Answered step by step

Verified Expert Solution

Question

1 Approved Answer

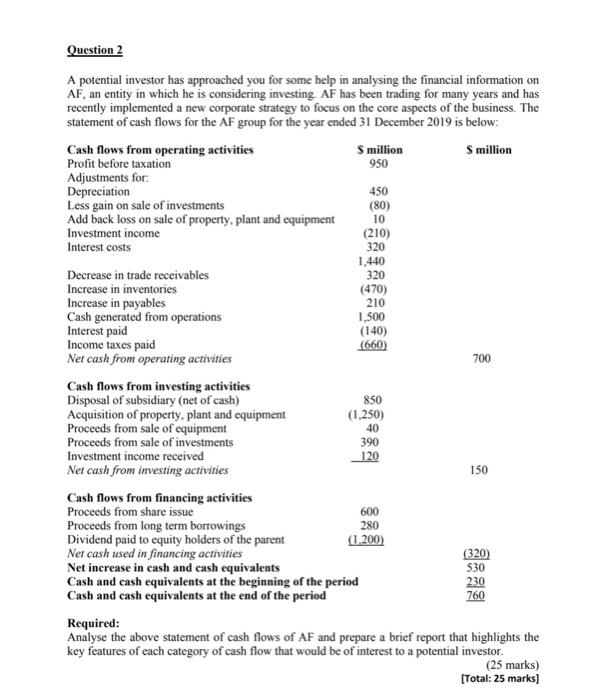

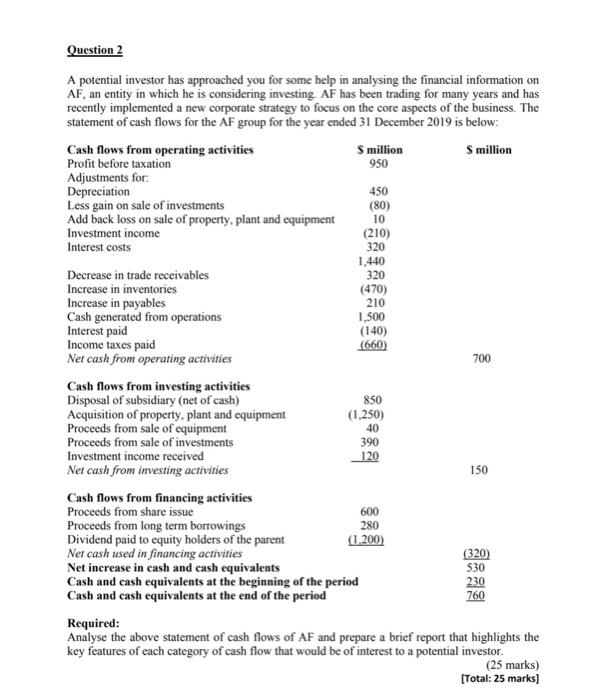

pleace add excle fild Question 2 (140) (660) A potential investor has approached you for some help in analysing the financial information on AF, an

pleace add excle fild

Question 2 (140) (660) A potential investor has approached you for some help in analysing the financial information on AF, an entity in which he is considering investing. AF has been trading for many years and has recently implemented a new corporate strategy to focus on the core aspects of the business. The statement of cash flows for the AF group for the year ended 31 December 2019 is below: Cash flows from operating activities S million S million Profit before taxation 950 Adjustments for: Depreciation 450 Less gain on sale of investments (80) Add back loss on sale of property, plant and equipment 10 Investment income (210) Interest costs 320 1,440 Decrease in trade receivables 320 Increase in inventories (470) Increase in payables 210 Cash generated from operations 1,500 Interest paid Income taxes paid Net cash from operating activities 700 Cash flows from investing activities Disposal of subsidiary (net of cash) 850 Acquisition of property, plant and equipment (1,250) Proceeds from sale of equipment Proceeds from sale of investments 390 Investment income received 120 Net cash from investing activities 150 Cash flows from financing activities Proceeds from share issue 600 Proceeds from long term borrowings 280 Dividend paid to equity holders of the parent (1.200) Net cash used in financing activities (320) Net increase in cash and cash equivalents 530 Cash and cash equivalents at the beginning of the period 230 Cash and cash equivalents at the end of the period 760 Required: Analyse the above statement of cash flows of AF and prepare a brief report that highlights the key features of each category of cash flow that would be of interest to a potential investor. (25 marks) [Total: 25 marks] 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started