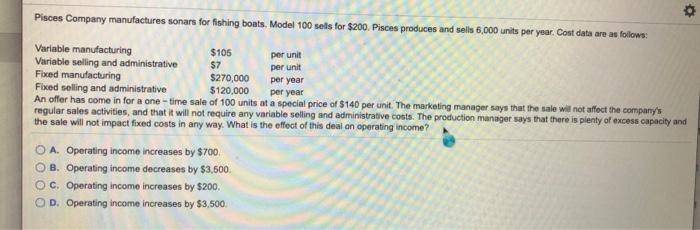

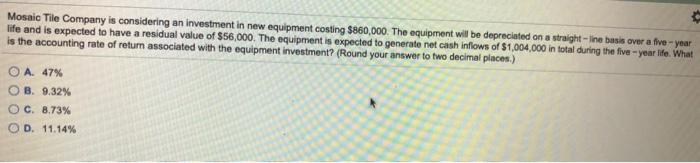

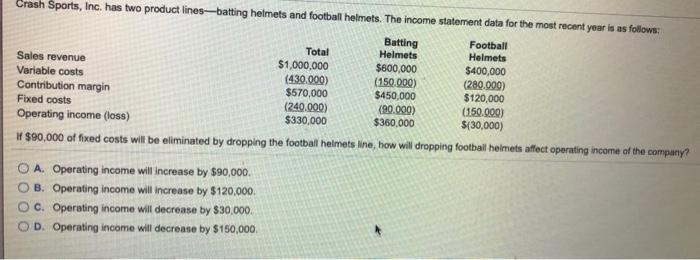

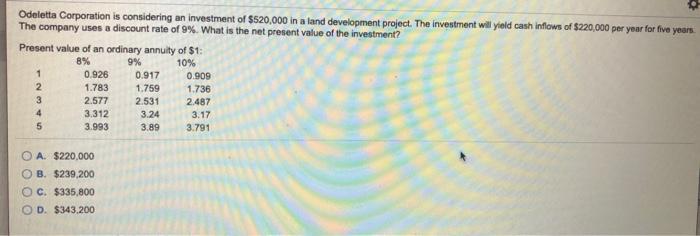

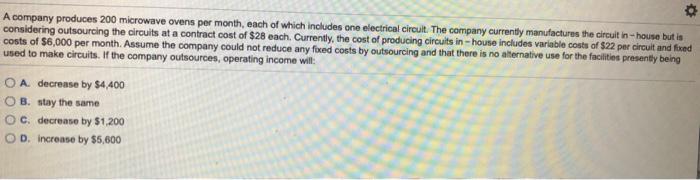

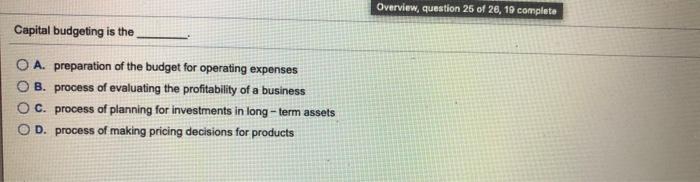

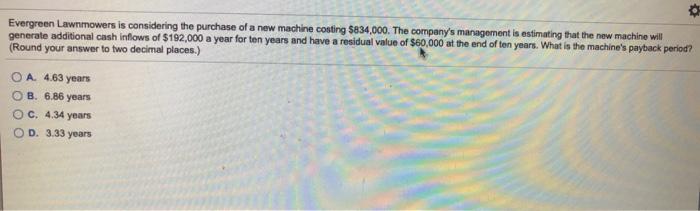

Pisces Company manufactures sonars for fishing boats. Model 100 sels for $200. Pisces produces and sells 6,000 units per year. Cost data are as follows: Variable manufacturing $105 per unit Variable selling and administrative $7 per unit Fixed manufacturing $270,000 per year Fixed selling and administrative $120,000 per year An offer has come in for a one-time sale of 100 units at a special price of $140 per unit. The marketing manager says that the sale will not affect the company's regular sales activities, and that it will not require any variable selling and administrative costs. The production manager says that there is plenty of excess capacity and the sale will not impact fixed costs in any way. What is the effect of this deal on operating income? O A. Operating income increases by $700 B. Operating income decreases by $3,600 C. Operating income increases by $200. OD. Operating income increases by $3,500 Mosaic Tile Company is considering an investment in new equipment costing $860,000. The equipment will be depreciated on a straight - Iine basis over a five-year life and is expected to have a residual value of $56,000. The equipment is expected to generato net cash inflows of $1,004,000 in total during the five-year life. What is the accounting rate of return associated with the equipment investment? (Round your answer to two decimal places) A. 47% B. 9.32% C. 8.73% D. 11.14% Crash Sports, Inc. has two product lines-batting helmets and football helmets. The income statement data for the most recent year is as follows: Batting Football Tota! Helmets Helmets Sales revenue $1,000,000 $600,000 $400,000 Variable costs (430.000) (150.000) (280,000) Contribution margin $570,000 $450,000 $120,000 Fixed costs (240.000) (90.000) (150.000) Operating income (loss) $330,000 $360,000 $(30,000) # $90,000 of fixed costs will be eliminated by dropping the football helmets ine, how will dropping football helmets affect operating income of the company? O A. Operating income will increase by $90,000 OB. Operating income will increase by $120,000 OC. Operating income will decrease by $30.000 OD. Operating income will decrease by $150,000 Odeletta Corporation is considering an investment of $520,000 in a land development project. The investment will yield cash inflows of $220,000 per year for five years. The company uses a discount rate of 9%. What is the net present value of the investment? Present value of an ordinary annuity of $1: 8% 9% 10% 0.926 0.917 0.909 1.783 1.759 1.736 3 2.577 2.531 2.487 4 3.312 3.24 3.993 3.89 3.791 1 2 3.17 5 A. $220,000 B. $239,200 OC. $335,800 D. $343.200 A company produces 200 microwave ovens per month, each of which includes one electrical circuit. The company currently manufactures the circuit in-house but is considering outsourcing the circuits at a contract cost of $28 each. Currently, the cost of producing circuits in-house includes variable costs of $22 per circuit and fixed costs of $6,000 per month. Assume the company could not reduce any fixed costs by outsourcing and that there is no alternative use for the facilities presently being used to make circuits. If the company outsources, operating income will: O A. decrease by $4,400 OB. stay the same OC. decrease by $1,200 D. Increase by $5,600 Overview question 25 of 28, 19 complete Capital budgeting is the O A. preparation of the budget for operating expenses B. process of evaluating the profitability of a business OC. process of planning for investments in long-term assets D. process of making pricing decisions for products Evergreen Lawnmowers is considering the purchase of a new machine costing $834,000. The company's management is estimating that the new machine will generate additional cash inflows of $192,000 a year for ten years and have a residual value of $60,000 at the end of ten years. What is the machine's payback period? (Round your answer to two decimal places.) OA. 4.63 years OB 6.86 years OC. 4.34 years OD.3.33 years Pisces Company manufactures sonars for fishing boats. Model 100 sels for $200. Pisces produces and sells 6,000 units per year. Cost data are as follows: Variable manufacturing $105 per unit Variable selling and administrative $7 per unit Fixed manufacturing $270,000 per year Fixed selling and administrative $120,000 per year An offer has come in for a one-time sale of 100 units at a special price of $140 per unit. The marketing manager says that the sale will not affect the company's regular sales activities, and that it will not require any variable selling and administrative costs. The production manager says that there is plenty of excess capacity and the sale will not impact fixed costs in any way. What is the effect of this deal on operating income? O A. Operating income increases by $700 B. Operating income decreases by $3,600 C. Operating income increases by $200. OD. Operating income increases by $3,500 Mosaic Tile Company is considering an investment in new equipment costing $860,000. The equipment will be depreciated on a straight - Iine basis over a five-year life and is expected to have a residual value of $56,000. The equipment is expected to generato net cash inflows of $1,004,000 in total during the five-year life. What is the accounting rate of return associated with the equipment investment? (Round your answer to two decimal places) A. 47% B. 9.32% C. 8.73% D. 11.14% Crash Sports, Inc. has two product lines-batting helmets and football helmets. The income statement data for the most recent year is as follows: Batting Football Tota! Helmets Helmets Sales revenue $1,000,000 $600,000 $400,000 Variable costs (430.000) (150.000) (280,000) Contribution margin $570,000 $450,000 $120,000 Fixed costs (240.000) (90.000) (150.000) Operating income (loss) $330,000 $360,000 $(30,000) # $90,000 of fixed costs will be eliminated by dropping the football helmets ine, how will dropping football helmets affect operating income of the company? O A. Operating income will increase by $90,000 OB. Operating income will increase by $120,000 OC. Operating income will decrease by $30.000 OD. Operating income will decrease by $150,000 Odeletta Corporation is considering an investment of $520,000 in a land development project. The investment will yield cash inflows of $220,000 per year for five years. The company uses a discount rate of 9%. What is the net present value of the investment? Present value of an ordinary annuity of $1: 8% 9% 10% 0.926 0.917 0.909 1.783 1.759 1.736 3 2.577 2.531 2.487 4 3.312 3.24 3.993 3.89 3.791 1 2 3.17 5 A. $220,000 B. $239,200 OC. $335,800 D. $343.200 A company produces 200 microwave ovens per month, each of which includes one electrical circuit. The company currently manufactures the circuit in-house but is considering outsourcing the circuits at a contract cost of $28 each. Currently, the cost of producing circuits in-house includes variable costs of $22 per circuit and fixed costs of $6,000 per month. Assume the company could not reduce any fixed costs by outsourcing and that there is no alternative use for the facilities presently being used to make circuits. If the company outsources, operating income will: O A. decrease by $4,400 OB. stay the same OC. decrease by $1,200 D. Increase by $5,600 Overview question 25 of 28, 19 complete Capital budgeting is the O A. preparation of the budget for operating expenses B. process of evaluating the profitability of a business OC. process of planning for investments in long-term assets D. process of making pricing decisions for products Evergreen Lawnmowers is considering the purchase of a new machine costing $834,000. The company's management is estimating that the new machine will generate additional cash inflows of $192,000 a year for ten years and have a residual value of $60,000 at the end of ten years. What is the machine's payback period? (Round your answer to two decimal places.) OA. 4.63 years OB 6.86 years OC. 4.34 years OD.3.33 years