Answered step by step

Verified Expert Solution

Question

1 Approved Answer

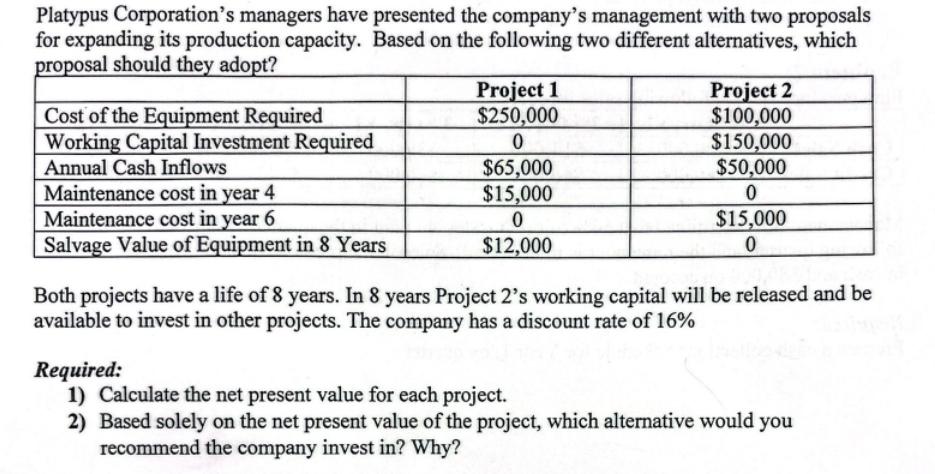

Platypus Corporation's managers have presented the company's management with two proposals for expanding its production capacity. Based on the following two different alternatives, which

Platypus Corporation's managers have presented the company's management with two proposals for expanding its production capacity. Based on the following two different alternatives, which proposal should they adopt? Cost of the Equipment Required Project 1 $250,000 Working Capital Investment Required Annual Cash Inflows 0 $65,000 Maintenance cost in year 4 $15,000 Maintenance cost in year 6 0 Salvage Value of Equipment in 8 Years $12,000 Project 2 $100,000 $150,000 $50,000 0 $15,000 0 Both projects have a life of 8 years. In 8 years Project 2's working capital will be released and be available to invest in other projects. The company has a discount rate of 16% Required: 1) Calculate the net present value for each project. 2) Based solely on the net present value of the project, which alternative would you recommend the company invest in? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the net present value NPV for each project we need to discount the cash inflows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started