Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20X5, for $300,300. On that date, the noncontrolling interest had

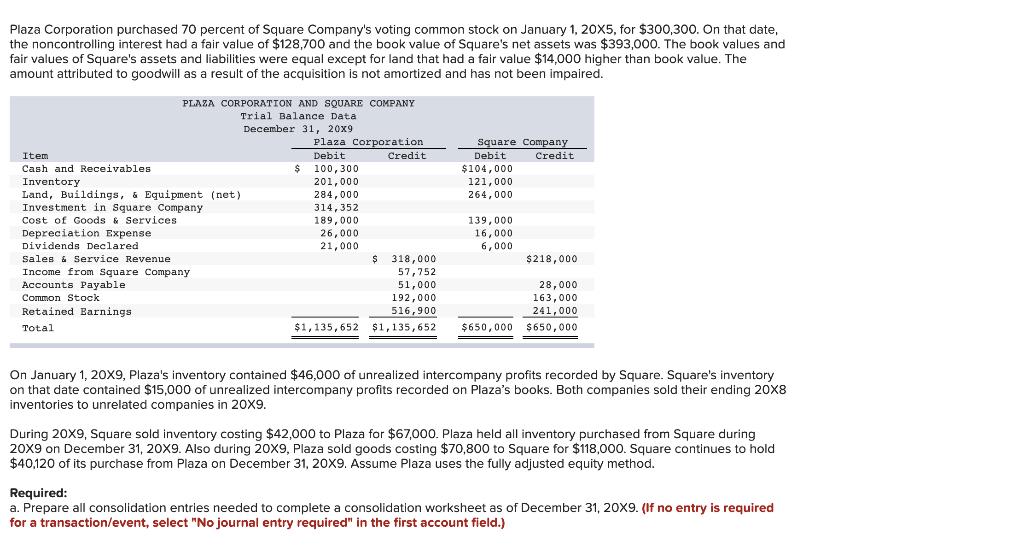

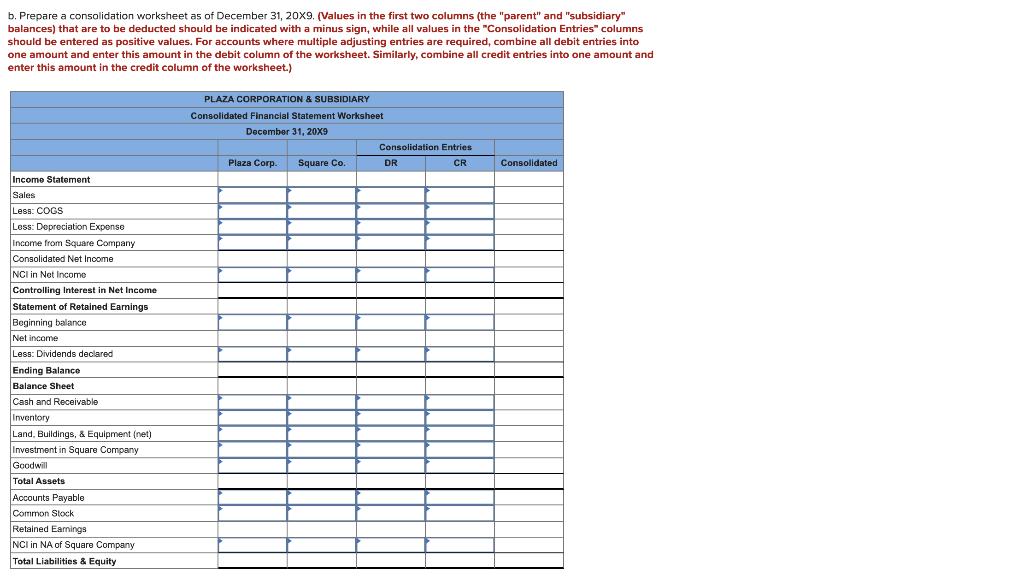

Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20X5, for $300,300. On that date, the noncontrolling interest had a fair value of $128,700 and the book value of Square's net assets was $393,000. The book values and fair values of Square's assets and liabilities were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impaired. PLAZA CORPORATION AND SQUARE COMPANY Trial Balance Data December 31, 20x9 Item Cash and Receivables Inventory Land, Buildings, & Equipment (net) Investment in Square Company Cost of Goods & Services. Depreciation Expense Dividends Declared. Sales & Service Revenue Income from Square Company Accounts Payable Common Stock Retained Earnings Total $ Plaza Corporation Debit Credit 100,300 201,000 284,000 314,352 189,000 26,000 21,000 $ 318,000 57,752 51,000 192,000 516,900 $1,135,652 $1,135,652 Square Company Debit Credit $104,000 121,000 264,000 139,000 16,000 6,000 $218,000 28,000 163,000 241,000 $650,000 $650,000 On January 1, 20X9, Plaza's inventory contained $46,000 of unrealized intercompany profits recorded by Square. Square's inventory on that date contained $15,000 of unrealized intercompany profits recorded on Plaza's books. Both companies sold their ending 20X8 inventories to unrelated companies in 20X9. During 20X9, Square sold inventory costing $42,000 to Plaza for $67,000. Plaza held all inventory purchased from Square during 20X9 on December 31, 20X9. Also during 20X9, Plaza sold goods costing $70,800 to Square for $118,000. Square continues to hold $40,120 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equity method. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Prepare a consolidation worksheet as of December 31, 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Income Statement Sales Less: COGS Less: Depreciation Expense Income from Square Company Consolidated Net Income NCI in Net Income Interes Controlling Interest in Net Income E Statement of Retained Earnings Sections Beginning balance E Net income Less: Dividends declared Ending Balance Balance Sheet Cash and Receivable Inventory Load Build Land, Buildings, & Equipment (net) Investment in Square Company Goodwill Total Assets Accounts Payable Common Stock Retained Earnings NCI in NA of Square Company Total Liabilities & Equity PLAZA CORPORATION & SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 20X9 Plaza Corp. Square Co. Consolidation Entries CR DR Consolidated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We know the following about Niece Equipments crane proposal unit price per hour variable costs per h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started