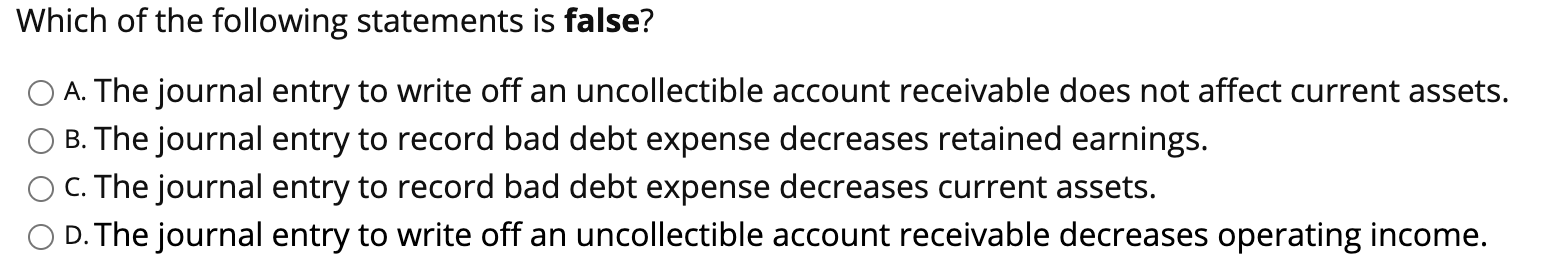

Pink Inc. sold a building for $3,250,000, purchased short-term investments for $320,000, issued $1,000,000 of preferred stocks, purchased an equipment for $500,000, and paid cash dividends of $30,000. What was the net cash flow from investing activities? A. $3,400,000 inflow. B. $2,930,000 inflow. C. $3,430,000 inflow. D. $2,430,000 inflow. Which of the following is correct? A. Deferred (unearned) revenues are considered increases to stockholders' equity. B. Working capital increases when a company pays the principal on a long-term note. C. Working capital is measured as current liabilities minus current assets. D. Deferred (unearned) revenues will eventually become revenue earned when the company has provided the services. Which of the following statements correctly describes a treasury stock transaction? A. A treasury stock purchase for an amount equal to the amount of the stock's original issue cost results in no change to total stockholders' equity. B. A treasury stock purchase for more than the amount of the stock's original issue cost results in an increase in total stockholders' equity. C. A treasury stock purchase for less than the amount of the stock's original issue cost results in a decrease in total stockholders' equity. O D.A treasury stock purchase for less than the amount of the stock's original issue cost results in an increase in total stockholders' equity. An understatement of the ending inventory in 2021, if not corrected, will cause which of the following? O A. 2021 net income to be overstated and 2022 net income to be understated. B. 2021 net income to be overstated and 2022 net income to be overstated. C. 2021 net income to be overstated and 2022 net income will be correct. O D.2021 net income to be understated and 2022 net income to be overstated. Which of the following are the components of stockholders' equity on the balance sheet? A. Common stock and liabilities. B. Retained earnings and net Income. C. Common stock and assets. D. Common stock and retained earnings. Which of the following transactions would be reported in the cash flow statement as a cash flow from financing activities? A. Purchasing shares of stock of another company using cash. B. Paying cash to stockholders for dividends. C. Acquiring land by signing a note payable. D. The cash payment of interest expense. Purple Company's retained earnings increased $10,000 during the current year. What was Purple's current year net income or loss given that Purple declared $2,000 of dividends during this year? A. Net loss was $8,000. B. Net income was $12,000. C. Net income was $8,000 D. Net loss was $12,000. Which of the following statements is false? O A. The journal entry to write off an uncollectible account receivable does not affect current assets. B. The journal entry to record bad debt expense decreases retained earnings. C. The journal entry to record bad debt expense decreases current assets. D. The journal entry to write off an uncollectible account receivable decreases operating income