Question

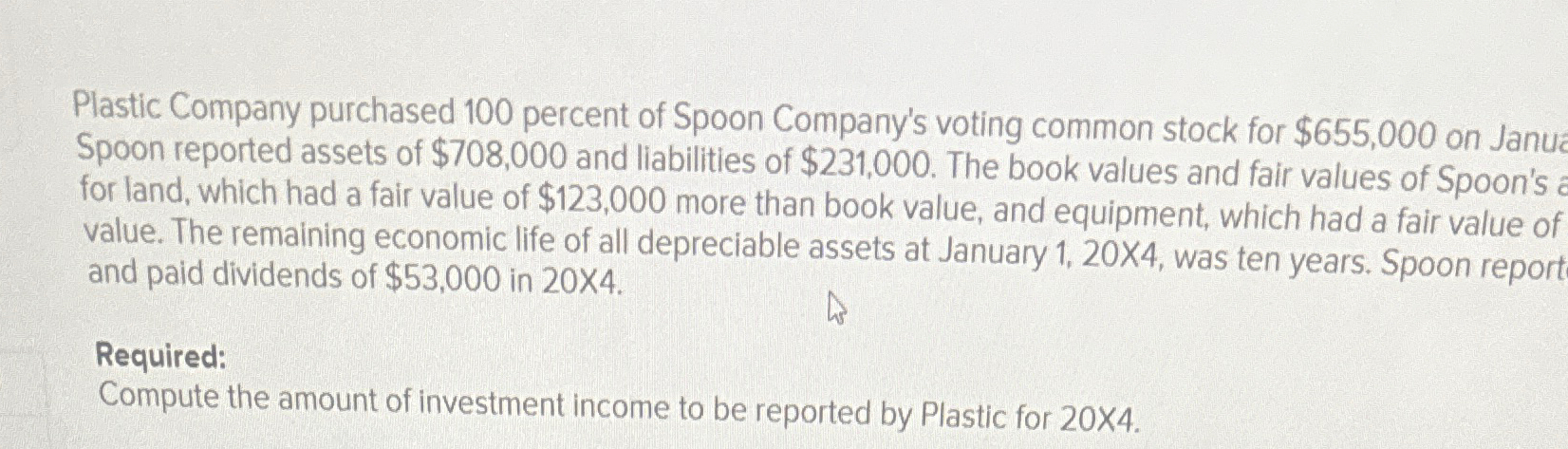

Plastic Company purchased 100 percent of Spoon Company's voting common stock for $655,000 on Janua Spoon reported assets of $708,000 and liabilities of $231,000.

Plastic Company purchased 100 percent of Spoon Company's voting common stock for $655,000 on Janua Spoon reported assets of $708,000 and liabilities of $231,000. The book values and fair values of Spoon's a for land, which had a fair value of $123,000 more than book value, and equipment, which had a fair value of value. The remaining economic life of all depreciable assets at January 1, 20X4, was ten years. Spoon report and paid dividends of $53,000 in 20X4. Required: Compute the amount of investment income to be reported by Plastic for 20X4.

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To compute the amount of investment income to be reported by Plastic for 20X4 we need to follow thes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore Christensen, David Cottrell, Cassy Budd

13th Edition

1260772136, 9781260772135

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App