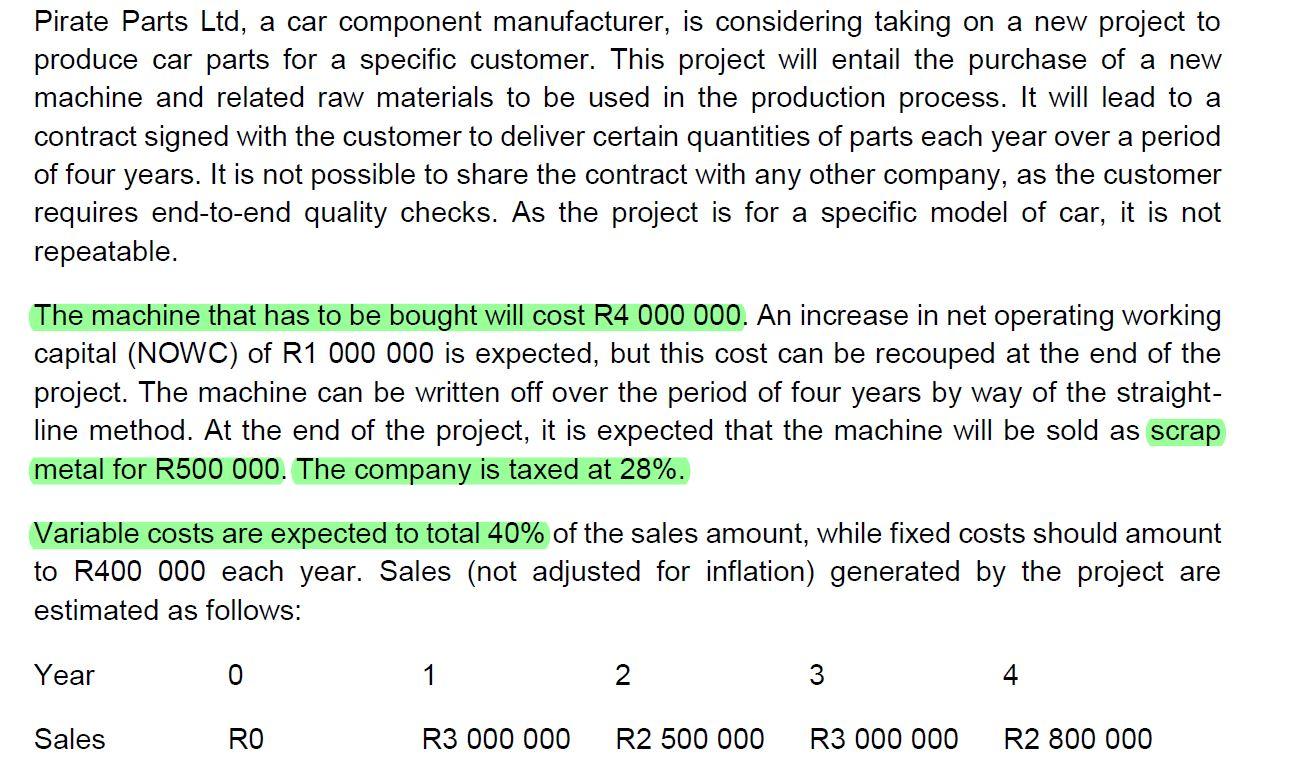

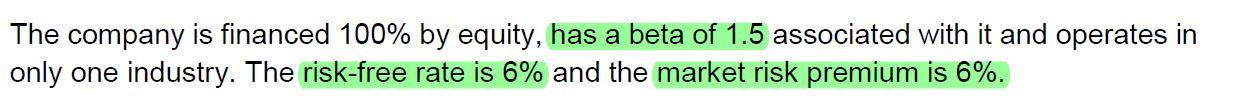

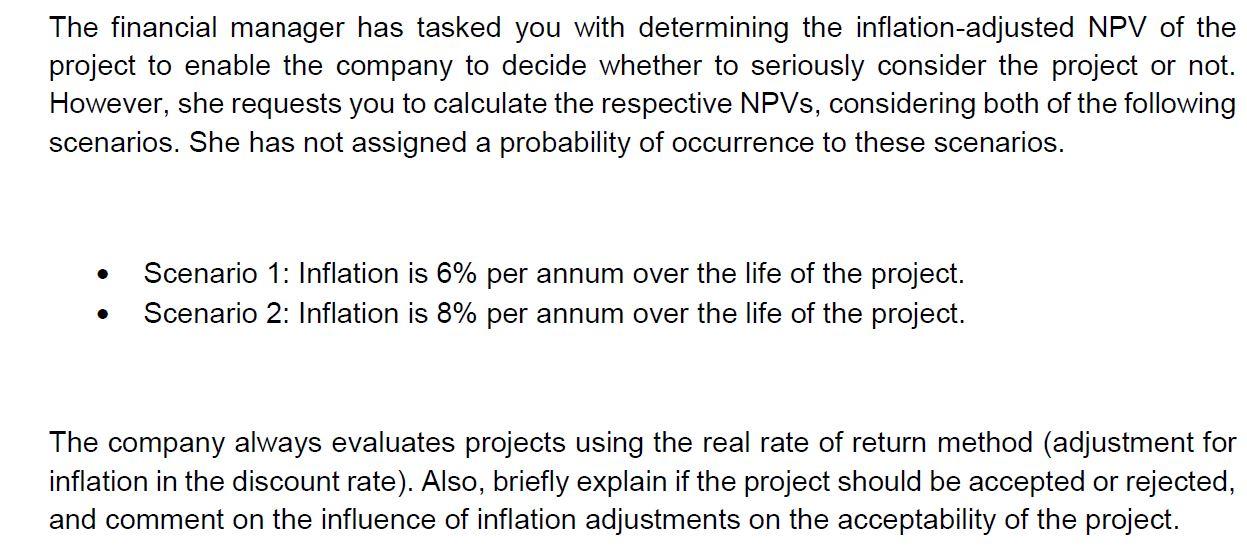

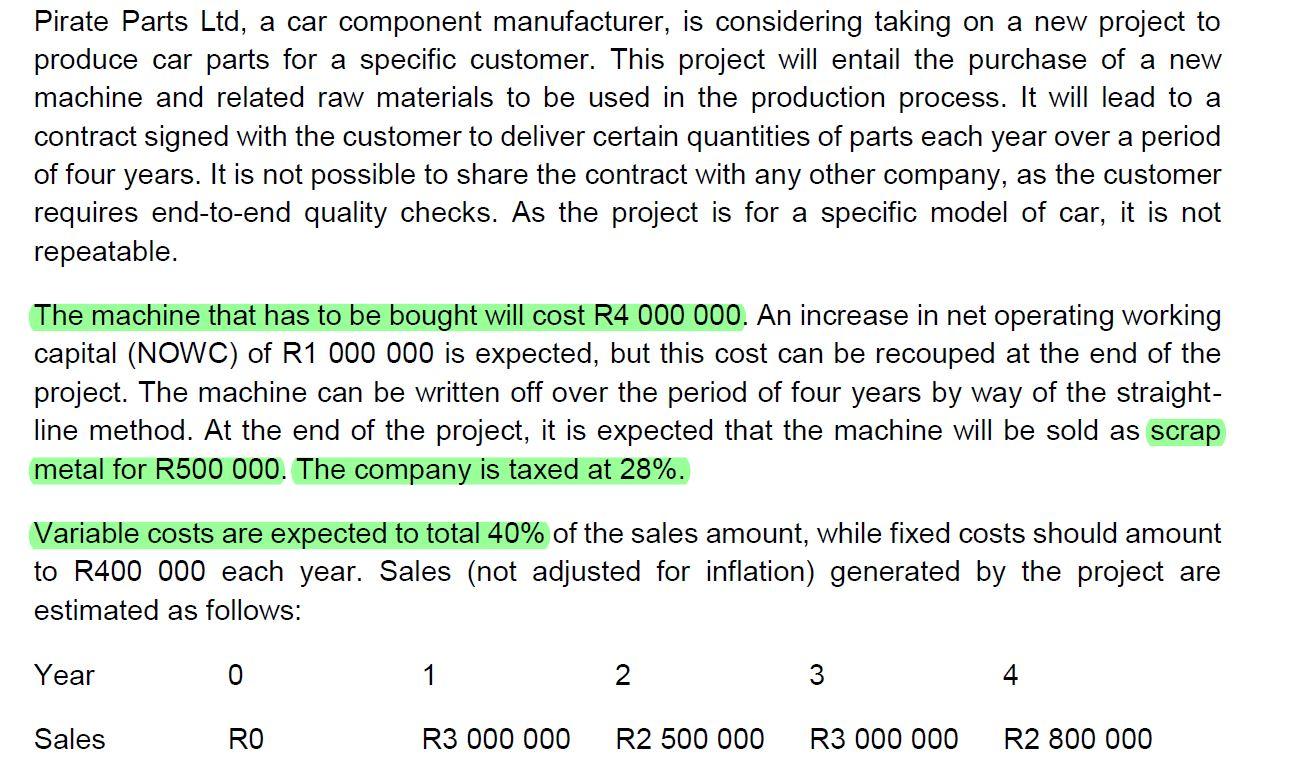

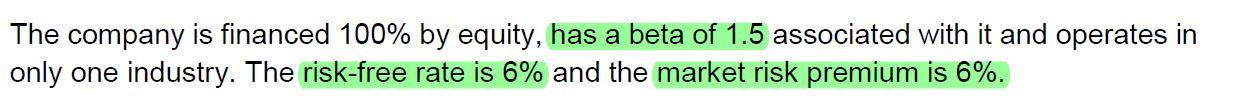

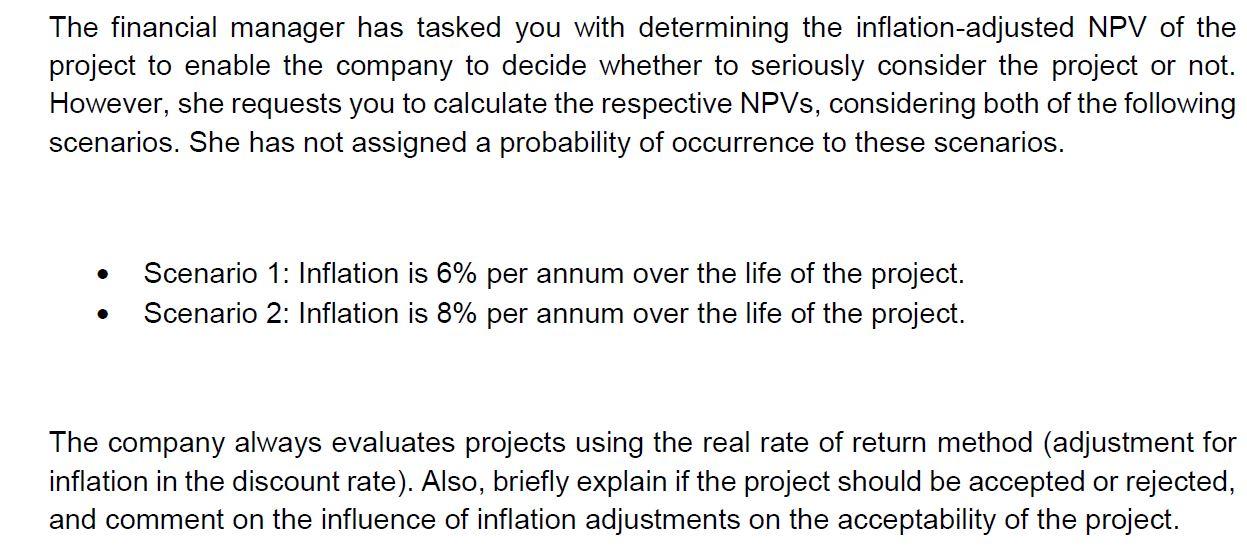

Pirate Parts Ltd, a car component manufacturer, is considering taking on a new project to produce car parts for a specific customer. This project will entail the purchase of a new machine and related raw materials to be used in the production process. It will lead to a contract signed with the customer to deliver certain quantities of parts each year over a period of four years. It is not possible to share the contract with any other company, as the customer requires end-to-end quality checks. As the project is for a specific model of car, it is not repeatable. The machine that has to be bought will cost R4 000 000. An increase in net operating working capital (NOWC) of R1 000 000 is expected, but this cost can be recouped at the end of the project. The machine can be written off over the period of four years by way of the straight- line method. At the end of the project, it is expected that the machine will be sold as scrap metal for R500 000. The company is taxed at 28%. Variable costs are expected to total 40% of the sales amount, while fixed costs should amount to R400 000 each year. Sales (not adjusted for inflation) generated by the project are estimated as follows: Year 0 1 2 3 4 Sales RO R3 000 000 R2 500 000 R3 000 000 R2 800 000 The company is financed 100% by equity, has a beta of 1.5 associated with it and operates in only one industry. The risk-free rate is 6% and the market risk premium is 6%. The financial manager has tasked you with determining the inflation-adjusted NPV of the project to enable the company to decide whether to seriously consider the project or not. However, she requests you to calculate the respective NPVs, considering both of the following scenarios. She has not assigned a probability of occurrence to these scenarios. Scenario 1: Inflation is 6% per annum over the life of the project. Scenario 2: Inflation is 8% per annum over the life of the project. The company always evaluates projects using the real rate of return method (adjustment for inflation in the discount rate). Also, briefly explain if the project should be accepted or rejected, and comment on the influence of inflation adjustments on the acceptability of the project