Answered step by step

Verified Expert Solution

Question

1 Approved Answer

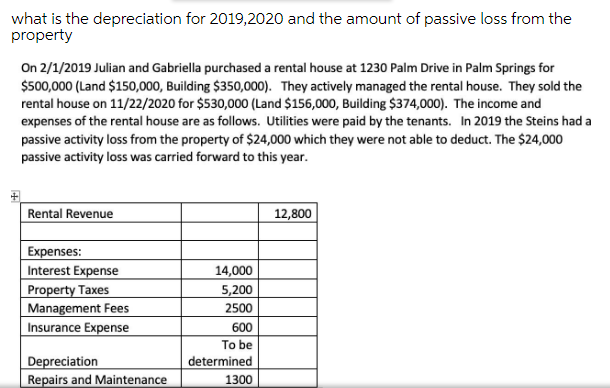

what is the depreciation for 2019,2020 and the amount of passive loss from the property On 2/1/2019 Julian and Gabriella purchased a rental house

what is the depreciation for 2019,2020 and the amount of passive loss from the property On 2/1/2019 Julian and Gabriella purchased a rental house at 1230 Palm Drive in Palm Springs for $500,000 (Land $150,000, Building $350,000). They actively managed the rental house. They sold the rental house on 11/22/2020 for $530,000 (Land $156,000, Building $374,000). The income and expenses of the rental house are as follows. Utilities were paid by the tenants. In 2019 the Steins had a passive activity loss from the property of $24,000 which they were not able to deduct. The $24,000 passive activity loss was carried forward to this year. Rental Revenue Expenses: Interest Expense 14,000 Property Taxes 5,200 Management Fees 2500 Insurance Expense 600 To be Depreciation determined Repairs and Maintenance 1300 12,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the depreciation for 2019 and 2020 we need to use the straightline method of dep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started