Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stanley Corporation had Pretax GAAP Income of $82,000 for the year-ended December 31, 20X1. This amount included municipal bond interest of $2,800, premiums for

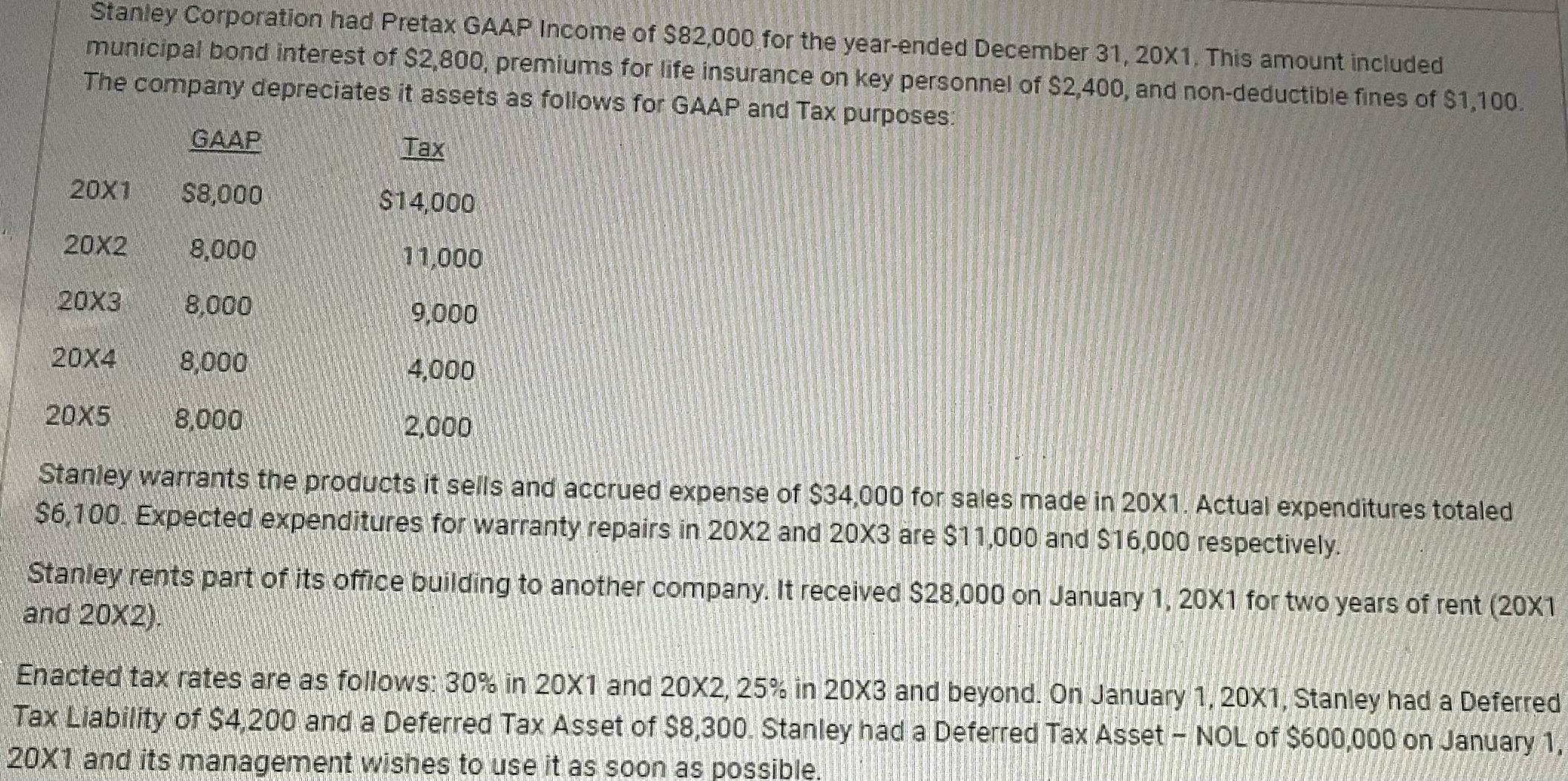

Stanley Corporation had Pretax GAAP Income of $82,000 for the year-ended December 31, 20X1. This amount included municipal bond interest of $2,800, premiums for life insurance on key personnel of $2,400, and non-deductible fines of $1,100. The company depreciates it assets as follows for GAAP and Tax purposes: GAAP Tax 20X1 $8,000 $14,000 20X2 8,000 11,000 20X3 8,000 9,000 20X4 8,000 4,000 20X5 8,000 2,000 Stanley warrants the products it sells and accrued expense of $34,000 for sales made in 20X1. Actual expenditures totaled $6,100. Expected expenditures for warranty repairs in 20X2 and 20X3 are $11,000 and $16,000 respectively. Stanley rents part of its office building to another company. It received $28,000 on January 1, 20X1 for two years of rent (20X1 and 20X2). Enacted tax rates are as follows: 30% in 20X1 and 20X2, 25% in 20X3 and beyond. On January 1, 20X1, Stanley had a Deferred Tax Liability of $4,200 and a Deferred Tax Asset of $8,300. Stanley had a Deferred Tax Asset- NOL of $600,000 on January 1, 20X1 and its management wishes to use it as soon as possible.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the taxable income and the income tax expense for Stanley Corporation we need to consider various adjustments and calculations Let...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started