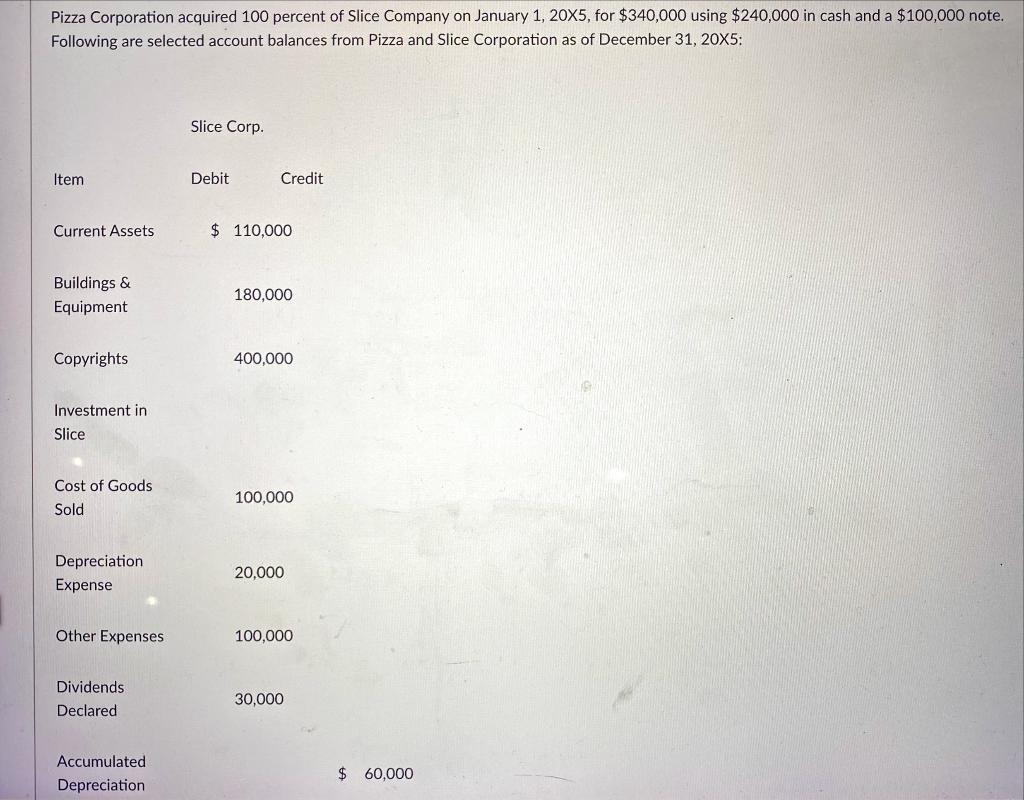

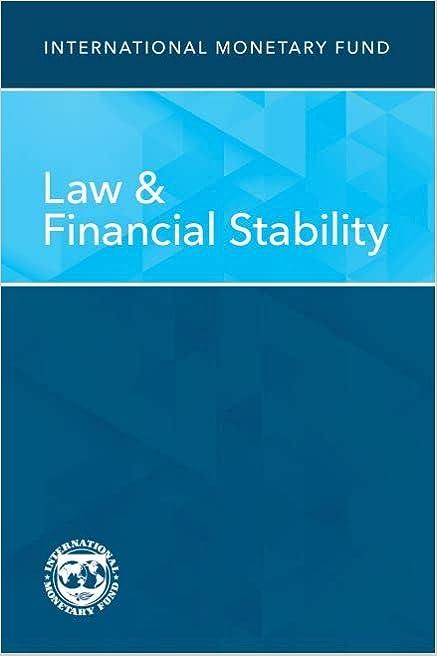

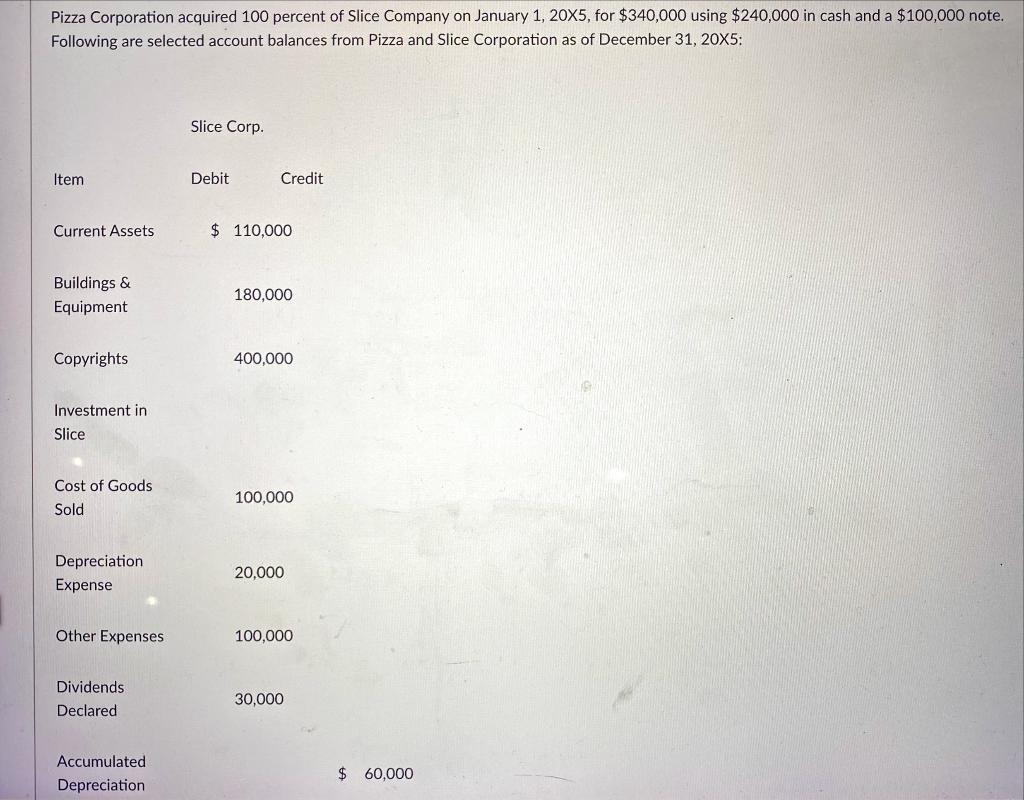

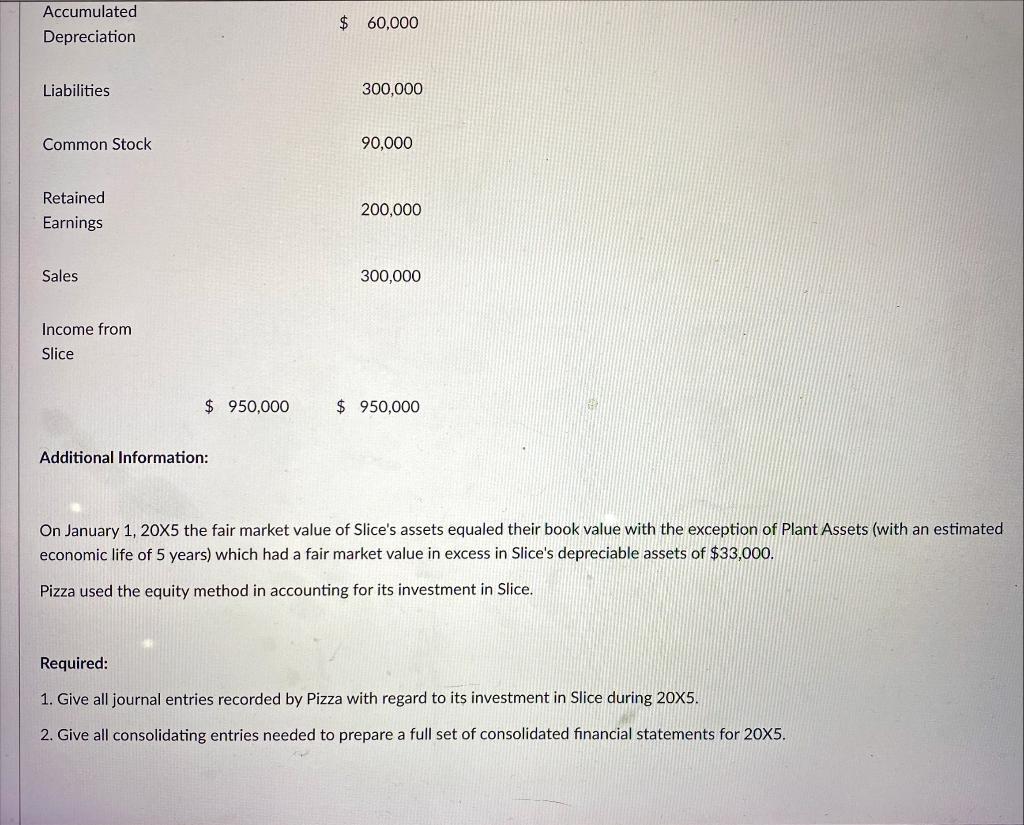

Pizza Corporation acquired 100 percent of Slice Company on January 1, 20X5, for $340,000 using $240,000 in cash and a $100,000 note. Following are selected account balances from Pizza and Slice Corporation as of December 31, 20x5: Slice Corp. Item Debit Credit Current Assets $ 110,000 Buildings & Equipment 180,000 Copyrights 400,000 Investment in Slice Cost of Goods Sold 100,000 Depreciation Expense 20,000 Other Expenses 100,000 Dividends Declared 30,000 Accumulated Depreciation $ 60,000 Accumulated Depreciation $ 60,000 Liabilities 300,000 Common Stock 90,000 Retained Earnings 200,000 Sales 300,000 Income from Slice $ 950,000 $ 950,000 Additional Information: On January 1, 20x5 the fair market value of Slice's assets equaled their book value with the exception of Plant Assets (with an estimated economic life of 5 years) which had a fair market value in excess in Slice's depreciable assets of $33,000. Pizza used the equity method in accounting for its investment in Slice. Required: 1. Give all journal entries recorded by Pizza with regard to its investment in Slice during 20X5. 2. Give all consolidating entries needed to prepare a full set of consolidated financial statements for 20X5. Pizza Corporation acquired 100 percent of Slice Company on January 1, 20X5, for $340,000 using $240,000 in cash and a $100,000 note. Following are selected account balances from Pizza and Slice Corporation as of December 31, 20x5: Slice Corp. Item Debit Credit Current Assets $ 110,000 Buildings & Equipment 180,000 Copyrights 400,000 Investment in Slice Cost of Goods Sold 100,000 Depreciation Expense 20,000 Other Expenses 100,000 Dividends Declared 30,000 Accumulated Depreciation $ 60,000 Accumulated Depreciation $ 60,000 Liabilities 300,000 Common Stock 90,000 Retained Earnings 200,000 Sales 300,000 Income from Slice $ 950,000 $ 950,000 Additional Information: On January 1, 20x5 the fair market value of Slice's assets equaled their book value with the exception of Plant Assets (with an estimated economic life of 5 years) which had a fair market value in excess in Slice's depreciable assets of $33,000. Pizza used the equity method in accounting for its investment in Slice. Required: 1. Give all journal entries recorded by Pizza with regard to its investment in Slice during 20X5. 2. Give all consolidating entries needed to prepare a full set of consolidated financial statements for 20X5