Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smith Company (Smith) purchased a machine on December 2, 2023, at an invoice price of $45,000 with terms 3/10, net 30. On December 6,

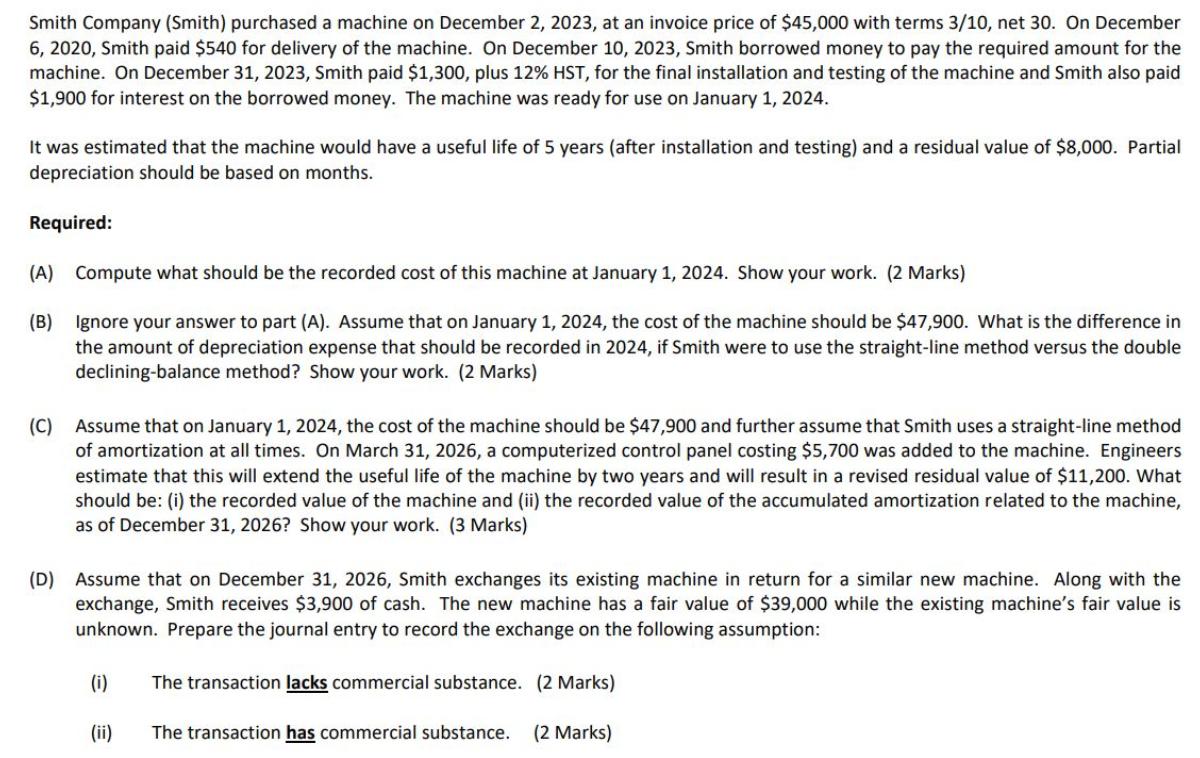

Smith Company (Smith) purchased a machine on December 2, 2023, at an invoice price of $45,000 with terms 3/10, net 30. On December 6, 2020, Smith paid $540 for delivery of the machine. On December 10, 2023, Smith borrowed money to pay the required amount for the machine. On December 31, 2023, Smith paid $1,300, plus 12% HST, for the final installation and testing of the machine and Smith also paid $1,900 for interest on the borrowed money. The machine was ready for use on January 1, 2024. It was estimated that the machine would have a useful life of 5 years (after installation and testing) and a residual value of $8,000. Partial depreciation should be based on months. Required: (A) Compute what should be the recorded cost of this machine at January 1, 2024. Show your work. (2 Marks) (B) Ignore your answer to part (A). Assume that on January 1, 2024, the cost of the machine should be $47,900. What is the difference in the amount of depreciation expense that should be recorded in 2024, if Smith were to use the straight-line method versus the double declining-balance method? Show your work. (2 Marks) (C) Assume that on January 1, 2024, the cost of the machine should be $47,900 and further assume that Smith uses a straight-line method of amortization at all times. On March 31, 2026, a computerized control panel costing $5,700 was added to the machine. Engineers estimate that this will extend the useful life of the machine by two years and will result in a revised residual value of $11,200. What should be: (i) the recorded value of the machine and (ii) the recorded value of the accumulated amortization related to the machine, as of December 31, 2026? Show your work. (3 Marks) (D) Assume that on December 31, 2026, Smith exchanges its existing machine in return for a similar new machine. Along with the exchange, Smith receives $3,900 of cash. The new machine has a fair value of $39,000 while the existing machine's fair value is unknown. Prepare the journal entry to record the exchange on the following assumption: (i) The transaction lacks commercial substance. (2 Marks) (ii) The transaction has commercial substance. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the problem and provide solutions Understanding the Problem The problem involves calculating the cost of a machinedepreciation expenses using different methodsand accounting for asset exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started