Answered step by step

Verified Expert Solution

Question

1 Approved Answer

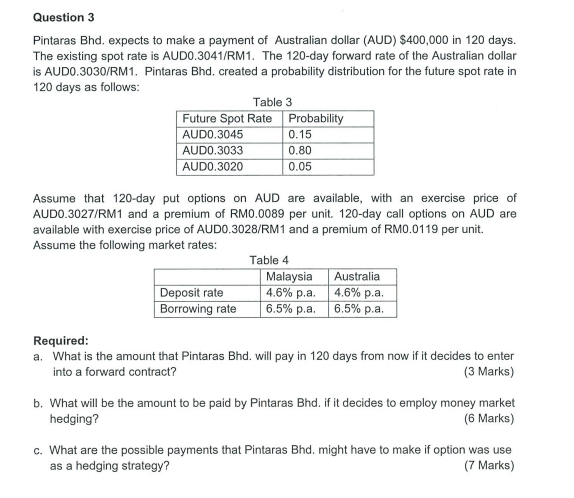

Pintaras Bhd. expects to make a payment of Australian dollar (AUD) ( $ 400,000 ) in 120 days. The existing spot rate is AUD0.3041/RM1. The

Pintaras Bhd. expects to make a payment of Australian dollar (AUD) \\( \\$ 400,000 \\) in 120 days. The existing spot rate is AUD0.3041/RM1. The 120-day forward rate of the Australian dollar is AUD0.3030/RM1. Pintaras Bhd. created a probability distribution for the future spot rate in 120 days as follows: Assume that 120-day put options on AUD are available, with an exercise price of AUD0.3027/RM1 and a premium of RM0.0089 per unit. 120-day call options on AUD are available with exercise price of AUD0.3028/RM1 and a premium of RM0.0119 per unit. Assume the following market rates: Required: a. What is the amount that Pintaras Bhd. will pay in 120 days from now if it decides to enter into a forward contract? (3 Marks) b. What will be the amount to be paid by Pintaras Bhd. if it decides to employ money market hedging? (6 Marks) c. What are the possible payments that Pintaras Bhd. might have to make if option was use as a hedging strategy? (7 Marks) d. What would be the possible payments if the company decide not to cover its exposure to foreign exchange rate risk? (5 Marks) e. Advice Pintaras Bhd. on which strategy to use based on your findings from above. (4 Marks)

Pintaras Bhd. expects to make a payment of Australian dollar (AUD) \\( \\$ 400,000 \\) in 120 days. The existing spot rate is AUD0.3041/RM1. The 120-day forward rate of the Australian dollar is AUD0.3030/RM1. Pintaras Bhd. created a probability distribution for the future spot rate in 120 days as follows: Assume that 120-day put options on AUD are available, with an exercise price of AUD0.3027/RM1 and a premium of RM0.0089 per unit. 120-day call options on AUD are available with exercise price of AUD0.3028/RM1 and a premium of RM0.0119 per unit. Assume the following market rates: Required: a. What is the amount that Pintaras Bhd. will pay in 120 days from now if it decides to enter into a forward contract? (3 Marks) b. What will be the amount to be paid by Pintaras Bhd. if it decides to employ money market hedging? (6 Marks) c. What are the possible payments that Pintaras Bhd. might have to make if option was use as a hedging strategy? (7 Marks) d. What would be the possible payments if the company decide not to cover its exposure to foreign exchange rate risk? (5 Marks) e. Advice Pintaras Bhd. on which strategy to use based on your findings from above. (4 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started