Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please also explain why. Thanks! On September 1, Year Three, the LaToya Corporation paid $42,000 for insurance for the next six months. The appropriate journal

Please also explain why. Thanks!

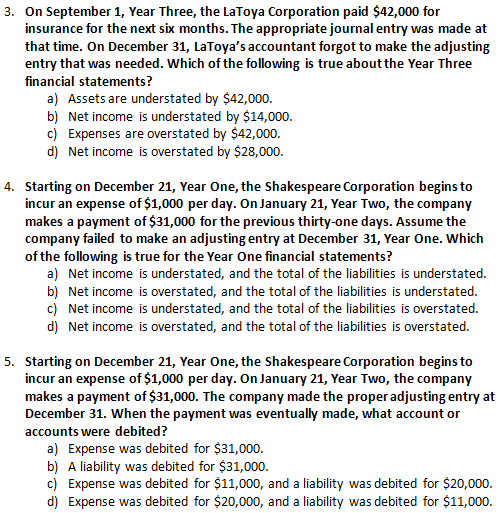

On September 1, Year Three, the LaToya Corporation paid $42,000 for insurance for the next six months. The appropriate journal entry was made at that time. On December 31, LaToya's accountant forgot to make the adjusting entry that was needed. Which of the following is true about the Year Three financial statements? Assets are understated by $42,000 Net income is understated by $14,000. Expenses are overstated by $42,000. Net income is overstated by $28,000. Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make an adjusting entry at December 31, Year One. Which of the following is true for the Year One financial statements? Net income is understated, and the total of the liabilities is understated. Net income is overstated, and the total of the liabilities is understated. Net income is understated, and the total of the liabilities is overstated. Net income is overstated, and the total of the liabilities is overstated. Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000. The company made the proper adjusting entry at December 31. When the payment was eventually made, what account or accounts were debited? Expense was debited for $31,000. A liability was debited for $31,000 Expense was debited for $11,000, and a liability was debited for $20,000. Expense was debited for $20,000, and a liability was debited for $11,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started