Answered step by step

Verified Expert Solution

Question

1 Approved Answer

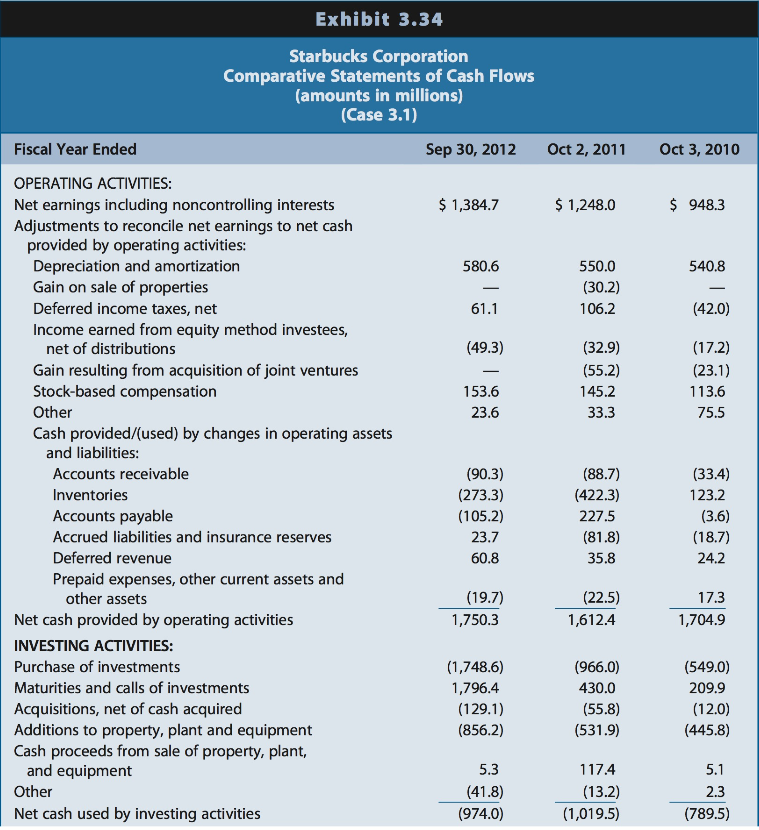

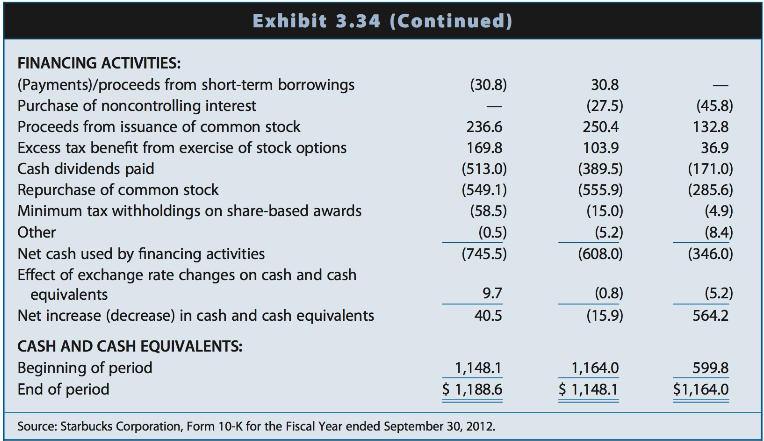

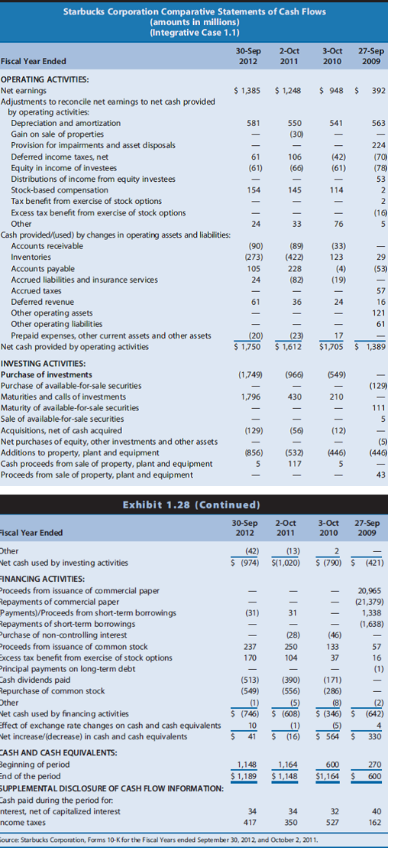

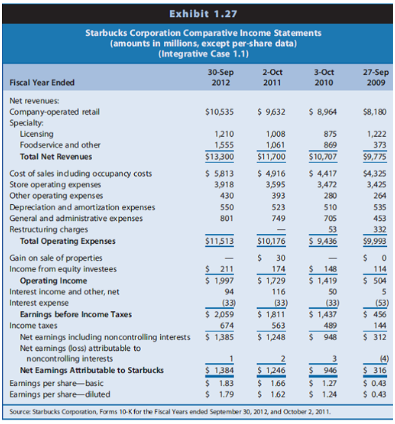

Please also calculate Starbucks total accrual, net non-working capital accrual and working-capital accrual for each of the three years (2010-2012). You may need to find

Please also calculate Starbucks total accrual, net non-working capital accrual and working-capital accrual for each of the three years (2010-2012). You may need to find the total assets numbers if necessary.

Exhibit 3.34 Starbucks Corporation Comparative Statements o Cash Flows amounts in millions) (Case 3.1) Fiscal Year Ended OPERATING ACTIVITIES: Net earnings including noncontrolling interests Adjustments to reconcile net earnings to net cash Sep 30, 2012 Oct 2, 2011 Oct 3, 2010 1,384.7 $1,248.0 948.3 provided by operating activities: Depreciation and amortization Gain on sale of properties Deferred income taxes, net Income earned from equity method investees, 580.6 61.1 (49.3) 540.8 550.0 (30.2) 106.2 (42.0) (17.2) net of distributions Gain resulting from acquisition of joint ventures Stock-based compensation Other Cash provided/(used) by changes in operating assets (32.9) (55.2) 145.2 33.3 153.6 23.6 113.6 75.5 and liabilities: Accounts receivable Inventories Accounts payable Accrued liabilities and insurance reserves Deferred revenue Prepaid expenses, other current assets and (90.3) (273.3) (105.2) 23.7 60.8 (33.4) 123.2 (3.6) (18.7) 24.2 (88.7) (422.3) 227.5 (81.8) 35.8 (19.7) 1,750.3 (22.5) 1,612.4 other assets 17.3 Net cash provided by operating activities INVESTING ACTIVITIES: Purchase of investments Maturities and calls of investments Acquisitions, net of cash acquired Additions to property, plant and equipment Cash proceeds from sale of property, plant, 1,704.9 (1,748.6) 1,796.4 (129.1) (856.2) (966.0) 430.0 (55.8) (531.9) (549.0) 209.9 (12.0) (445.8) and equipment Other Net cash used by investing activities 5.3 (13.2) (1,019.5) 2.3 (974.0) (789.5)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started